o you know some of the most popular high street banks in the UK? United Kingdom is blessed with not only some of the world's most popular high street banks but also some of the best banks in the world.

From Barclays to TSB, street in the UK is full of highly performing banks with a long history of operation.

Popular High Street Banks In the UK

Below you will find a list of some of the most popular high street banks in the UK. The list is not exhaustive, but will give a general overview of the current banking institutions in Great Britain.

Barclays Bank is a universal bank with operations in retail, wholesale and investment banking, as well as wealth management, mortgage lending and credit cards. It has operations in over 50 countries and territories and has around 48 million customers.

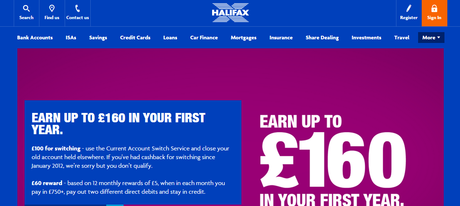

Services Halifax offers include bank accounts, savings, ISAs, credit cards, loans, car finance, mortgages, insurance, investments, mobile banking, online banking etc.

HSBC's business and financial services range from the traditional high street roles of personal finance and commercial banking, to private banking, consumer finance as well as corporate and investment banking.

The bank's international network comprises around 7,500 offices in over 80 countries and territories in Europe, the Asia-Pacific region, the Americas, the Middle East and Africa.

Co-operative Bank is one of the Britain's biggest lender and majority of the its revenue is made from interest charges on loans.

The TSB name was previously used by the Trustee Savings Bank prior to its merger with Lloyds Bank in 1995 resulting in the formation of Lloyds TSB in 1999. The new bank has more than 4.6 million customers and over £20 billion of loans and customer deposits.

With a large network of 1,600 branches and 3,400 cash machines across Great Britain, NatWest is traditionally considered one of the Big Four clearing banks.

The bank also offers 24-hour Actionline telephone and online banking services to its over 7.5 million personal customers and 850,000 small business accounts.

Nationwide provides financial services both directly, and through around 700 branches. Nationwide is a major provider of both mortgage loans and savings in the UK, as well as personal banking such as loans, credit cards, bank accounts and insurance products.

Santander's '123' product range was ranked third best in the UK in 2013. Also in 2014, customers ranked their satisfaction higher than with any of other main high street banks according to moneysavingexpert.com poll.

Lloyds Bank has an extensive network of branches and ATM in England and Wales (as well as an arrangement for its customers to be serviced by Bank of Scotland branches in Scotland, Halifax branches in Ireland and vice versa) and offers 24-hour telephone and online banking services.

RBS has around 700 branches, mainly in Scotland though there are branches in many larger towns and cities throughout England and Wales. The bank offers extensive personal banking products including bank accounts, mortgages, loans, savings and more.