Home > Stock Market > Time for a breather.

Time for a breather.

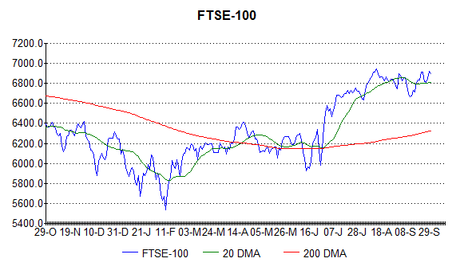

I am quite positive at the moment and believe the the 15% leg up we have just seen could be the start of a major boom. In the run-up to the 1987 and 2000 crashes there was a three year period where the FTSE doubled from a low point after a significant decline and I suspect that we could be about to see that again. As I am expecting another crash soon, I think it is quite possible that the FTSE could hit 12,000 within three years and go on to 14,000 from there, before the market finally realizes that the western world is bankrupt and the index plummets 85% (as seen in the 1929 crash). The bond market is obviously in a bubble and speculators have started to question whether the bull run will continue much longer and so may look for somewhere else to put their money. This could boost stock markets strongly (until the bond market finally collapses!). The yield on many government bonds has turned negative, which means that prices are so high, simply holding on until the bond matures will lose you money. Speculators are relying on the "greater fool" to sell on to, at ever higher prices, in order to make money and, if they can't find these people any more, they will move their money to other markets.

In the short-term however, again looking back at this point in previous booms, I expect the FTSE to fall back to support at 6,700 for a few weeks before making further progress.