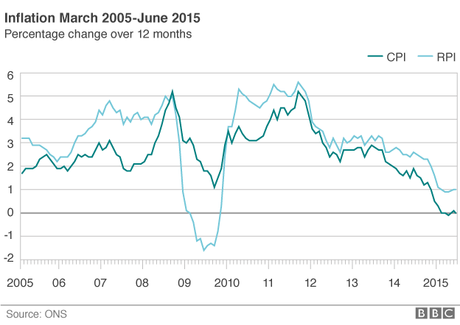

ffice of National Statistic has disclosed that the rate of UK Consumer Prices Index inflation fell to 0% in June, from 0.1% in May.

Falls in clothing and food prices were the main contributors to the change in the rate, the Office for National Statistics (ONS) said.

The ONS said the rate was also affected by a smaller rise in air fares in June than a year ago.

Bank of England governor Mark Carney has said he expects inflation to remain low in the immediate short term. But the Bank expects it to start picking up around the turn of the year.

The rate of Retail Price Index (RPI) inflation - which includes housing costs such as mortgage interest payments and council tax - was 1% in June, unchanged from May.

"Inflation has continued its pattern of recent months, when prices have been very little changed on the previous year," said Philip Gooding from the ONS.

"The headline rate for June has dropped very slightly on May, back to zero, thanks to small downwards effects from movements in clothing and food prices and air fares."

The CPI rate has been hovering around zero since February, and moved into negative territory in April for the first time on record, dropping to -0.1%.

Howard Archer, chief UK economist at Global Insight, said the latest figure was good news for consumers. "With earnings growth currently seeing clear improvement and employment high and rising, purchasing power is currently in rude health," he added.

While flat or low inflation can be good news for consumers, a prolonged period of negative inflation is generally perceived as harmful to an economy.

The fear is that people will defer spending in the hope that goods or services will become cheaper later. The current inflation figure is well below the Bank of England's target of around 2%.