Initially, I've only ever heard of value investing from videos, podcasts, and various literature. Warren Buffet, Berkshire shareholder letters, "The Intelligent Investor" and the like. The concept struck a curiosity with me because the ideas and investing philosophy made a lot of sense and were comprehensible to me (unlike some of the finance formulas I learned about in *academia). So I went about studying the discipline more in-depth out of interest, and looking to see if I could apply it (I was 22 then, and fresh out of college, 2019).

While the principles seemed rational, at this point it was all theory. It was not until the pandemic when Covid-19 hit the US in Feb/March of 2020, was I able to observe, validate, apply some of these principles in action on the markets.

Some core principles of value investing;

- A stock is not just a piece of paper, it is fundamentally a piece of ownership of a company and therefore Its price/value should parallel the value of that company.

- (How do you determine the value of a company? Probably some function of the value of its assets + the value of the company's earning power and/or potential earnings)

- Concept of margin of safety: when the market price is selling below its "intrinsic" or real value, the difference is the margin of safety. Your room for error and protection in your assumption/negative outcomes. The notion that you can minimize risk/loss of money when the price falls far below real business value (i.e. a large margin of safety)

- Mr. Market - erratic behavior/manic depressive (feel free to google the story). The notion that markets are not always efficient and assets are not always priced correctly. On occasions, you can find quality assets that are undervalued often due to unchecked pessimism or an overreaction to an event (the reverse is true as well that over-optimism can make a stock overvalued). And because of this truth, you can capitalize when price and value do not match.

At the time I was monitoring Microsoft (MSFT) stock. Truthfully for no reason other than being familiar with it as a household name and using its products (as most of my peers in the business school have). I did not know the complexities of the business model, just the high-level overview of it (even today I do not truly know the nuances). I knew it sold Microsoft Office and had a robust cloud platform (Azure) that seemed to be doing well (business media wrote praises about its competitiveness and how it was taking some market share from AWS). A quick glance at its balance sheet/income statements (despite the fact, I was not confident in my ability to read them correctly) and I had convinced myself it was a strong business that would probably continue to be in existence for the next 10 years, i.e. continue to grow, be profitable, and would not go bankrupt. It was dominant in the productivity software (Excel/PowerPoint/Word/Outlook), that much was obvious. And while Google had its own suite of software, It didn't seem likely businesses would adopt them over Microsoft's (perhaps this narrative may change in the future?). I thought to myself that was a very valuable competitive edge. It's strongly integrated into the backbone of many enterprises, and its positioning/existing relationship would make it easy to cross-sell solutions (e.g. cloud).

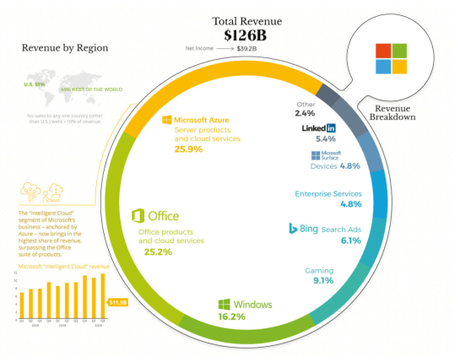

I also stumbled across this chart once, that helped me visualize its business (from visualcapitalist.com)

Anyhow, come Covid-19 in late Feb/early March of 2020. Nobody could predict with certainty what the impact, duration, and ultimate consequence would be. The only thing that seemed certain was the immediate future then looked bleak. Infection rates were spiking, people were being hospitalized, quarantine was being put in place, and businesses would have to shut down or be restricted someway, somehow. The "norm" of what was once part of everyday day life was suddenly re-written overnight.

And, it would seem that during times of crisis/uncertainty, people pull money out of the markets driven by fear because they rather have cash than risk watching the value of their portfolios fall. Perhaps a reasonable thing to do, if you can get out ahead of the herd. But when a wave of people think this way and sell, the sudden surge in stock selling to liquidate drove prices significantly down. Some below their real value.

