Home > Stock Market > It's looking like a spike minimum.

It's looking like a spike minimum.

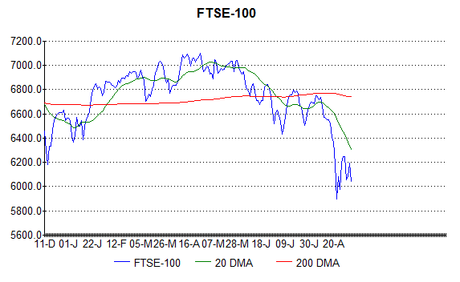

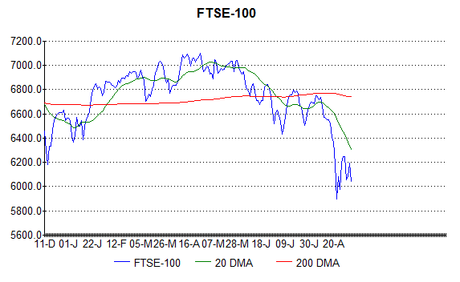

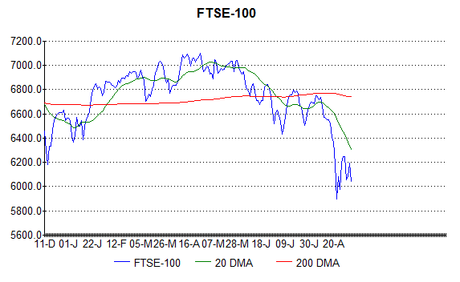

We've had a bounce, as I predicted a couple of weeks ago, and it is looking like a typical spike minimum. Obviously there are no guarantees, but I am optimistic that the FTSE will bottom out no lower than 5,850. China troubles seem to be less newsworthy now and we are moving back to focussing on US rate rises so I am hopeful that the panic may be fading (also as predicted in my last post). Any rate rise will be very small and probably not followed quickly by others, so, in practice, it will have little effect. The market's anxiety over it is overdone, and, in time, I suspect that a return to "normality" will be seen as a good thing. This dip looks like the sort of clear out that often occurs after a long period of flatlining, prior to further progress being made, so I still believe that stock markets could do very well over the next two or three years. I am looking for the trailing twelve month price-earnings ratio (TTM P/E) to hit 30 before we get the real crash. It is only around half that value now (about average), so markets could still double from here!