Stock market traders must take advantage of high-quality software if they wish to be successful. You won’t accomplish much with a manual market analysis. There are many things in a good stock trading software program, such as alerts, watchlists, and charts. With their assistance, you can plan your trade and benefit from real-time market developments. There are many types of stock trading software, and I can guide you through them.

Stock trading software is a series of computer programs that make it easier for users to transact financial products like stocks and currencies. The use of technical and basic analysis, however, may also allow you to make more informed stock choices. Software that facilitates transaction processing is also available.

Trading software is offered by some brokers free of charge while others offer a discount. In some cases, it is an incentive meant to spur the trader into undertaking a certain amount of trading. In addition to software from independent vendors, traders can also get assistance from independent vendors. Get a platform that suits you by finding a trading software that works for you using our guide.

What To Look for When Choosing Your Stock Trading Software

Need help getting started? We’ve outlined the features we think the best stock trading software needs to possess.

1:Real-time and statistical data of the past and present

Real-time data are supplied immediately or shortly after the moment the information is disseminated. Many websites pledge to give free retail quotes, but they are held up for up to 20 minutes continuously. Even the slightest difference between the quotation and the actual price of the asset might lead towards a reduction in profit or even loss in real-time data is crucial for traders. Also essential are historical quotes, because the price of safety moves in patterns that may be found and trends that recur over time.

2: Analytical techniques and strategies

The active trader uses many trading strategies, including day trading and swing trading, rather than the long-term buy-and-hold method. During day trading, the position is closed within the same day. During swing trading, traders hold securities for an extended period of time to profit from the movement in prices. Swing traders normally apply some defined criteria based on fundamental, technical, or combined analyses.

The trading program allows traders to handle open positions and manage them. Certain sorts of orders are for the market (purchase/sale at current prices) or are pending (where transaction goes through at a predetermined price). A still-pending order may be a purchase limit, halt purchasing, limit selling or stop selling. A dealer might potentially make an end loss or take advantage of the order pending.

3: News updates in real-time

It is an unpredictable market that is influenced by a number of factors, such as macroeconomics, geopolitics, and corporate news. Real-time news update is crucial for profit-making in stocks since market-moving news impacts stocks in an instant.

4: A backtesting program

By using historical data, this method enables the testing of a trading strategy, which serves as a method for confirming its efficacy. Basically, it involves simulating the trading strategy and then analyzing the returns and risks in relation to the strategy over time.

5: Indicator for screening stocks

By using stock screeners, traders can filter stocks based on some predetermined criteria

Factors That Affect The Accuracy Of Stock Market Data

The reality is that a lot of stock trading software does not live up to its claims. Market data is sparse and clunky, and they’re often difficult to use. Traders who deal with day trading demand immediate information. Traders make their trading decisions based on near-real-time information, and on inaccurate information, the odds are against them.

Online reviews play a crucial role in this process. Stock trading software often gets a bad rap from those who have had trouble with it. They should be able to tell you what frustrated them and where information was erroneous if they give you specifics.

What you Need to Know to Use Stock Trading Software

You can explore possible stocks using software for stock trading and see charts, analyze reads, create watchlists, etc. Many high-end hedge funds employ computer algorithms that can analyze data at amazing rates and parse the stock market at light speed. Most of us may not have access to these programs, but technology may still be used. Beginners may find stock trading software programs intimidating even when the programs are designed intuitively.

Avoid a runaway course of action. Get to know the program’s features and navigational indicators instead of trying to stick to a strict schedule. The first thing you’ll want to do is check the news, charts, and scanners relevant to the stock market trading software.

The scanner will display specific company or stock information based on the stocks you select, while the news segments keep you informed on current developments. Unquestionably, the most popular stock trading software applications have the most visually appealing charts.

We all have very specific tastes when it comes to charts, there’s no doubt about that. In any case, whatever your preference is, you should be aware of the fact that the chart you selected should be simple, customizable, and trackable in format.

Also available within the top stock trading program is a paper trading platform. The paper trade can be viewed as an investment simulation tool. Buying, selling, and shorting are conducted without risking your own funds. You can use this opportunity to try trading if you’ve never done so before.

