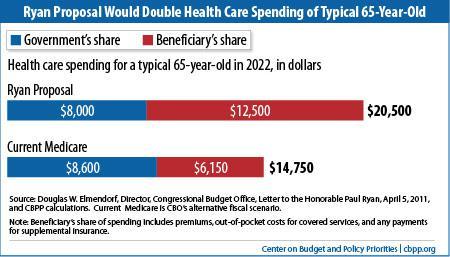

A Graph from the Center on Budget and Policy Priorities

As you read the title to this article, perhaps you thought I was alluding to socialism, in which the resources of a nation are reallocated to create economic equality. I'm not. Instead, we're facing a nation that's run as the antithesis to this 'Robin Hood' model, a system that rewards those who are already rich and further punishes the poor of America. The effective tax rate for a millionaire (an adjusted figure, distinct from the listed rate) has plummeted from 66.4% during World War II to a scant 32.4% today, according to The Tax Foundation, a nonpartisan organization. Meanwhile, Paul Ryan's plan recently passed in the House of Representatives; it proposes to slash the rates for those earning more than $375,000 to 25% (which means the effective rate for millionaires would be even lower). That's just for standard income; capital gains on investments are taxed at a mere 15%. If anything, taxes on these gains should be higher than those on income. People who depend on capital gains as a primary revenue source (e.g. most of the very rich investors and tycoons) are now able to keep more of their earnings than a worker who helps to generate these very profits via his or her production of goods and services.So, how does Ryan's plan pay for a new tax system with lowered top rates, still-cushy capital gains rates, and no new brackets for the ultra-rich? The Path to Prosperity cites the elimination of tax loopholes, but this foots only a small segment of the bill. The plan does so by slicing programs that serve low-income Americans and by replacing Medicare with a voucher system. As you can see from the graph at top, a senior's share of total health expenses under a voucher system would go from 42% to 61% over a decade - while costs rise! When poor Americans have to progressively pay more out of pocket to survive while rich Americans get increasingly bigger tax breaks, the gap between classes widens. The House's long-term bill would accomplish redistribution of wealth, which most Republicans malign. The big difference here is that it's in the opposite direction of the stereotype: towards the economics of the gilded age, not those of socialism.

I'm not trying to make this a partisan issue; I'm not unilaterally condemning the actions of Republicans. However, the fact is that in capitalist societies, people have a monetary incentive to do work and create value. The direction the US headed is in at a sharp contrast to this - a system in which there are more incentives to feed off the value produced by others - to invest rather than work. It's the "hammock which lulls able-bodied people into lives of complacency and dependency," only nothing like what Paul Ryan had in mind when he said that. How to start fixing the problem? Raise the capital gains tax to 50%, and create new higher-rate income tax brackets for multimillionaires. A system like this wouldn't create a level playing field. But unlike the present system, it wouldn't actively produce a more uneven one.