Certification of Loss of Nationality (Wikipedia)

I haven't written in this blog for a while, but this story is too important to ignore. The US is trying to solve its public relation disaster of the massive increase in the number of Americans giving up their citizenship by throwing up as many obstacles to renunciation as possible.The Background

First, Americans back in the US frequently have a distorted view of Americans abroad. In fact, we know from extensive expat research (my own polling, the research of Amanda Klekowski von Koppenfels, and many others), that most Americans move abroad for love, work, study, or adventure. We're not rich, we're just average folks who happen to live in different countries.

Many Americans back home think we're ungrateful, rich sods who've turned our backs on the US. As previously mentioned, most of us aren't rich, polls show that few of us moved abroad for political reasons and we don't hate America. We get up, go to work, hang out with our friends, mow the lawn, love our children, and so on. Not much different from back in the US, except that the food's different, the language is different, the culture is different, etc.

So why are so many Americans abroad giving up their citizenship? Most of them will tell you the same thing: FATCA, a law designed to force international banks to report US customers to the IRS. Thanks to this law:

- Americans abroad are often being denied bank accounts

- Americans abroad are being denied business opportunities (happened to me)

- Some overseas companies have simply stopped hiring Americans

- FATCA is breaking up marriages

- Americans abroad are now going into hiding

- People who didn't know they were Americans are being hunted by the IRS

- US Congressman have been trying to bankrupt US expats

- And so on ...

There are, at the present time, only two countries in the world who tax their citizens abroad: the brutal dictatorship of Eritrea and the US. Taxing Americans abroad was an old law instituted during the US civil war to punish Americans fleeing abroad to avoid the war (and paying for it via taxes). However, the law remained on the books but was largely ignored. Americans abroad were not old about it and they lived, retired, and died in blissful ignorance of this Civil War era law.

In 1970, the Bank Secrecy Act was passed and it contained the Foreign Bank Account Reporting provision (tell the IRS if you have a foreign bank about with more than $10,000), but this was a money laundering measure, not an attempt to enforce the Civil War law.

It was after the Great Recession of 2008 that the US government started searching for other sources of income that it realized it had largely been ignoring this old law on the books. Despite the complete lack of evidence that enforcing this law will work (the US Census Bureau doesn't count Americans abroad, despite repeatedly losing lawsuits over this), law makers are painting expats as billionaire tax dodgers living abroad to avoid paying taxes. Honestly, anyone who thinks I live in France to dodge taxes is an idiot, and as mentioned above, surveys repeatedly show that we're just a bunch of ordinary Americans — not wealthy tax dodgers.

Ironically, this move has been championed by many politicians who are themselves famous for dodging taxes.

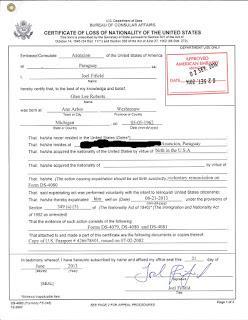

The Government's Solution All of the above has led to the problem of record numbers of Americans trying to renounce their citizenship. Previously, it had always been free to renounce your US citizenship. Go to a consulate abroad, fill out your paperwork, and wait for your CLN (Certificate of Loss of Nationality). In 2010, the US started charging $450 for allowing Americans to renounce. However, US renunciations continued to skyrocket, though the numbers appear to be seriously underreported. There have been reports of increased waiting times for various countries as a result.

Rather than address the root issues, the US attempted to contain the damage by raising the renunciation fee by 422% to $2,350! This puts it out of the price range of many Americans abroad, particularly those in lesser-developed nations, or those living paycheck-to-paycheck. However, this still didn't work. In 2015, there was a 20% increase in the number of Americans giving up their citizenship. From 2008 to 2015, the number of Americans renouncing has increased 18-fold and, as mentioned earlier, this is probably severely unreported.

So again, instead of fixing the problem, the US government has found yet another "solution." You can't legally renounce without an appointment, since January 2016, the US embassies in Canada are simply not scheduling renunciation appointments. People are reporting delays of over a year to get an appointment. In Germany, renunciations are now restricted to the US Consulate General in Frankfurt, despite there being an embassy in Berlin and five consulates around the country. Here in France, they've restricted this to Paris and Marseille, despite an embassy and six consulates. If you've ever had the misfortune of wading through the consulate lines in Paris or trying to get an appointment, you know what a high bar they've set for letting Americans abroad renounce.

You would think that a politician might ask the obvious question: why are so many Americans giving up their citizenship? But no, no one cares. Americans abroad overwhelmingly say they don't want to do this, even they're filling out the forms to renounce. Something has to change.