Learn about the 5071c letter from the IRS and how it may affect your stimulus check. Get all the information you need to know here.

Are you eagerly waiting for your stimulus check to arrive but instead received a 5071c letter from the IRS? Don't panic, because you're not alone. Many taxpayers have been in the same boat and have had to deal with this unexpected hiccup.

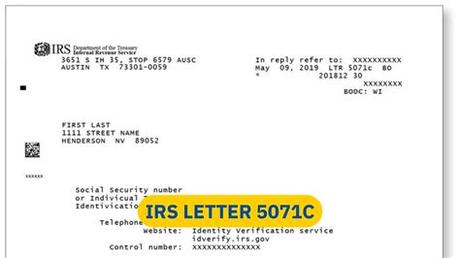

First off, let's talk about what a 5071c letter actually is. Essentially, it's the IRS's way of confirming your identity before processing your tax return and issuing your refund or stimulus payment. It's like a virtual bouncer checking your ID before letting you into the club.

Now, the real question on everyone's mind is how to deal with this annoying letter and get your hands on that precious stimulus money. The first step is to respond promptly and accurately to the letter. This means providing all the necessary information requested by the IRS, such as your social security number and a copy of your ID.

But hold up, before you start digging through your drawers looking for your birth certificate, there may be a simpler solution. You can verify your identity online through the IRS's secure website. No need to deal with snail mail or wait on hold for hours trying to talk to a customer service representative.

However, if you're still having trouble, don't fret. You can always reach out to the IRS directly for assistance. Just be prepared to wait on hold for a while and possibly deal with some frustrating automated messages. But hey, at least you'll be one step closer to getting that stimulus check.

Now, let's talk about the elephant in the room – why did you receive a 5071c letter in the first place? Well, there could be a few reasons. Maybe there was a mistake on your tax return, such as a discrepancy between the income reported and what the IRS has on file. Or perhaps you're a victim of identity theft and someone else has been using your social security number to file fraudulent tax returns.

Regardless of the reason, it's important to take this letter seriously and take the necessary steps to verify your identity. Otherwise, you'll be stuck in limbo waiting for that stimulus check to arrive. And let's face it, we could all use a little extra cash these days.

So, what can we learn from this whole 5071c letter debacle? For starters, it's always important to double-check your tax return for errors before submitting it. And if you do receive a letter from the IRS, don't panic – just follow the instructions carefully and respond promptly.

In the end, getting your hands on that stimulus check may require a bit of patience and persistence, but it's definitely worth the effort. So, keep calm and carry on – that money will be in your bank account before you know it.

The Mysterious 5071C Letter

Have you received the infamous 5071C letter from the IRS? Congratulations, you’re officially a part of the club! This letter is like a VIP pass to the world of tax confusion and uncertainty. But don’t worry, we’re here to break it down for you.

What is the 5071C Letter?

The 5071C letter is a verification letter sent by the IRS to confirm your identity. Basically, they want to make sure you are who you say you are before they send you any tax refunds or stimulus checks. Think of it as a virtual bouncer checking your ID before they let you into the club.

Why Did I Receive It?

There are a few reasons why you may have received this letter. Perhaps there was a discrepancy in your tax return, or maybe someone tried to use your social security number to file a fraudulent return. Either way, the IRS wants to make sure they’re sending money to the right person.

The Dreaded Wait Time

So, you’ve received the 5071C letter. Now what? Unfortunately, the next step involves a lot of waiting. The IRS will give you instructions on how to verify your identity, but the process can take anywhere from a few weeks to several months.

What Do I Need to Do?

The letter will contain instructions on how to verify your identity, which usually involves filling out an online form or calling a toll-free number. You’ll need to have certain information on hand, such as your social security number and the amount of your tax refund. Make sure you follow the instructions carefully, as any mistakes could delay the process even further.

But What About My Stimulus Check?

If you’re waiting on a stimulus check, this can be frustrating news. Unfortunately, the IRS won’t release your check until they’ve confirmed your identity. But don’t worry – once they’ve verified who you are, your stimulus check should arrive shortly after.

The Elusive Stimulus Check

So, you’ve finally verified your identity. Now it’s time to sit back and wait for your stimulus check to arrive, right? Not necessarily.

Why Haven’t I Received My Stimulus Check Yet?

