Output Vs Creativity

Output Vs Creativity

I’ve handed out a few bonuses in my time. Some years our results were spectacular; other times poor. Payouts went up and down accordingly. I can only remember two people opening the envelope and saying “thank you”. Both cases were in poor years. It never happened in a good one.

Perhaps that’s a function of good times. Bull markets are defined by optimism. Expectations climb beyond reality. Ask how much is enough and the answer, inevitably, is just a little bit more.

Do incentives work?

Not always, according to the research. Here are some things we now know.

At the team level, incentives can crowd out creative thinking. Studies show those paid an incentive to solve a problem perform worse than those who receive no reward. The focus on financial return diverts attention from more creative solutions. Incentives work okay for process jobs but are counterproductive when cognitive input is required.

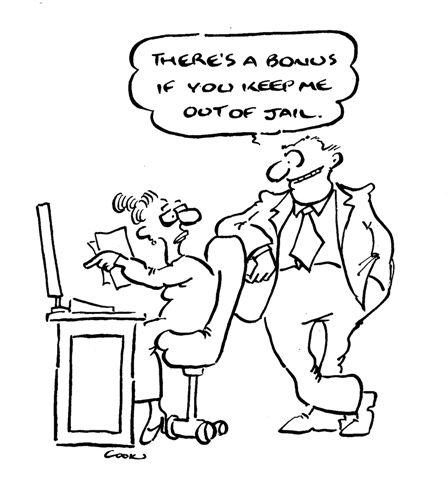

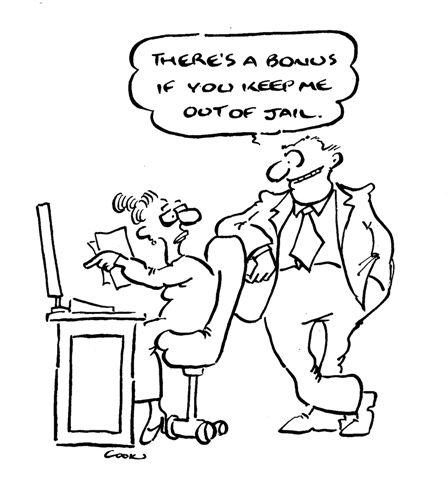

At the macro level, incentives encourage people to transfer risk further down the line. They’ve done the job. They’ve been paid. What happens after that is someone else’s problem. The risk, however, remains.

Mortgage bonds are a great example of pass the parcel. Everyone took a cut. The estate agent sold the house, picked up a commission, and moved the risk to the mortgage provider. The banks rolled the mortgages into bonds. They sold them on after paying a ratings agency to value them, passing the risk to investors, some of whom insured the bonds, passing the risk to insurance companies, who charged a premium and then used reinsurance to spread the risk to other parties.

Incentives and commissions drove this. It wasn’t creative. It was like process work. Forget the product; look at the volume. The more you do, the bigger the bonus. No surprise it ran amok. The volume of bonds rose; their quality fell. The risk never went away. It was just moved on and when the music stopped, the taxpayer was left holding the parcel.

Where do incentives fit in?

Where do incentives fit in?

At the team level, motivation is about achieving solutions. Individuals take pride in being part of a successful team. If remuneration must be an issue, avoid individual rewards. Tailor a bonus pool for the group. Base it on the impact of their results and the overall performance of the firm. Seek the team’s view on how they would allocate it.

At the firm level, reflect the long-term values and strategy of the firm, not this quarter’s bottom line. Make it inclusive. Avoid “us and them” and manage expectations. Make it clear that all stakeholders, not just employees, need to get a result. Don’t pay out if you are still at risk. Even sales bonuses need to be paid on money received, not on orders taken.

At the macro level, the rules of engagement should acknowledge systemic risk and its costs to both the firm and the community. When your counter-parties fail, they may take you with them. Get a reputation for quality products. They’re lower risk and they underwrite sustainable business.

For a functional incentive scheme, tie rewards not simply to the volume being done but to the quality of what is being achieved and the contribution people make to the overall wellbeing of the business and its stakeholders.