Predictions are usually wrong

Predictions are usually wrong

It’s February. We’ve made it through another prediction season. We now know what to expect in 2013.

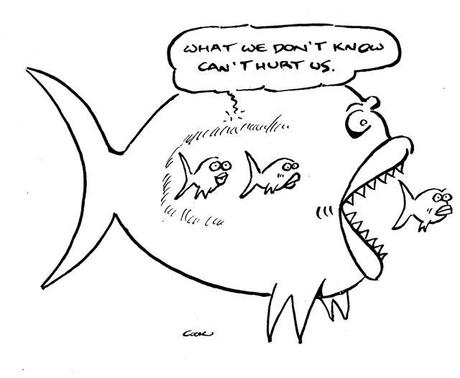

Or do we? After all, most of the things commentators told us would happen a year ago failed to materialize. Mostly, they were wrong.

Some failures were well broadcast. US election predictions were pretty much all wrong. Left and right-wingers were equally hopeless. They had Obama winning or losing by huge margins. The result was a close call. Democracy, as usual, muddled through.

Financial commentators were way off the mark. Had they been right, Europe would now be a smoking ruin. It’s not. Stock markets would have ended lower than they started. Some did; most didn’t. Corporate profits should have collapsed. In the US, they reached an all time high. Greek bonds should have defaulted and fallen in value. Instead they rallied.

Elsewhere, the big shakeout in China failed to occur. The iron ore price recovered rather than collapsed. As far as we know, Iran hasn’t yet produced a nuclear bomb. To date, no one has left the Euro.

A lot of those things could happen in 2013. People are saying they will. Sooner or later, some predictions are right. As Keynes famously said: in the long run, we are all dead.

Should we worry?

It’s true that some people get it right. But there’s a lot of luck to it and empirical studies show that most – not all, but most – of those same people will probably get it wrong next year.

There are some good forecasters out there, but most of them don’t put it all on black. The people who do that are those who are convinced they are right. And that’s where the problem is. There is a limit to the positive impact of self-belief.

Research bears it out. Take the Tetlock experiment. Over 20 years, it found that not only were forecasters generally wrong, the ones that were most wrong were the ones who thought they were most right.

It doesn’t stop at public commentators. A landmark study by Stanford medical professor, John Ioannidis, found most medical research findings also to be wrong. They were heavily influenced by things like the popularity of particular theories or the likelihood of attracting research funding.

Business leaders don’t fare any better. Studies show that corporate leaders who make big statements about management don’t necessarily produce better corporate results. In fact, many celebrity CEOs deemed “charismatic” make inappropriate radical changes, polarize staff and oversee a decline in corporate performance.

As Bradley Agle, an author of one such study puts it, there is a thin line “between charisma and dysfunctional forms of narcissism”.

So what do you do?

For a start, be very wary of the constant background noise. That’s all it is. Nobody really knows. The upshot of Tetlock’s work suggests you avoid leaving decision-making to mono-cultural managers with a rigid worldview.

Instead, embrace the input from those more open to the possibility that they could be wrong. It’s the informed skeptic who is more likely to see both the wood and the trees. In unexceptional times, they will find a way through.

Even in exceptional times, flexibility is an asset. Sometimes you might need a Churchill. It’s just that most of the time, you don’t. For that matter, Churchill’s firmness, which was inspirational during WWII, was a liability in WWI.

The problem with “confirmation bias” is that it confirms things are either black or white, whereas reality is more often gray. Taking the view that it could go either way is necessarily a hedged position. It’s lower risk as a result.

What’s a reasonable prediction for the coming year? Maybe there will be some Black Swan event; maybe there won’t. By definition, we can’t predict that, or do much about it if there is one. But it also may be that, just like most democracies, we will kind of muddle through. That’s what we did in 2012.

That’s a perfectly plausible forecast, just like most of the others.