Credit score requirements for getting a mortgage are more important than ever and most lenders now require a score of at least 640 to get financing approval. Your interest rate will also be determined based on your credit score so it can have a long-term effect on your finances.

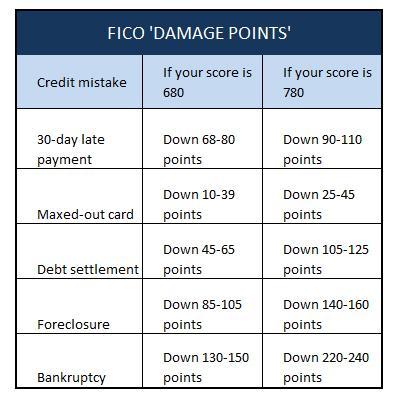

What many people don't know is how big an impact just one late payment can have on your credit score... and the higher your score the more it can drop.

According to FICO, just one 30-day late payment can cause your credit score to adjust...

- Down 90-110 points if your score is 780

- Down 60-80 points if your score is 680

That could be enough to kill your financing approval in a hurry! The more recent the late payment the bigger the impact.

At least once you are approved you are good to go through closing, right? Unfortunately, NO!!! Your lender will verfiy your employment and credit right before closing so if there are any significant changes you could go from 'approved' to 'unapproved' at the last minute!

Wondering how your overall credit score is determined? Check out Calculating your credit score.

The chart below shows how the most common credit mistakes can affect your score.

Sharlene Hensrud, RE/MAX Results - Email - Buying a Home

RELATED POSTS