The money comes in, and then it goes out… and out… and out. What happens to it all? The best way for a family to keep track of income and expenses is to use a budget.

If you’re not accustomed to budgeting, the planning, decision-making and sacrifices involved can be challenging. Here are some suggestions to make the transition easier.

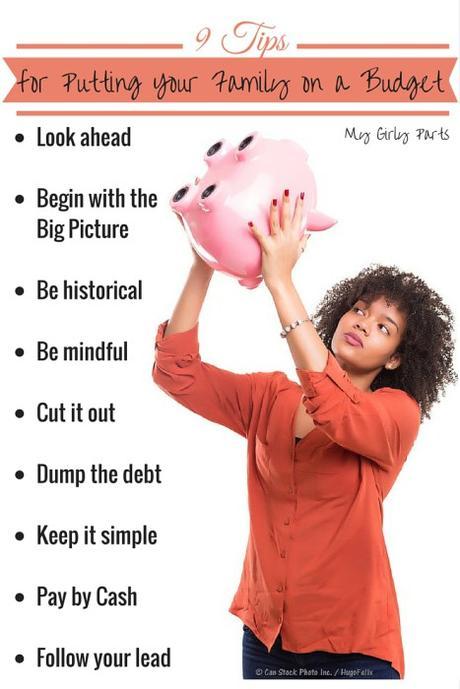

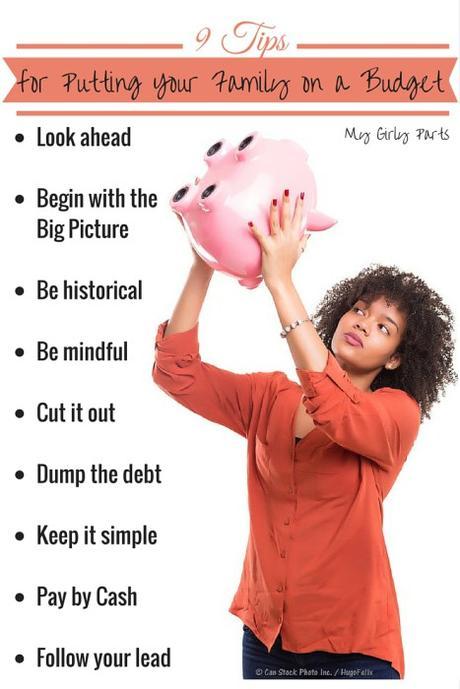

1. Look Ahead

Many people stick to budgets better when they’re trying to achieve a specific goal. With a goal, keeping within limits becomes real and important.

Are your kids going to college soon? Saving for your first house? Want to go to Hawaii? Worried about retirement? With a target in sight, budgeting seems more reasonable.

2. Begin With the Big Picture

Start planning your budget by figuring out your family’s monthly income. This includes wages as well as any other regular revenue, such as stock dividends, child support or business income.

The next part is less pleasant: Consider your standard bills. Include payments such as mortgage, rent, utilities, phones, cable, Internet connection, credit card payments and life insurance. Don’t leave out smaller expenditures, like gym memberships or kids’ lessons.

Remember the bills that aren’t due every month, such as car insurance premiums or medical expenses. Put a little into the budget each month to cover them. But don’t guess — do the math.

Subtract your bills from your total income. Hopefully, that’s a positive number. Divvy up what’s left over for groceries, clothing, transportation, entertainment, special occasions, donations and savings.

Be aware that needs vary during the year. Reassess your budget at the start of each month.

For example, you may want more money for entertainment during periods when the kids aren’t in school. If you drive a lot during the summer, set aside extra for gas. Plan for seasonal clothing purchases if your kids are still growing.

3. Be Historical

How much should you allocate for your monthly costs? Make estimates by checking receipts from the last couple of months. Use them to determine average spending.

You’ll also need to set aside funds for any large annual expenditure such as tuition, family vacation or summer camp. What did you pay last year?

4. Be Mindful

As you look at your expenses, consider whether you’re getting your money’s worth. Maybe you can drop a service or find a less expensive alternative.

For instance, if you pay for a gym membership, are you taking advantage of it? Is your phone service a good value? Do you really watch all those TV channels you’re paying for?

When it comes to insurance, you might be able to save a lot by combining coverage. Some companies offer significant savings to customers with multiple policies. Combine your homeowner’s and car policies, or link auto and life insurance.

5. Cut It Out

If unfortunately, you subtract your expenses from your income and get a negative number, that’s a problem. You’re going to have to cut back somewhere.

What are non-essentials? Maybe eat out less often or go to fewer shows. If your cable or satellite bill is high, examine streaming or rental options.

Together, your family needs to decide what you can live with. This part isn’t easy, but staying within a budget gets you closer to your specific goal.

6. Dump the Debt

While you’re planning for that goal, work to reduce high-interest debt you’ve accrued, such as for credit cards. Those payments really take a bite out of your income.

With high-interest rates, you’re not paying off principle very quickly. Focus on getting out from under those rates, and you’ll be able to put more towards your goal.

7. Keep It Simple

Unless you’re familiar with budgeting software or spreadsheets, keeping records in a plain old notebook is fine. It’s handy: You can easily move it wherever and whenever you need it. No sharing or power cords needed.

8. Be a Cash Customer

Whenever you can, pay cash. That may seem inconvenient for the grocery store or gas station, but it keeps you on track.

When you fork over bills, you’re more aware of your spending than when you swipe a credit or debit card. Plus, if you commit to cash, you can’t spend more than you have with you. If you know there’s exactly $100 in your wallet to buy groceries, you’re less likely to make unplanned purchases.

9. Follow Your Lead

Now that you have your budget thoughtfully determined, stick to it. Don’t make impulse purchases. Resist the temptation to give in to others’ pleas.

At the end of each month, track your income and spending. See how well you did compared to your plan.

9 Tips for Putting Your Family on a Budget @SavHemmings #moneysavingClick To TweetKeep your specific goal in mind. When other family members are less cooperative, remind them of the goals, too. You’re all in this together.

Savannah Hemmings graduated from Tulane University with a degree in Journalism and Mass Communications. She is a Philadelphia-based personal stylist and writes about style, personal finance and career tips on her lifestyle blog, Sincerely Savannah. Her work has been featured on Hello Giggles, Bustle, Self Magazine and TIME.