This illustrated the notion of Mr. Market perfectly to me. Stock prices are " suppose" to reflect what a business is worth. However, on occasion, there is depressive/irrational behavior in the market and things fall well below their "intrinsic or real worth". This was the case in MSFT. Pre-covid, for argument's sake, assume it was fairly priced. When Covid hit, the stock market as a whole (SP500, major indexes, etc) prices were in freefall (the result of mass sell-offs). I had thought to myself then, how could a company such as Microsoft suddenly lose so much of its "value" so quickly? When thinking about stocks, it's best to think about the company as a whole, as if you were considering buying the entire company. In a little over a week, MSFT fell from a $190 high to $160, and then the following month a low of $140 (roughly $1.4 Trillion, $1.2T, to $1T). Suddenly the company's sticker price was saying it was worth over almost 30% less? Was the business itself suddenly really worth 30% less? What had changed in that time? Did its prospects, fundamentals, or business model deteriorate?

Going back to the circle chart of Microsoft's revenue lines, my thought process was this: Most of these products/revenue streams were largely digital (it is a software co after all). How would the pandemic affect Microsoft's earnings? Microsoft Office didn't seem like it was going anywhere, I didn't think Windows was going anywhere. I didn't really know how Cloud would be affected (but off the top of my head I also didn't think it would be drastically/negatively impacted) etc, etc. These are all guesstimates of course, that's the best you can do when trying to predict the future (pro tip; you never can with 100% certainty, but you can make reasonable guesses). None of the above seemed to justify the company's loss in value (of course I wasn't certain, but I was just confident enough in my reasoning to put some money on it), and so I concluded the stock was mispriced and bought in around ~$150. I had convinced myself that the price drop didn't make sense, and the new prices were not reflective of the prospects of the business.That current prices were selling for at a discount relative to what the company was really worth.

Come Q2 of 2020; during earning's releases is when businesses could get some semblance of measure on the impact of covid. And as it turned out (benefit of hindsight, and luck) most of the major tech companies (Microsoft included) benefited majorly from the effect of Quarantine. More people spending time online, using online services, work from home, etc. This led to a correction of prices in these stocks and actually increased their values significantly because growth (and thereby earnings) had actually been accelerated.

Travel/Hospitality/Restaurants, the impacts in those industries were apparent (and one probably could've guessed early on). But not all industries were impacted the same, and yet initially, the stock market was in freefall across the board when the pandemic struck. In truth, you could have thrown money in any direction with the exception of those few industries that were severely impacted and you would have made a significant gain on the recovery. Partly due to the initial overreaction that created underpriced opportunities, and partly due to economic stimulus/printed money/low interest, that would help drive equity prices up. Of course, you can't predict what the Fed will do (so that was happenstance), but you could have made an assessment about the value of a particular business and if it made sense for what it was selling for. How a large-scale event created a gap of uncertainty about the future and how that created a fall out between value and price, (i.e. a value opportunity).

Of course, hindsight in financial markets is always 2020. But with a little bit of forethought, I do believe one can find these opportunities. This is just a story of how I went about justifying my narrative and investment reasoning. At the price that I got in, my margin of safety was 30%+ and I was genuinely confident that at a minimum, I would not lose money on my principal (even if my assumptions weren't 100% correct, I only need to be mostly right; and although nothing is ever truly risk-free; I felt this was a close second) because the underlying value of the business would act as a floor to the stock price.

All in all, as of 4/22/21 (1 year later, yet still in partial quarantine)I made a healthy +50% gain (+8K on a small sum invested) on what I'd consider a relatively low-risk investment.

I say this not to boast, but to make a case study of this and reinforce the notion that underpriced opportunities really do exist. How the market is erratic sometimes, and while value and price should align, they sometimes fall out of parallel. Covid is an extreme example and riddled with more easily identifiable opportunities in retrospect. But I have no doubt other pocket events happen and incur these same mispricings, even if on a smaller scale. And with a little bit of forethought and reasoning, I believe one can find these opportunities as I have with here.

*As I know now, the world is not so linear, nor black & white that it can be easily modeled by some function. And that human behavior can often be neither rational nor predictable.