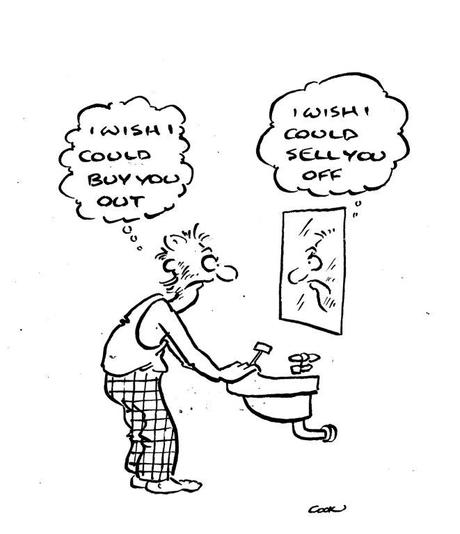

Buy low; sell high

Buy low; sell high

Two things, very simple; makes sense. In 40 years in finance I rarely found people who were consistently good at both. The industry has a natural bent to invest rather than divest. In early years as an analyst, people asked me what to buy; few asked what to sell.

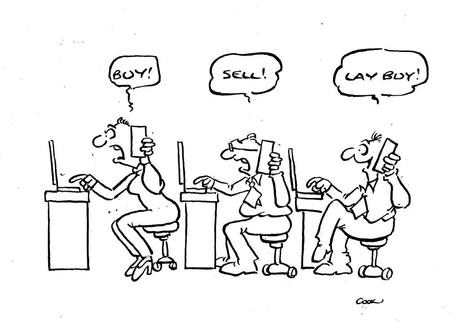

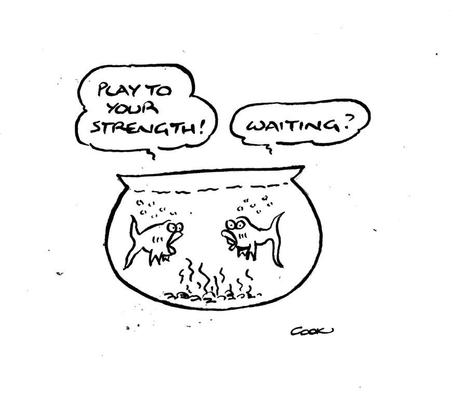

Some were better at shorting, ie selling, but not always good at covering the short, ie buying. When natural buyers or natural sellers had to do the opposite of their strength, it was often too early or too late.

This was an observation, not empirical analysis, but plenty of research has shown these decisions to be heavily affected by emotions. People exit good investments too early and poor performers too late. I’ve done this myself.

Functional traders try to curb this emotional response by sticking to rules — hedging strategies, stop losses, limit orders and the like. But many admit to occasionally breaking them on a so-called hunch. Sometimes they win; sometimes not.

What does this say about your career, your business — or your life?

Managing you

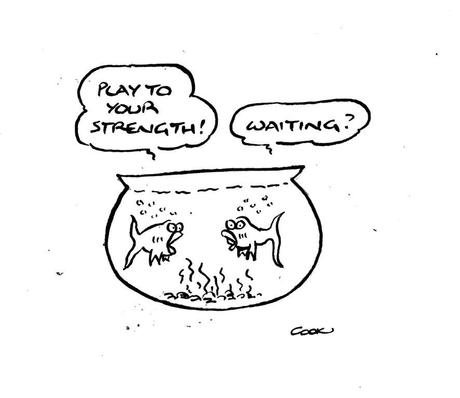

Risky behavior is more common when under pressure to perform in areas which are not strengths. MRI studies show it presses the flight, freeze or fight button. Cognitive processes are impaired and decisions are dumber as a result. The opposite occurs when you are in your strong zones.

For personal growth, set goals which take your strong suit to the next level. If you want something more lateral, apply those strengths to other tasks. If you are an investment analyst with great analytical skills, don’t put all your efforts into buys. Come up with a portfolio of amazingly rigorous sell recommendations.

Managing your business

Businesses also have strengths. No competitor looks exactly alike. Yours is better at something. What is it? It may be simple things like delivery, location or sales. Maybe it’s technology or customer processes. Whatever it is, give it a chance to shine.

It’s also your people. An executive with a firm I work closely with has a knack for solving problems for leading edge customers. Recognising that strength led to launching a highly marketable Solutions Lab. Another executive, who is meticulous in the production of die casting moulds, now runs the toolroom as a Centre of Excellence.

Managing your life

The hardest part is knowing your own strengths. Sometimes they occur so naturally you don’t notice them. I once chastised myself for continuously changing roles and locations. Why couldn’t I be more of a stayer? In a chance meeting years later the chairman said how lucky it was to have me onboard. How so, I asked? “Whenever we had a problem,” he replied, “we’d parachute you in and you’d sort it out.’’

If you look back at your life, at what you’ve done and where you’ve been, you’ll find times when you got it just right. Something about you made it happen.

What was it?

It was probably a strength.