Home > Stock Market > FTSE didn't go quite to plan, but I was close!

FTSE didn't go quite to plan, but I was close!

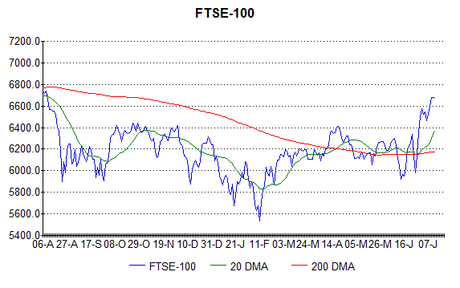

In the short term, I see the FTSE taking a breather after its recent run; I am looking for the index to pause at its current level, then drop back 240 points or so to below the 20 day-moving-average (the green line above). Thereafter, I see good progress being made, perhaps to around 7,400.

In the longer term, the US and UK stock markets don't seem as overvalued to me as some commentators think: the Dow Price/Earnings Ratio is still below 20, which is above average, but well below danger levels. Given the ridiculous prices of western government bonds, with yields going negative, I think that stock markets still have a long way to go. A P/E of 30 is what I generally consider expensive and I suspect that this value will be exceeded significantly if share prices get as silly as bonds. So I still wouldn't be surprised to see the Dow going well over 30,000 in the next few years and the FTSE reaching 14,000 before the financial system spectacularly falls apart.