Home > Stock Market, The Economy > It's lose - lose for Greece!

It's lose - lose for Greece!

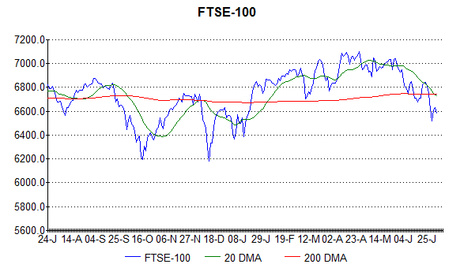

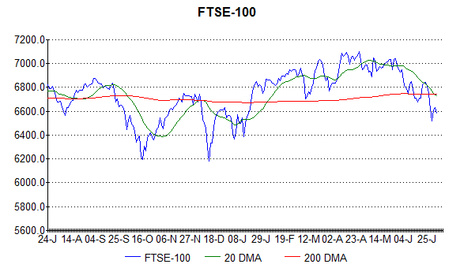

As I predicted in my last post, the dip in the FTSE-100 index has continued. Greece votes in its referendum today and it could go either way, but it probably won't make much difference: vote "Yes" and the government has threatened to resign - vote "No" and they will be even more obstinate than before, leading to uncertainty either way. Staying or leaving the euro probably won't make much difference either. Stay, and the Greek people will have to accept bailout austerity, leave, and a devalued new drachma will cut purchasing power. In addition, Greek banks are insolvent and will have to be bailed out, but by whom? The EU won't want to pour even more money down the drain and the Greek government doesn't have the means. It seems to me that both sides are trying to avoid Grexit, but that it is the best solution for all concerned. The EU made a mistake in allowing Greece to join the eurozone in the first place and should admit it and let them go, and Greece made a mistake in pretending that its economy was anywhere near sufficiently aligned with Germany's (or ever would be) and should accept that it doesn't belong in the bloc. The threat of contagion (other struggling countries being forced out) is minimal I think, because everyone can see that Greece's situation is unsalvageable due to its impossible debt mountain. Offering debt relief to keep Greece in is more of a risk, because then other struggling countries will want the same concessions (which is why Germany is so set against it). All-in-all it is better to write off the issue as a huge error and try to keep everyone else in line by dismissing Greece as an exceptional case.

In the longer term, the rest of the Western world will be in Greece's position in a few years anyway as our debt piles are still growing rapidly, so it would probably be prudent for them to go now while there is still relative stability. Austerity isn't just an issue in Greece; most Western countries have been living beyond their means for decades and their populations have got so used to life on credit that it has become "normal". There is so much resistance to cutting back on what people feel are their entitlements that I cannot see us avoiding a financial meltdown. We are seeing now in Greece what happens when unsustainable debts are called in, and this is the fate awaiting the rest of us unless radical action is taken quickly.

So I think the FTSE will continue to decline and I am sticking to the target levels given in my last post. In the event of the Greeks voting yes and the government doing a u-turn by not resigning and capitulating to the troilka's demands I suppose we could see a bounce, but there is still the problem of the banks being bankrupt so I cannot see it lasting.