This post is part of a social shopper marketing insight campaign with Pollinate Media Group® and Payoff, but all my opinions are my own. #pmedia #payoffmindset #whatsyourpayoff http://my-disclosur.es/OBsstV

As you come into a New Year, now is the time more than ever to start planning better financially for yourself, especially if you’re right out of college.

When I graduated college, I wish I had a better plan for myself financially, and instead of spending money, in actuality, I honestly should of been saving money, for a better future.

So, in honor of it being a new year, and a new start, i’ve decided to list for you guys 4 steps on how to have a better plan for yourself financially.

Step 1:

Organization is key

Keeping track of your spending is a huge part of saving yourself some money and saving money. Every single time that you spend money, be sure to write it down in a check book, or in a planner, to keep track of how much money you are spending a day, and give yourself a daily spending limit.

Take out a loan to payoff debt, and to consolidate your expenses

This is honestly something I wish I did, right when I graduated college. If you have a ton of bills to pay for and you’re racked up in debt, taking out a loan is the best way to take care of all of this. A few days ago, I was recently introduced to Payoff, it’s a loan that is dedicated to helping you payoff your credit cards, and they just make it easier to simplify your life.

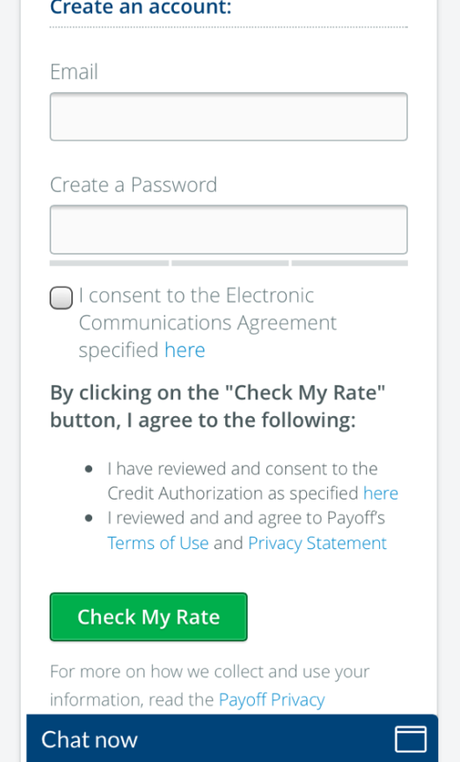

I actually went through the Payoff application process to see for myself, how easy this system could possibly be.

Here’s how I did it:

1. You go into their main website which is: www.payoff.com

2. You can either have someone directly contact you to help you set up the loan, or you can simply just click the “Apply Now” button on their main homepage. I clicked “Apply Now”, when I went to apply for mine.

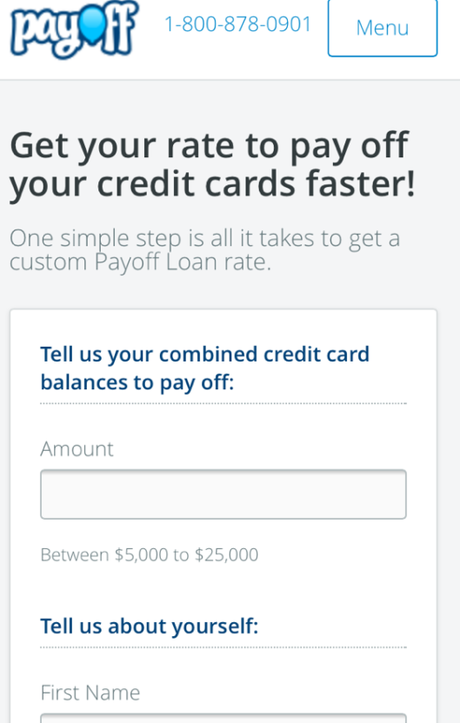

3. When you click the “Apply Now” button, it gives you the option of taking out a loan from $5,000 to $25,000, based off of your credit score, and by the way, applying for this loan, doesn’t affect your credit score in any way, shape or form.