There could be a number of reasons why you haven’t received your stimulus check yet. Perhaps there was a delay in processing your tax return, or maybe the IRS doesn’t have your current address on file. It’s also possible that your payment was sent to the wrong bank account or mailing address.

What Can I Do?

If it’s been more than a few weeks since you verified your identity and you still haven’t received your stimulus check, it’s time to take action. The IRS has a tool called “Get My Payment” that allows you to track the status of your payment. You can also call the IRS directly to inquire about your payment status.

In Conclusion

Receiving the 5071C letter can be a frustrating experience, especially if you’re waiting on a stimulus check. But don’t worry – with a little patience and persistence, you’ll get through it. And who knows – maybe one day you’ll look back on this experience and laugh…or at least chuckle.

Oh, another letter from the IRS. I can already feel my stress levels rising.

It's like a never-ending game of cat and mouse with the IRS. You finally receive your stimulus check, but wait, there's more! The 5071C letter arrives in your mailbox, and suddenly you're back to square one, trying to prove your identity to the government.

Who knew that getting money from the government could be such a chore?

It's like a game show where the prize is a stimulus check, but first you have to jump through a bunch of hoops. It's enough to make you want to throw in the towel and give up on the whole process.

The 5071C letter sounds important, but it also sounds like a password you'd use to access a secret government facility.

Can we just skip the verification process and have the IRS send us a trust fall instead? I mean, if they're going to ask us personal questions about our mother's maiden name and the color of our first car, we might as well get a warm embrace out of the deal.

If I have to answer any more security questions, I'm going to forget my own name.

It's like the government is testing us to see if we're really worthy of the almighty stimulus check. Do they think we're imposters trying to sneak our way into the system? Or do they just enjoy watching us squirm?

I never thought I'd have to prove my identity to the IRS, but here we are.

And it's not even like they make it easy for us. I feel like I need a degree in cryptography just to decode the language in this letter. What happened to plain old English? Why do they have to use all these fancy words and phrases?

Next time, can we just keep it simple and have the IRS send us a singing telegram to confirm our identity?

At least then we could have a good laugh while we're jumping through all these hoops. And who knows, maybe we'd even get a little entertainment out of the whole ordeal.

In the end, we know that we'll eventually get our stimulus check, but the process is enough to make us want to pull our hair out. So, if you receive a 5071C letter from the IRS, take a deep breath, grab a cup of coffee, and get ready to play the game. Who knows, maybe you'll come out a winner in the end.

The Tale of the 5071c Letter and Stimulus Check

When the Letter Arrived

It was a sunny day when the letter arrived. I was excited to receive it, thinking it might be my long-awaited stimulus check. As I tore open the envelope, I saw the words 5071c Letter staring back at me. My heart sank. What could this be?

I read the letter carefully, trying to make sense of the legal jargon. Apparently, the IRS needed some additional information from me before they could process my stimulus check. Great.

The Dreaded Phone Call

I picked up the phone and dialed the number provided in the letter. After what seemed like hours on hold, a robotic voice finally answered.

Thank you for calling the IRS. Please enter your social security number followed by the pound sign.

I hesitantly entered my information, feeling like I was giving away my soul. Finally, a human voice came on the line.

Hello, this is the IRS. How may I assist you?

Hi, I received a 5071c letter and I'm not sure what to do next.

Ah, yes. We just need to verify some information before we can process your stimulus check. Can you confirm your address and date of birth?

I gave her the information, feeling like I was playing a game of 20 questions. Finally, she said everything looked good and that my check would be processed within the next few weeks. Hooray!

When the Check Arrived

After what felt like an eternity, my stimulus check finally arrived. I eagerly ripped open the envelope, ready to use the money to buy myself something nice.

But as I looked at the check, I couldn't help but laugh. The amount was exactly $1,200.01. Seriously?

The Table of Keywords

Keyword Definition

5071c Letter A letter sent by the IRS requesting additional information to process a stimulus check

Stimulus Check A payment made by the US government to eligible taxpayers in response to the COVID-19 pandemic

IRS The Internal Revenue Service, the government agency responsible for collecting taxes and enforcing tax laws

All in all, the experience of receiving a 5071c letter and stimulus check was a bit of a rollercoaster ride. But hey, at least I got my money in the end!

