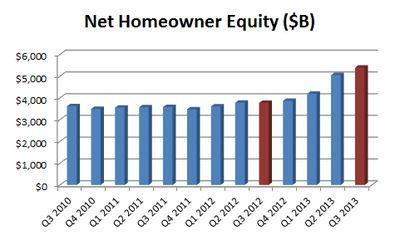

Homeowners' net equity showed record growth nationwide for the 12-month period from third quarter 2012 to third quarter 2013, according to data released by the Federal Reserve.

If you are one of the hundreds of thousands of homeowners who have been underwater on your mortgage for years, it could mean you can finally sell your home and bring less... or no money to closing. You might even walk away with some money in your pocket.

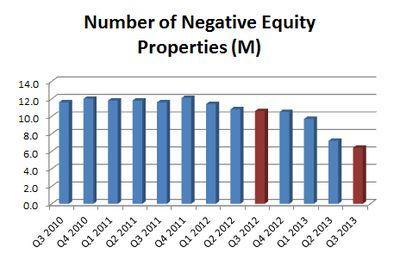

Negative equity woes aren't over yet, but the drop in the number of properties with negative equity is significant. Nationwide 13% of all homes with a mortgage were underwater in the third quarter 2013... down from 15% just the quarter before. Things are headed in the right direction.

Minnesota is doing better than the national average, with 9.6% of homes underwater (meaning the current value of your home is less than your mortgage balance). The Twin Cities metropolitan area ranks 11th of 25 metropolitan areas nationwide at 9.9%... national range is 4.2% in Houston, TX to 32.3% in Orlando, FL. (See the full CoreLogic Equity Report.)

If you have been wanting to refinance, tap into equity for home improvements, or are ready to sell and buy another home but have been stalled by negative equity... it could be worth finding out what your home might sell for in today's market. The stars may finally be aligning in your favor... mortgage interest rates certainly are!

Sharlene Hensrud, RE/MAX Results - Email- Twin Cities Realtor

RELATED POSTS

- Median price holds steady in spite of typical holiday activity slump

- Foreclosures at lowest levels since 2007

- It's a seller's market again... 6 things that are different this time

- One of the most affordable home buying environments in decades