These are the top seven stock trading programs used by professional day traders

1: StocksToTrade

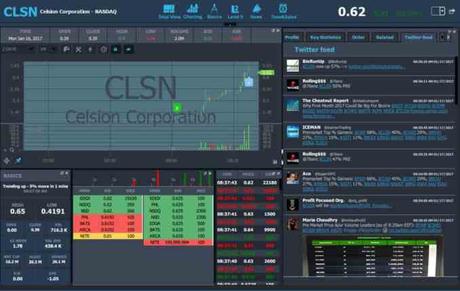

With StocksToTrade, traders have access to an all-in-one trading tool to swiftly discover crucial financial dealings without the assistance of a manager for hedge funds. StocksToTrade, a forex broker offering unparalleled client service, continuous training, and an up-to-date platform, has housed more than hundreds of thousands of trades.

There is a lot of potentials to make a lot of money from stock trading. A common beginner mistake for new traders is using the wrong tools. It is imperative that you use the right software and tools for day trading. There are quite a few options for trading today, but few are geared toward day-trading.

Timothy Sykes conceptualized this software. Timothy Sykes is a highly skilled trader and business owner with a wealth of trading experience. He made millions of dollars investing in pump and dump stocks with a few hundred dollars.

The following are its features:

Oracle: Traders are alerted automatically about stocks with the highest profitability rate using this proprietary algorithm scan tool. With the help of this tool, investors can easily determine when and how much to enter the market and when to exit the market. Information is updated in real-time and trends are forecasted based on what stock prices have done over time.

Paper Trading: The paper trading platform included with StocksToTrade offers a $30,000 starting balance allowing traders to simulate demo trading without having to risk real money. Traders without experience can learn to place and manage trades while at the same time watching their investments and making informed decisions without being influenced by their emotions. The platform, therefore, serves as a platform upon which newbies can build their confidence levels before beginning to invest real money.

Charts: The smooth charts in StocksToTrade can be complemented with key indicators and trading tools. Chart types include bar charts, candlestick charts, and line charts, along with time frames ranging from minute-by-minute trading to monthly trading. A variety of momentum indicators are also included in the charts, including moving averages, pivot points, Bolinger bands, MACD, and stochastics. A trader can also choose from various color schemes and settings for each indicator.

Scanners: Easy identification of high-growth stocks is made possible with this feature. Users can customize their stock screen or use existing screens created by Timothy Sykes if they prefer. Besides examining some of the mainstream exchanges such as NASDAQ and NYSE, it also includes Pink Sheet stocks, AMEX stocks, and OTCBB stocks. To summarize, scanners do all the legwork for the trader leaving him free to choose the most profitable stocks to monitor and trade.

Twitter updates and news updates in real-time: With StocksToTrade, you can track hashtags associated with specific investments. Trades are narrowed down to the most important trading information by the Twitter feed’s filter feature. As it pulls headlines from Yahoo!, news can also be filtered based on a variety of criteria, such as one’s specific time frame, watch list, keywords, or stocks. Seeking Alpha, MSN Money, Finance, Finviz, Wall Street Journal, and MSN Money.

Level 2: StocksToTrade provides traders with level 2 platform access for deeper analysis. On the platform, users can view the bid and ask the price of a stock. Trading platforms like this can be used to identify market conditions that will ensure the best liquidity for traders. Although this platform provides useful information, it is best used in conjunction with other analyses for maximum effect.

2: Profit.ly

Considering Profit.ly as a social network, educational resource, and trade analytics service, combine these features and you will perceive it to be an all-in-one. The Best Traders Online Are Here For You. Step up your trading game. Detailed analysis can help you improve your trading by learning from the best.

3: RealTick

Tools for trading differ based on the trading style. So RealTick offers a variety of add-ons to choose from and a flexible user interface. You can adjust your trading platform according to your strategies, so you can see the market in a broader perspective. In-depth, You can personalize, Immediate. Web and mobile solutions are available.

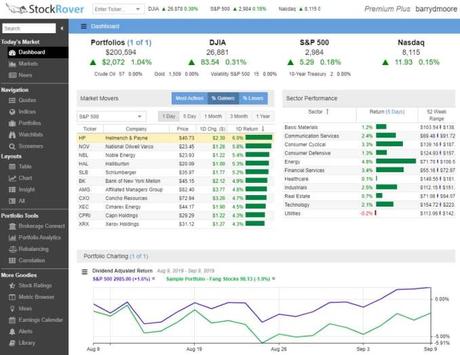

4: Stock Rover

The Stock Rover service screens stocks conduct research and manage portfolios. This database contains historical financial and earnings data as well as Morningstar analyst ratings for ten years. As an industry-leading research tool, it can match and balance portfolios, screen for dividends, check safety margins, and determine fair value. Investors seeking fundamental and financial analysis software that is industry-leading for value, growth, and income stocks should check out Stock Rover. Despite being easy to use, Stock Rover is extremely powerful.

