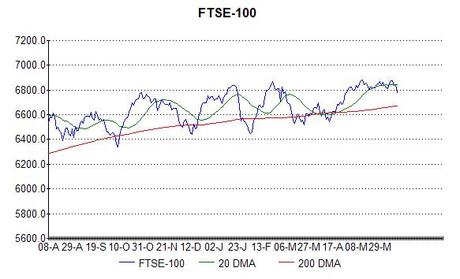

OK, I’ve changed my mind again! In my last post I was expecting the FTSE to finally break through its all-time high, but it hasn’t, and the longer it fails break this resistance level the less likely it is that it will. In addition, an instance of my FTSE peak signal has occurred (one dip just above the 20 day moving average quickly followed by two just below) which suggests that a significant dip may be in the offing. The index only managed to bounce back over the 20dma for one day after the third dip and, in previous such instances, this has been followed by a drop of between 11 and 17 per cent, i.e. down to the 6,000 – 5,650 range.

OK, I’ve changed my mind again! In my last post I was expecting the FTSE to finally break through its all-time high, but it hasn’t, and the longer it fails break this resistance level the less likely it is that it will. In addition, an instance of my FTSE peak signal has occurred (one dip just above the 20 day moving average quickly followed by two just below) which suggests that a significant dip may be in the offing. The index only managed to bounce back over the 20dma for one day after the third dip and, in previous such instances, this has been followed by a drop of between 11 and 17 per cent, i.e. down to the 6,000 – 5,650 range.

The stock market has managed to largely ignore the civil wars in Syria and Ukraine, but maybe recent events in Iraq are stretching a point too far. If this increases the oil price, inflation may rise and so might interest rates. And the fear of that would have an adverse affect on share prices.