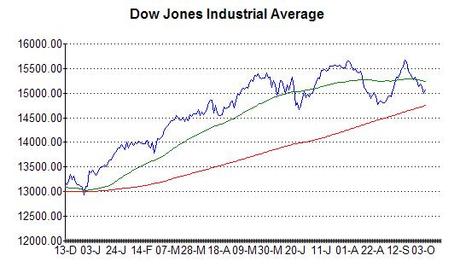

After reading this article on the WSJ MarketWatch website, I am beginning to think that the chances of a US government default are a lot higher than the market seems to think. When it comes to a Tea Party which is used to getting its way over spending cuts, and the president, who is determined not to give up on his flagship healthcare policy, it seems to me that there is considerable scope for neither side to blink. The stock market still hasn’t really reacted to the shutdown and seems to be completely ignoring the debt ceiling. Shutdowns have happened in the past and don’t normally have any lasting ill-effects, but for the US government to default on the interest and repayments of its bonds would be unprecedented. This is what would happen though, if there is no agreement on raising the debt ceiling, and it would cause a major market upheaval.

After reading this article on the WSJ MarketWatch website, I am beginning to think that the chances of a US government default are a lot higher than the market seems to think. When it comes to a Tea Party which is used to getting its way over spending cuts, and the president, who is determined not to give up on his flagship healthcare policy, it seems to me that there is considerable scope for neither side to blink. The stock market still hasn’t really reacted to the shutdown and seems to be completely ignoring the debt ceiling. Shutdowns have happened in the past and don’t normally have any lasting ill-effects, but for the US government to default on the interest and repayments of its bonds would be unprecedented. This is what would happen though, if there is no agreement on raising the debt ceiling, and it would cause a major market upheaval.

It will be interesting to see how jittery the market gets in the run-up to the October 17th deadline. If it doesn’t particularly, then I think we could be in for a sharp downturn.