Stock Rover is available for PCs, Macs, Tablets, and Smartphones. It doesn’t require any installation; it just works. There are no market data, scoring, ranking, or analysis for markets other than the United States and Canada. Stock Rover’s dashboard shows you a quick breakdown of market performance, as well as your portfolio and dividend performance, as soon as you register and log in.

Stock Rover has a cloud-based software architecture, meaning that you don’t need to install any client software, and all the stock exchange data is hosted on the vendor’s servers. You will find all the charting and visualization in the cloud, and you will be able to see any chart you wish to see on the client device.

5: NinjaTrader

NinjaTrader is an American software firm that offers comprehensive research capabilities on a large trading platform. The firm was established in 2003. In addition to providing NinjaTrader software, NinjaTrader is an introducing broker of Phillip Capital and Dorman Trading, and an NFA (National Futures Association) registered company. By becoming an introducing broker, you direct your assets and cash to a broker, like Phillip Capital, while NinjaTrader provides the platform, fees, and customer support.

Designed for day traders interested in futures, forex, CFDs, and stock markets, NinjaTrader’s award-winning platform aims to provide a direct connection to day trading options across all markets. As with MetaTrader 4 (MT4), NinjaTrader is an open-source system. However, whereas MT4 mainly attracts forex day traders, NinjaTrader is also very popular for futures day trading.

NinjaTrader is accessible on Mac OS X, Windows, and Linux.

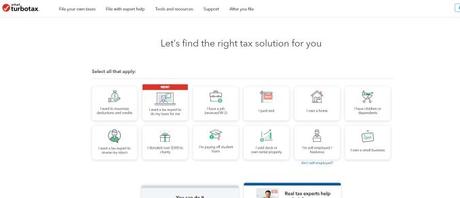

6: TurboTax

The TurboTax software is designed for tax trading. TurboTax can handle your tax needs for most situations with ease. There are cheaper options out there, but TurboTax has its advantages. Hence, you get a tax refund with the utmost money in your pocket, good customer service, and easy-to-use forms and interfaces.

According to a report from Moody’s, TurboTax processes 30% of all electronic tax filings.

Even though TurboTax is generally more expensive than other services available, many consumers believe that the experience and availability of humanitarian assistance are sufficient to warrant the higher expense.

TurboTax has long been lauded for its ease of use and attractive appearance.

TurboTax currently has a free version allowing you to file a Form 1040, however, you can also enter the unemployment income, which is reported on a Form 1099-G. TurboTax has an interface that feels like chatting with a tax preparation in a chat room. Throughout the process, a banner shows where you are and what is still to be done.

7: Jigsaw Trading

7: Jigsaw Trading

Across its wide range of services, Jigsaw Trading excels. This application compiles economic indicators, resting orders, current stock prices, and much more. Using the Pace of Tape tool, you can easily estimate volume and volatility in an instant.

But most of the potential of the trading platform lies in the “Depth and Sales” tab. Besides providing you with a huge amount of data regarding the depth of the market, it also shows you the current balance between the trade and momentum, as well as alerts relating to pre-market notes.

Day traders using Jigsaw Trading can access a variety of educational resources and tools designed to help them learn how to trade effectively using order flow charts. It offers a variety of signals and indicators for traders to see what they are doing internally as they “read the tape”.

Due to the ease of use of these tools, day traders are better equipped to evaluate the market according to the current order book, which will ultimately result in generating more effective trades in a shorter amount of time.

With Jigsaw’s trading tools, a day trader cannot use trade execution indicators like some other trading software, but can instead enhance his/her knowledge of how to take positions based on order book information. The Jigsaw Trading tools are only useful to day traders who have already developed their own trades and understand order book trading.

There are a few alternative trading tools on the market with comparable capabilities to Jigsaw Trading, but Jigsaw Trading’s tools are largely regarded as the finest by both novice and expert tape traders.

In Summary

The best stock trading software applications can assist in demystifying the process and providing you with tools to possibly make wiser trades. With the above-mentioned top seven stock trading programs, I want to believe that it would serve as a game-changer for you.