Senate Minority Leader Mitch McConnell (R-Ky) told senators this week that the Social Security payroll tax cut should be extended.

President Barack Obama took advantage of his trip to Pennsylvania on Wednesday to highlight once again the importance of extending the Social Security payroll tax cut. The tax break was introduced in January 2011 and is due to expire on Dec. 31. The president is convinced that not extending the legislation into 2012 would represent “a massive blow to the economy, because we are not fully out of the recession yet.”

Mr. Obama will be pleased to hear that the Republicans in the Senate are willing to support the measure. Republican Minority Leader Mitch McConnell told senators on Wednesday that it was no longer “an argument about whether or not we ought to extend the payroll tax cut. The issue is how do you pay for that.” Indeed, there are still stark differences between the two parties on that point.

The Democrats would impose a 3.25-percent surtax on those earning over $1 million in order to offset the cost of, on the one hand, extending the tax cut into 2012, and, on the other hand, expanding it. Indeed, in his American Jobs Act, President Obama proposed to halve the payroll tax rate of workers from 6.2 percent of income to 3.1 percent. This would amount to a $1,500 tax break for a family earning $50,000 a year. Workers currently benefit from a two-percentage-point cut and only contribute 4.2 percent of their earnings toward Social Security, which, for 2011, represented a saving of $1,000. Extending the measure for an additional 12 months and expanding the tax break so that workers pay even less in Social Security contributions would cost an estimated $265 billion.

The Republicans, however, are still firmly opposed to any form of tax hike. Their current proposal, which would only cost around $115 billion because it only includes extending the tax benefit until Dec.31, 2012, would be paid for by decreasing the number of federal civilian workers by 10 percent and freezing the pay of those still in employment for three years. In addition, the Republicans would make millionaires ineligible for food stamps and unemployment benefits (according to GOP figures, unemployed millionaires received nearly $21 million in benefits in 2009), and would require millionaires to pay the full cost of Medicare Parts B and D. Mitch McConnell explained that the Republican proposal would “provide some relief to struggling workers who continue to need it but without raising taxes on job creators, which is what the Democrats’ proposal would do.”

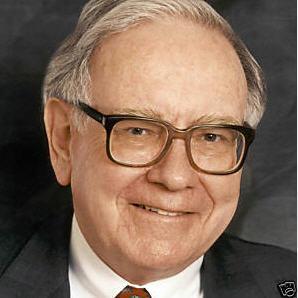

Warren Buffett declared in August 2011 that he would be willing to pay a higher income tax rate in order to help bring down the deficit.

Following Warren Buffett‘s comments in the summer that he would be willing to pay more taxes in order to help reduce the deficit, the Republicans also propose to add a section on the federal income tax return to enable the rich to make voluntary payments if they feel they ought to pay a higher level of tax.

The Democrats also propose to halve the Social Security tax on employers’ first $50 million in wages to 3.1 percent, something that the Republicans do not seem to have considered.

Congress could vote on the proposal as early as Friday.