You get fed every day. All you can eat. Treated very nicely too. As such days go by, you grow ever more confident they will continue. Then comes Thanksgiving — and you are a turkey.

Or a sucker, says Nassim Nicholas Taleb in his book The Black Swan – The Impact of the Highly Improbable. Like that turkey, we are all suckers of a sort in failing to anticipate the possibility of a dramatic discontinuity in our reality. What Taleb calls a “black swan.” We may believe all swans are white, until a black one comes along, blowing up that assumption.

The book is fascinating, engaging, thought-provoking. It was published in 2007, just before a big black swan, the financial crisis. And reading it in 2020 gave it special added force. The Trump presidency makes many of us feel like that turkey. And then of course the pandemic hit.

The book’s watchword is unpredictability. Taleb considers it an inherent characteristic of existence. Yet we go through life seeming to ignore that. Thinking we know what’s going on, when in a deep sense we do not. Taleb is from Lebanon, his perspective shaped by the trauma of its 1975-90 civil war — coming after a thousand years of sectarian comity, this unforeseen black swan utterly changed the country.

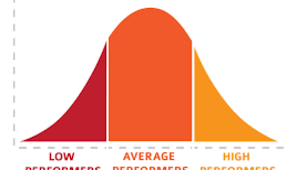

Taleb divides things between Mediocristan and Extremistan. In the former, as its name implies, matters cluster around a middle, dictated by averages, conforming to a bell curve. Take height for example. Outliers like three foot dwarves and seven foot basketballers exist but disappear into the average, hardly affecting it because of the vast numbers closer to the middle.

But while in Mediocristan you do get people 50% above average, for something like wealth the outliers are thousands of times higher, with big effects on the overall picture. That’s Extremistan. Taleb sees reality as more like Extremistan; yet again we behave largely as Mediocristanis.

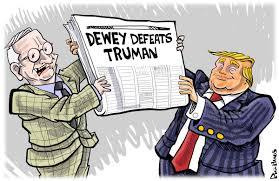

Trump’s election prompted an avalanche of analysis. Seemingly a tectonic cataclysm, but remember it was extremely close. Had it tipped the other way, the after-talk would have been totally different. His 2020 defeat will be, in major part, attributable to the pandemic. But for that, history might be going in a very different direction.

However — those things are not in fact black swans as Taleb defines the term. (He’d actually call them gray swans.) His black swan is something not just unforeseen but unforeseeable (except in hindsight). Taleb says we retrospectively paste our explanations onto past events as though they were (or should, or could, have been) foreseeable. But history just doesn’t work that way.

Reality is complex to an extreme degree. To navigate it, one’s mind creates a representation of it that is perforce vastly oversimplified. I’m reminded here of “LaPlace’s demon,” hypothetically knowing literally everything about the Universe at a given moment — what every particle is doing — enabling it to predict the next moment (and the next). Of course humans are way short of that. One of Taleb’s key points is insufficiency of information available to us. Especially what Donald Rumsfeld famously called “unknown unknowns” — things we don’t realize we don’t know.

The book mentions the “butterfly effect” — a butterfly flapping its wings in China causing a storm in Kansas. I’m not sure that can ever literally happen, but the point is that a very small cause can trigger a very big effect. A black swan. Which we cannot foresee because we, unlike LaPlace’s demon, cannot assess every small thing happening in the world at a given moment. And, Taleb argues, the black swan’s disproportionately big impact renders what we do know about the world pretty much nugatory.

While most of us did not expect Trump’s presidency, we did at least see it as within the realm of possibility. And many voices had long been warning of a pandemic, someday, much like what we’ve got. It makes sense (though not to Trump) to prepare for such things. Los Angeles has preparations for an earthquake bound to happen someday. But in human psychology, “someday” is not an immediate concern, and for all practical purposes Angelenos live their lives in disregard of the earthquake threat. Just as we all did regarding the possibility of a pandemic. That’s actually not crazy.

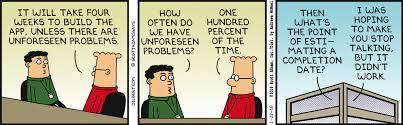

Taleb is scathing about hosts of so-called experts, analysts, economists, etc., calling them frauds who are anchored in Mediocristan and oblivious toward Extremistan. Who don’t know what they don’t know. Taleb cites psychologist Philip Tetlock’s famous study of political and economic “experts,” analyzing their predictions compared against results. Their predictions stunk. And the bigger their reputations the worse they stunk. Taleb comments: “We attribute our successes to our skills, and our failures to external events outside our control.” I recall hearing one forecast Taleb would have applauded: a “psychic” who predicted “unpredictable weather!”

Taleb’s particular bête noir is the Gaussian bell curve, which he deems an artifact of Mediocristan with scant applicability to the real world. I disagree, considering the bell curve a useful conceptual tool for understanding. For example, regarding the mentioned distribution of heights. Though of course one has to know when not to apply a bell curve. A black swan can blow it up, as Taleb insists.

For the stock market, you might expect daily ups and downs to fall along a bell curve — that is, most clustering around the average daily change, with the more extreme moves growing in rarity as they grow in size. That would be Mediocristan. But again Taleb thinks that’s not reality. He presents an analysis showing that if you remove from a fifty year stock market chart the ten most extreme days, the total return falls by half.

Another point is that absence of evidence is not evidence of absence. Taleb cites the story of the ancient philosopher (Epicurus) shown portraits of sailors who prayed to the gods and survived shipwrecks. “But where,” he asked, “are the pictures of those who prayed, then drowned?” Of course those couldn’t testify about their experience. That’s absence of evidence, or what Taleb calls “silent evidence.”

So what should we do? Taleb says (his emphases) “the notion of asymmetric outcomes is the central idea of this book: I will never get to know the unknown since, by definition, it is unknown. However, I can always guess how it might affect me, and I should base my decisions around that . . . . This idea that in order to make a decision you need to focus on the consequences (which you can know) rather than the probability (which you can’t know) is the central idea of uncertainty. Much of my life is based on it.”

Reading this charitably, Taleb spent most of his life in financial markets, and that’s the context he’s mainly talking about. But as advice for life more generally — it’s insane.

One problem with his above quote is that if something really isunknown, you can’tguess its effect. But even in the realm of the knowable, myriad possibilities for disasters could conceivably strike us. We may not be able to gauge their probabilities with precision, but we can in fact know they are individually very small. A life spent trying to avoid every remote danger would be absurd. If you actually followed Taleb’s advice and focused on the potential (very large) impacts in disregard of their (very small) probabilities — you would never get out of bed in the morning.

No, we cannot know everything, and can be hit hard by things we couldn’t foresee. But we do the best we can. Evolution gave us minds — and psychologies — that, for all their undoubted limitations, are actually pretty darn good at equipping us to navigate through life and avoid pitfalls. Otherwise we wouldn’t be here.