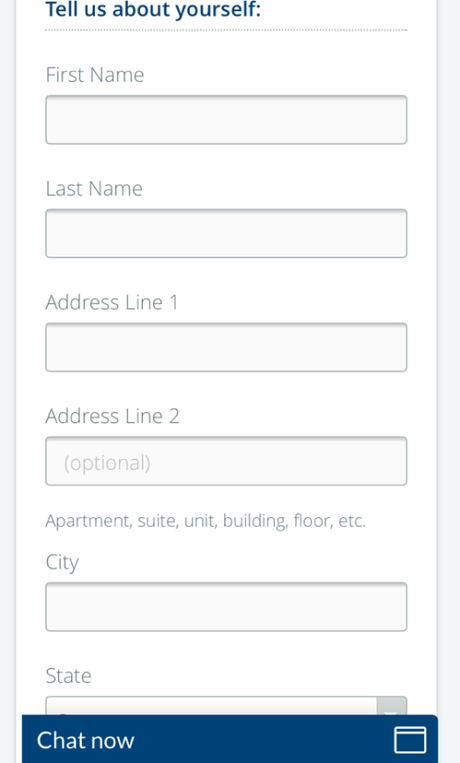

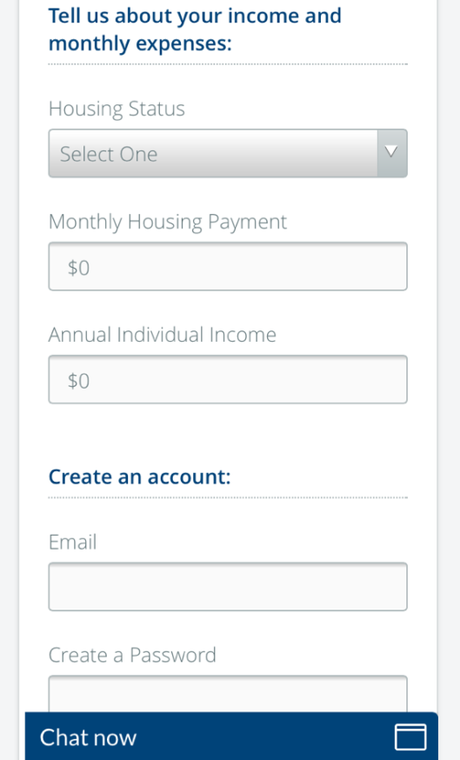

4. Then just fill out all of the required information, that it asks for.

- Starting with putting in the total amount that you’re asking to borrow.

Again, this will not affect your credit score, at all.

- And make sure that you create an account, so that you can log back into the website, when you need to.

Even if you do not get approved for a loan, the great part is that Payoff can still help you out, as they have a product called “Lift”, that is designed as a credit and money education platform to help you gain control over the simple areas of your financial aspects.

Step 3:

Take control of your lifestyle

When you start to give up little things in your life like, buying Starbucks every morning, or perhaps getting your nails done once a week, or buying clothes once a week, these can make BIG changes in your finances. I, myself, use to buy Starbucks every single day, and I actually stopped because it became too pricey, and I just ended up making my own pot of coffee in the comfort of my own home, instead of going out every morning to grab a cup. These little changes, can make big impacts, even though you may not think that they will.

Step 4:

Create financial goals for yourself in 2015

These are mine:

- I will be painting my nails at home from now on, instead of going to the nail salon once a week.

- I will manage every purchase I make, by keeping track of my expenses in a daily planner, or my check book

- I want to travel this spring with the money that I saved up from not getting my nails done, and only buying the things that I need, not the things that I want.

- I will use Payoff to keep track of my finances from now on, and now that my credit card is closed, I will not be opening another one, until I know that I have financial stability.

What are your 2015 financial goals?

I want to hear them loud & clear!

TO GET STARTED WITH PAYOFF LIKE I DID CLICK HERE

TO VISIT PAYOFF ON FACEBOOK CLICK HERE

Visit Payoff on social media:

- Facebook: @Payoff

- Twitter: @Payoff

- Instagram: @Payoff

Pinterest: http://goo.gl/VQUiFO