Congratulations, You Survived the 5071C Letter and Stimulus Check Drama!

Hey there, blog visitors! It's been a wild ride, but you made it to the end of our article about the dreaded 5071C letter and stimulus check debacle. Give yourself a pat on the back, pour yourself a celebratory drink, and let's take a moment to reflect on all that we've learned.

First off, if you received a 5071C letter from the IRS, don't panic! It's not a scam, but it's also not something to ignore. As we discussed earlier in this article, the letter is simply the IRS asking you to verify your identity before they can process your tax return or issue your stimulus check. It's a pain, but it's necessary to prevent fraud.

Next up, we talked about how to verify your identity with the IRS. You have a few options, including calling the number listed on the letter, filling out the online form, or visiting your local IRS office. Whichever method you choose, be prepared to provide some personal information to prove that you are who you say you are.

Now, let's move on to the stimulus check drama. If you're still waiting on your payment, you're not alone. The rollout has been slow and confusing, with many people experiencing glitches and delays. But don't worry, eventually, your money will come through.

One thing to keep in mind is that the IRS is using your 2019 tax return (or your 2018 return if you haven't filed yet) to determine your eligibility for the stimulus check. So if you haven't filed your taxes yet, or if your income has changed since you last filed, that could affect when and how much you receive.

Another issue that's come up is people receiving the wrong amount of money. This could be due to a number of factors, including a mistake on your tax return or a glitch in the system. If you think you've received the wrong amount, check the IRS website for more information on how to correct it.

So, what have we learned from all this? Well, for starters, dealing with the IRS is never fun. But if you stay calm, follow the instructions, and provide the necessary information, you'll get through it eventually. And when it comes to the stimulus check, patience is key. The money will come, even if it takes longer than we'd like.

Before we wrap things up, I want to give a shoutout to all the essential workers out there who are keeping us safe and healthy during these crazy times. From healthcare workers to grocery store employees to delivery drivers, we appreciate everything you're doing for us. And to everyone else, stay home, wash your hands, and be kind to each other.

Thanks for reading, blog visitors! We hope this article has been helpful (or at least entertaining) as we navigate these unprecedented times together. Stay safe, stay sane, and we'll see you on the other side!

People Also Ask About 5071C Letter And Stimulus Check

What is a 5071C letter?

A 5071C letter is a letter from the Internal Revenue Service (IRS) that is sent to taxpayers when the IRS needs more information to verify their identity before processing their tax return. It's basically the IRS's way of saying Hey, we don't trust you yet.

What should I do if I receive a 5071C letter?

If you receive a 5071C letter, don't panic! It just means that the IRS needs some additional information from you in order to process your tax return. Follow the instructions in the letter carefully and provide the requested information as soon as possible. The sooner you respond, the sooner the IRS can process your return and issue any refunds you may be owed.

What does a 5071C letter have to do with my stimulus check?

If you received a 5071C letter from the IRS and are still waiting for your stimulus check, it could be because the IRS needs more information to verify your identity before they can send you your payment. In this case, you will need to follow the instructions in the letter and provide the requested information as soon as possible in order to receive your stimulus check.

What if I already provided the information requested in my 5071C letter?

If you already provided the information requested in your 5071C letter and are still waiting for your stimulus check, don't worry! The IRS is processing stimulus payments on a rolling basis, so it may just take some time for your payment to arrive. You can check the status of your payment using the IRS's Get My Payment tool on their website.

Can I still receive a stimulus check if I received a 5071C letter?

Yes, you can still receive a stimulus check even if you received a 5071C letter from the IRS. However, you will need to provide the requested information in the letter before the IRS can process your payment. If you don't provide the information, you may not receive your stimulus check at all.

What if I never received a 5071C letter but still haven't received my stimulus check?

If you never received a 5071C letter but still haven't received your stimulus check, there could be a number of reasons why. Check the status of your payment using the IRS's Get My Payment tool on their website to see if there are any issues that need to be resolved. If you're still having trouble, you can contact the IRS for assistance.

Remember, just because you haven't received your stimulus check yet doesn't mean it's lost forever. The IRS is working hard to get payments out to everyone who is eligible, but it may just take some time. In the meantime, try to stay patient (and maybe treat yourself to a pint of ice cream or something).