Nothing to see here. These chairs are not for you.

There’s one travel article that really needs to be written. It’s a column we’ve had on the back burner for quite some time and it’s titled “Why ‘Don’t Worry About Money and Just Travel’ is the Worst Advice of All Time.” Unfortunately, the piece recently published by Time.com under that same headline is not at all what we had in mind.

If only its author, Chelsea Fagan, had attempted to address the title question her story may have stood as a useful tonic against some of the more irresponsible financial advice that sometimes passes for lifestyle wisdom these days. Instead, she chose to use most of her 1,100 words to rail against a single rich blogger’s privilege. Entertaining, perhaps, in the way that watching a temper tantrum can sometimes be but about as illuminating.

Worse is that rather than tearing down the travel finance myth her title promises, the article instead enthusiastically perpetuates another, more common, myth: that only the very rich can travel. Reading Ms. Fagan you’re left with the impression that there are only two economic classes in America. On one end of the financial divide are wildly wealthy trust fund kids represented by travel bloggers who want for nothing but self-awareness. On the other end are huddled masses living lives of complete immiseration. That’s it.

In this telling there’s no room for anyone with even a modicum of financial flexibility. So when we, or other bloggers, encourage people to think more wisely about the tradeoffs between time and money and life goals what we’re really doing is writing “aspirational porn, which serves the dual purpose of tantalizing the viewer with a life they cannot have, while making them feel like some sort of failure for not being able to have it.” (emphasis mine.)

Think about that statement for a second. “Tantalizing the viewer with a life they cannot have.”

The breadth of this claim is surely false. She’s talking, after all, about a travel blog where “the viewer” is anyone who has access to the internet. Leaving behind the spectacularly self-nullifying claim that no one on the internet can have the life that some of us on the internet have achieved, the more objectionable problem is the underlying premise that only the wildly wealthy can afford to travel. That’s demonstrably not true.

The breadth of this claim is surely false. She’s talking, after all, about a travel blog where “the viewer” is anyone who has access to the internet. Leaving behind the spectacularly self-nullifying claim that no one on the internet can have the life that some of us on the internet have achieved, the more objectionable problem is the underlying premise that only the wildly wealthy can afford to travel. That’s demonstrably not true.

Money is certainly one limiting factor that keeps people from traveling but it’s not necessarily the most important, especially for average Americans. The bigger constraint is often whether they’re willing to do what is necessary to turn that trip into a reality.

Because once you know how to do it, a week long excursion to even an expensive European city like Paris is generally affordable. These days it’s easy enough to exploit credit card sign-up bonuses to finagle nearly free flights. When combined, the Chase Sapphire Preferred and United Explorer credit cards currently offer bonuses large enough to purchase a round trip flight to Europe.

A week in Paris for $350

You can then arrange free lodging through one or more couchsurfing hosts. That takes care of your two largest expenses. If you then shop markets for meals, take public transportation and walk instead of taxis, utilize free events and don’t go crazy with the more expensive attractions, it’s entirely possible to keep your other expenses down to $50 per day or less. By doing things that way a week in the City of Light might set you back only $350.

Now $350 is not nothing. But it’s not exactly trust-fund style money either. We’re only talking about saving a single dollar a day over the course of a year to fund a trip like this. Well, that and also being willing to jump through some credit card hoops (which might also involve repairing bad credit), do the couch surfing thing, and plan a holiday that is high on experience but low on extravagance. If I had to guess, it’s not the dollar per day cost that’s keeping most Americans from going on this kind of excursion.

But if we believe Ms. Fagan, that’s exactly what’s holding everyone back.

What the condescending traveler means by ‘not worrying’ [about money] is ‘not making it a priority, or giving it too much weight in your life,’ because on some level they imagine you are choosing an extra dollar over an all-important Experience. But the ‘worrying’ that is actually going on is the knowledge that you have no choice but to make money your priority, because if you don’t earn it — or decide to spend thousands of it on a trip to Southeast Asia to find yourself — you could easily be out on the streets. Implying that this is in any way a one-or-the-other choice for millions of Americans is as naive as it is degrading.”

Once again the only way to make sense of this statement is to read it from the perspective of abject poverty. The choice in Ms. Fagan’s mind isn’t between a daily cup of coffee and a trip to Paris but between travel and homelessness. Of course that’s a ridiculous way to frame the tradeoffs most Americans face. To see just how ridiculous let’s take a look at a couple of the ways we Americans spend our money.

Several years ago we wrote about Six Life Changing Things You Can Do for the Price of an Average U.S. Wedding. It turns out that one thing a couple can do with the money they’d typically blow on an elaborate one-day celebration is travel around the world for an entire year. How many newlyweds, mostly young people presumably “too poor to travel,” have even considered alternative uses for all that wedding cash?

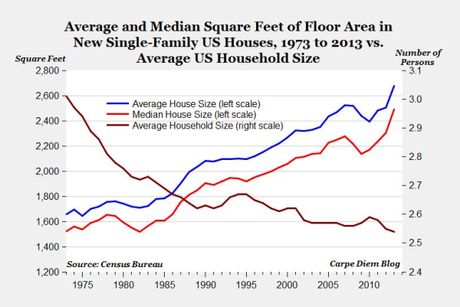

Or consider the extravagance of the average American house. Thirty years ago our houses were a third smaller than they are today even though we had more people living in them. If Ms. Fagan wants to argue that the average American can’t afford to travel because they need to work overtime to finance 1,000 square feet of living space per person she’s perfectly in her right to do so. But she might also consider that one way some of us have managed to save for travel is by choosing homes that are half to an eighth the size of the ones our less-traveled compatriots enjoy.

So while it’s true that there are plenty of people so financially strapped that travel is not a realistic option for them, that doesn’t remotely describe the average American. Nor does it describe the audience your typical travel blogger is even writing for.

A better article written under the same headline might have challenged the new-agey, spiritualized, financial guidance offered by some prominent bloggers or critiqued the approach favored by many 20-something gap-yearers who never imagine a day when they may no longer be physically able or willing to work menial odd jobs for a few Baht and a dorm bed.

There are plenty of examples of reckless financial advice circulating the blogosphere deserving a take down. So it’s not that we don’t agree with Time. We absolutely do. “Don’t worry about money and just travel” is spectacularly terrible advice. If only Time had published an article worthy of the topic.