Both experienced and inexperienced online day traders depend on charting software for their day trading. With the age of the internet and the advent of digital media, the days of pencil and paper charts have passed. Charting software programs of today offer real-time market information in a variety of formats so you can prepare and execute your trades in an informed manner.

Choosing the “right” charting software can be likened to choosing the right car – it is a very subjective decision. One trader’s choice might not coincide with yours, and vice versa. Therefore, before choosing a data feed and charting package, carefully evaluate a list of features and their advantages and disadvantages.

A key aspect of choosing a charting package is establishing a list of criteria and comparing available options based on those criteria. The results will assist you in making your decision. Listed below are some criteria that you might want to consider:

1: A Real-Time Data Feed

The Chart Trading Software or platform you use should provide real-time data in an instant. Because many web-based apps will have some type of delay, this feature will disqualify the vast majority of them. You cannot afford a delay, no matter how insignificant it may appear in the long run, whether you are day trading or swing trading.

2: Diverse Indicators

In addition to indicators and charting methods, you may be interested in a variety of different types of charts, such as bar charts, point-and-figure charts, or Japanese candlestick charts depending on your needs.

As well, ensure that the chart software can display basic indicators such as MACD, RSI, and Moving Averages. Those who are serious about technical analysis should learn to program their own indicators or modify those that already exist to fit their needs easily.

3: Detailed market data coverage

See if the charting application covers the markets you are interested in. Most charting packages cover the most important markets in the United States, but if you require market data for other markets, such as Asian or European, then make sure that data is synchronized in real-time.

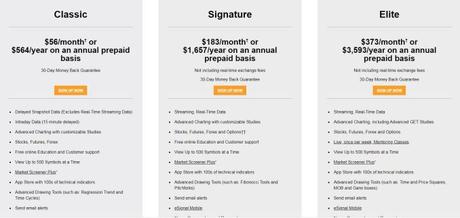

4: Money back guarantee and competitive rates

It’s essential to use trading software that will not drain your bank account before you even place your first trade. Comparison shopping is crucial. The price does not necessarily indicate the software is cheap, however. Investing is a process that requires a certain amount of care. Take the time to consider your options.

We’re not talking about buying an inexpensive trading program that gives you little to no value, but at the same time, you’re not going to use the most expensive one, which has features you won’t ever use anyway.

If you choose a platform provider, make sure you will have time to test how it works before making a final decision. The first 30 days should allow you to claim a refund if you’re uncomfortable using it.

5: A reliable company

Pick a reliable company that has an established reputation on the Internet and a data feed you can rely on. Also, ensure that the company offers exceptional customer support. As you put together this list, don’t forget to add criteria based on your trading goals such as the ability to switch between multiple timeframes quickly.

6: An easy-to-use platform and complete training

You need a platform that’s simple to use and doesn’t need a computer engineering degree unless you’re a competent programmer. It’s essential that your software allows you to create bespoke indicators and to back-test strategies efficiently.

Look for trading software that has a thorough user guide if you cannot find one that is easy to use. It will assist you in becoming familiar with the system and provide you with educational information as well.

The following part contains my own evaluations of a few key software programs.

-

eSignal (www.esignal.com)

Since 1999, eSignal has been a mainstay in the trading industry as owned by Interactive Data Corporation. The website went live on the Internet in April 1999.

In February 2008, eSignal’s monthly fees ranged from $125 (for eSignal Premier) to $195 (for eSignal Premier Plus), making it the most costly trading platform available. If you’re trading options, you’ll be able to view 1,000 symbols using an options analysis program. As a result, you should be prepared to pay between $249 and $360 every month.

With eSignal’s charting and data feeds coming from the same provider, there won’t be any problems the software provider can attribute to the data feed and vice versa. The eSignal user interface does not seem to be the most intuitive out there.

Users have to constantly refer to the help system. In spite of this, charts can be tailored to your liking in various ways, and once you learn to use the shortcuts, the charting platform enables you to make quick decisions very quickly.

