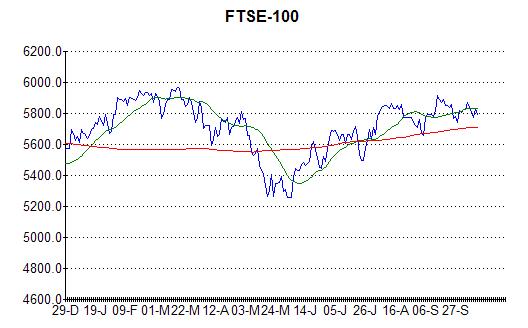

Well, the FUD factor seems to have ended the bull run for now; the FTSE has been oscillating around the 20-day moving average for the last couple of weeks. If this continues for another two or three weeks, I’d consider that a sign of a dip coming. It won’t necessarily be the end of the rally – I’m only expecting a three or four hundred point drop, but I feel that any peak after that is likely to be the last hurrah before a sizeable slump.

Whereas the market has been looking to ECB QE as a way of “resolving” the Eurozone debt crisis, it has been reacting negatively to the rumours of a Spanish bailout which would actually trigger it. This suggests that the market is starting to worry about the longer term prospects for Western economies with unlimited rounds of money printing (QE Infinity) promised in both the Eurozone and the US. While it had been portrayed as temporary (and theoretically reversible), the market could ignore the implications for inflation, but now central bankers are admitting QE is going to be a long-term policy, concerns about hyper-inflation are on the horizon. There is no sign that Western economies are getting their budget deficits under control and, if they are forced to fund them by printing money, their currencies will be significantly devalued and inflation will take off.

Governments have been looking to economic growth to help reduce their deficits, but I think this is unrealistic. What they like to talk of as pre-crisis “normal” growth rates (2.5 – 3%) were artificially boosted by the credit boom increasing consumer spending and I don’t think we will see growth at that level again in the foreseeable future. Consequently there is going to have to be a lot more austerity than is currently planned. With concerns about even the mild austerity in the US which would be caused by the “fiscal cliff” (automatic government spending cuts and the expiry of some tax cuts in the new year) pushing them back into recession, it is no surprise that the markets are getting worried. But, as I have said before, the longer you put off the inevitable, the worse it is for you.