Hard yards for incumbents and startups

Hard yards for incumbents and startups

General Electric (GE) was dropped from the Dow Jones last year. After more than a century, the oldest member finally left. It was replaced by a drugstore chain.

Many incumbents have a similar profile to GE. They have long histories. Many are profitable, household names that remain viable. Their balance sheets are strong and their reach is deep.

What’s missing?

Growth — in revenues, margins and bottom lines. The 25 largest F&B manufacturers in the US command 45% of the market, yet last year they generated only 3% of market growth. The other 97% came from smaller firms, new entrants and disruptive startups. For established firms, there are limits to growth.

Why don’t they buy more startups?

Why don’t they buy more startups?

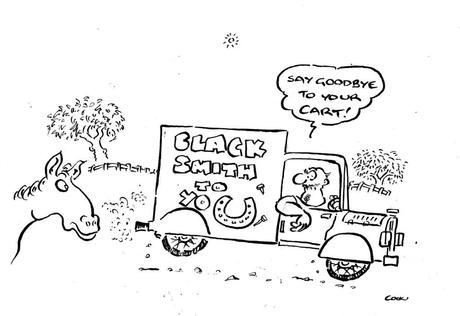

It’s hard to disrupt yourself. Especially if you are big. Incumbents are like aircraft carriers. Changing direction takes a lot of ocean. Even deciding which way to turn can be problematic.

It can be difficult to identify the disruptive shift, let alone the appropriate response. Imagine Elon Musk went to General Motors (GM) in 2010 and said. “I’ve got this idea. It will need a billion dollars and will lose money non-stop for at least a decade. There’s a chance it won’t succeed but it’s pretty exciting.” You could understand some reluctance on GM’s part.

There is also the high cost of disrupting your own business model. You can buy a start-up but it takes a long time to contribute. In an age of quarterly performance updates, who wants their bottom line eroded for a few years while a risky experiment gathers traction — especially if you are on an executive package tied to your stock price. Shareholders don’t like long-term plans that curtail short-term earnings.

So if incumbents struggle, what about startups?

Most entrepreneurs fail. Barely one third of new businesses celebrate their tenth birthday. One Harvard study says as many as 75% won’t make it. That doesn’t mean they didn’t have a good idea, or enough passion, vision or any of the other entrepreneurial cliches. It mostly comes down to three Cs - not enough capable staff, not enough capacity to scale, and not enough capital.

Who has those things?

Who has those things?

That would be the incumbents. The notion of incumbents saving themselves by acquiring disrupters clearly isn’t a lay down misere, but buying a pivot can be less risky than building one. It lays off the odds and injects lateral thinking that can challenge existing cultures. Even modest bolt-ons can boost efficiency. They can lift margins or provide opportunities to tap new market sectors.

In the life cycle of any firm, that underlines a key issue not just for incumbents but for disrupters as well. Startup strategy is not simply who is going to buy your product. Equally important is who might buy your business.