Bitcoin hit my $3,000 target for about three-quarters of an hour! And it got there a lot quicker than I expected so I didn't catch the bottom, but, even so, I am currently running a nice profit on my investment due to the very strong rebound we have seen since then.

Bitcoin hit my $3,000 target for about three-quarters of an hour! And it got there a lot quicker than I expected so I didn't catch the bottom, but, even so, I am currently running a nice profit on my investment due to the very strong rebound we have seen since then.

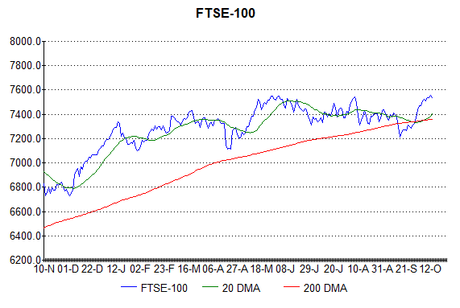

I remain hopeful of much greater gains to come as I am still looking for a final, blow-off phase to the current bull market. (And I am not alone in this; see the articles here and here). While some commentators are adamant that the US stock market is over-valued, I disagree; some indicators are high by historical standards, but if you look at the more fundamental ones such as the Trailing Twelve Months (TTM) Price/Earnings (P/E) ratio and dividend yield, there is still plenty of scope for advancement. Consulting an old edition of the Financial Times, I can see that the US dividend yield fell to around 1% at the peak of the dot.com boom, but it is currently around twice that level, so, even without further dividend increases, the market could double from here before we hit crash inducing levels. And the P/E ratio is also well below danger levels at about 20 for the Dow: I would say that 12-15 is typical, 6 very cheap and 30 very expensive. So again, even without any increase in company profits (earnings), the index could rise 50% before it hits danger levels. And with interest rates much lower than in 2000, it is perfectly possible than previous levels could be exceeded significantly before a crash occurs.