The new users are provided with complete audio and video training whenever there is a tutorial system. It doesn’t matter if you’re a novice, you can quickly become familiar with the program. If you’re comfortable with how the chart is set up, which is achieved by customizing size, color, indicators, etc. The format of this chart can be saved and applied to other charts instantly.

There is the ability to save charts and quote lists as pages and to switch between them quickly and easily. eSignal’s multi-monitor platform lets you pop out every single window, so you can get the most out of that multi-monitor system.

eSignal’s charting features are complemented by its quote lists, level 2 screens, and news tickers. This entire set of features can be linked together. If you select a symbol through a quote list, all linked charts, level 2 screens, etc., will be changed almost immediately to that symbol.

There is access to all of the usual technical indicators, and there is also a software called EFS (which is the foundation language for eSignal Formula Script) that allows you to write your own processes for reuse. Also, EFS can be used to communicate with broker interfaces, as well as to carry out backtests.

If you want to go into more sophisticated customization, there are a few tiers of API available at an extra cost that provides raw access to the eSignal data stream.

The data stream is most likely the most important component of the eSignal package.

A reliable worldwide market data stream, on which eSignal has based its strong reputation among active traders, is here in front of you. The firm maintains completely redundant ticker facilities to ensure continuous transmission and flawless data accuracy, and data may be exported as a flat-file for you to view in Excel or any spreadsheet program.

Data feeds found on the Internet are few and far between, but eSignal is without a doubt one of the best. The charting software is robust enough for most traders, and EFS enhances its efficacy.

-

MetaStock (www.metastock.com)

When it comes to technical analysis, Equis International’s MetaStock maybe your best trading tool. Even if you are not skilled in technical analysis, and wish to utilize it in the marketplace, this program could be a valuable learning tool.

According to MetaStock’s website, you can purchase it for $1395 one-time.

QuoteCenter, which provides real-time financial news right from Reuters, the world’s largest financial news provider, can be used in conjunction with MetaStock Pro.

You can easily become familiar with all of its features even if you’re a newbie. The main software itself is fairly user-friendly. Furthermore, the application can be directly integrated with Microsoft Office, facilitating data copy and paste into both Excel and Word.

It has a wide range of chart shapes and features; trendlines, moving averages, resistance and support lines, and a variety of other trading tools are all available with the click of a button. To access Reuters’ free quotes, news, and option symbols, you can also select the Internet option.

It offers all the features of the previous version, including detailed charting and analysis, and it is designed to connect to real-time data streams, such as those offered by BMI or Signal Online by Data Broadcasting Corporation.

Metastock’s search feature is said to be one of its finest features by many traders.

According to the parameters you specify, the search function allows you to search your complete stock and share database. This will help you find stocks that behave according to your trading style. You can then use a particular trading strategy to find out how much you can earn. This information will give you specific information such as when and at what price you should buy and sell, and the profit or loss you incurred on each trade.

As part of the Equis package, you’ll also receive a CD that contains historical data that you can use to construct charts and an internet connection that you can use to update the database at any time. Even the most novice trader will be able to learn the program and technical analysis methodologies with the help of the 550-page technical analysis handbook.

-

Genesis Trade Navigator (www.genesisft.com)

Trade Navigator is a full-featured charting, technical analysis, and trading platform developed by Genesis Financial Technologies, Inc.

As Trade Navigator is paired with a variety of trading methods that utilize indicators such as Moving Averages, Seasonal, ADX, and Stochastics, it can become a great automated trading tool. There are many features available, including Single-Click Trading, Calendar, Indicator, Bracketing, Trailing Stop, and more.

Additionally, the platform allows users to divide charts into panes, such as OHLCs, Candlesticks, Lines, Mountains, HLCs, Histograms, and Points charts.

Using panes, you can display a single indicator or study, or a combination of the two, and modify the look of the chart by simply dragging and clicking to draw trendlines, resistance and support lines, and other items. Therefore, Trade Navigator is the right tool for you, regardless of the type of display you choose.

The Trade Navigator Platinum can perform all back-testing, development, and analysis for your trading strategies with Tradesense, which offers an intuitive way to input data without requiring special programming skills.

Among its features are a series of video tutorials, free training, and a guide. Tradersense is the primary feature of the Platinum system, and it is easily understood. Its analysis and critical input are made possible by combining ordinary English with basic arithmetic symbols.

Any trading strategy concept can be tested with Tradesense, whether it came from a trading book, a seminar, or even a friend. This can be done by creating and evaluating a range of order types (such as limit orders and stop orders).

When you search for indicators, Tradesense recognizes them and fills in the data for you.

The Genesis system features Precision Tick as well, allowing you to back-test any strategy and making sure that every rule is applied exactly according to real-time market conditions. Creating future bar orders is also possible. Any strategy you implement inside the application may be completed with an “Action.” In order to place a specific order, certain conditions must be met, Long or Short.

Trade Navigator allows you to create custom indicators and strategies, trade directly from the chart, and practice your trades with instant replay. With Instant Replay, you can walk back in time and watch the data fill in on the days when that particular bar was generated, as well as watch how it moves.

Three different versions of Trade Navigator are available: Standard, Gold, and Platinum. The starting price is $99, plus $25 per month in data update fees for stocks, or you can choose the $65 per month plan for stocks, futures, indexes, and certain options. There are hundreds of preprogrammed indications and settings built into Genesis, so you can run it instantly in order to determine the best plan depending on how you approach the problem.

As part of their software package, Genesis also provides training videos and free webinars regularly.

-

TradeStation (www.tradestation.com)

TradeStation was introduced to the internet trading community in 1997. It has won several industry awards including those from Barron’s and Technical Analysis of Stocks and Commodities. Five years in a row, from 1994 to 1999, Stocks and Commodities Magazine awarded it the Readers’ Choice Award for Best Trading Software.

It is widely considered to be the industry standard when it comes to chart software. TradeStation is perhaps the world’s first trading platform that allows you to design, test, and completely automate your own rule-based trading strategies on a regular basis. Upon making your first trade, TradeStation can monitor your trading rules and even execute them automatically.

It is also intended to assist you in identifying possible market opportunities and then carrying out your transactions more professionally than you could ever accomplish on your own. TradeStation effectively watches the markets for you tick by tick, in real-time on the Internet, and looks for any opportunities depending on your trading strategies.

When an opportunity occurs based on your specific buy or sell rules, it is meant to instantly construct your entry and exit orders and submit them to the market within fractions of a second of the market change.

Even a simple programming language called Easy Language is available from TradeStation.

The trading rules you establish can vary based on your personal preferences, such as when to enter the market and buy and when to exit the market and sell. There is almost no trading strategy that cannot be automated, including numerous orders, entry, and exits, stop losses, protective stops, and trailing stops, among others.

You can backtest, program custom indicators, and customize indicators to your specifications.

Afterward, it will run a back-test on up to 20 years of real, intraday market data to provide you with simulated results. TradeStation will provide you with a complete portfolio report before you risk one cent of your actual trading assets. This report will feature your simulated net profit or loss after every trade and more.

Due to its dependability and automation capabilities, TradeStation has become one of the most popular trading platforms for active traders, experts as well as beginners.

Final thoughts

Now that you know what kind of trading software would suit your requirements best, you probably have a better understanding of what to look for. As a result of the sophisticated charting software, you will be able to respond quickly to breaking news by executing near-instant trades. You may decide to upgrade to more complex software as you gain expertise in the trading industry.

Make sure you compare all your options before purchasing trading software. It is very easy to be lured by inexpensive software that has little functionality you need, or by costly software that has many capabilities you won’t use. Take the time to evaluate and contrast several solutions before deciding.

The customer service department of the company can assist you in setting up your trading platform or with any other issues you may encounter.

Make sure that any platform you choose has free trials and money-back guarantees. You won’t know if a program is a right fit for you until you use it, so selecting the right one for you is quite personal.