Data Vizualization & Predication – Elephant Snack today 05-01-2020.

#My first Mode, I took the INRvsUSD values from the website as CSV

#and cleaned the data and tested the predictor values against the response variable

#tested the mode using below techniques

# R2(square) of the model

# Cooks distance of the model

# Confidence using Confint

# AVPlots

# Adjusted R2 value

# AIC Value – Akaikie Information Criterion

# Stepwise Analysis

# Null hypothesis test method = Chi

# Finally Chose the the best fit model as Price (response) vs (High & Open) (predictor)

#Set up WOrking Directory

setwd(“C:/Users/asket/Documents/Exploratory Data Analysis/DataSet/INRvsUSD”)

#install library

library(MASS)

library(Hmisc)

library(car)

#upload the file

inrvsusdprediction<-read.csv(“USD_INR_Historical_Data.csv”)

#Data Cleaning

names(inrvsusdprediction) <- gsub(“..”, “”, names(inrvsusdprediction),fixed = TRUE)

names(inrvsusdprediction) <- gsub(“ï”, “”, names(inrvsusdprediction),fixed = TRUE)

as.character(inrvsusdprediction$Change)

inrvsusdprediction$Change<-sub(“%”,””,inrvsusdprediction$Change)

inrvsusdprediction$Change<-sub(“-“,””,inrvsusdprediction$Change)

as.numeric(inrvsusdprediction$Change)*10

as.numeric(inrvsusdprediction$Change)

class(inrvsusdprediction$Change)

inrvsusdprediction<-inrvsusdprediction[c(-1)]

#summary of the data

summary(inrvsusdprediction)

#response variable is INR PRICE

#learn about variables

#to subplot

par(mfrow=c(1,2))

#INR Price

boxplot(inrvsusdprediction$Price,main = ‘INR-Price’)

hist(inrvsusdprediction$Price,main = ‘Hist-INR-Price’)

#Open Price

boxplot(inrvsusdprediction$Open,main = ‘Open-Price’)

hist(inrvsusdprediction$Open,main = ‘Open-Price’)

#High Price

boxplot(inrvsusdprediction$High,main = ‘High-Price’)

hist(inrvsusdprediction$High,main = ‘High-Price’)

#Low Price

boxplot(inrvsusdprediction$Low,main = ‘Low-Price’)

hist(inrvsusdprediction$Low,main = ‘Low-Price’)

#%change in Price

boxplot(inrvsusdprediction$Change,main = ‘Change-in-Price’)

hist(inrvsusdprediction$Change,main = ‘Change-in-Price’)

#to check the response variable noramlity, if the p value is > 0.05 then okay else take sqr

#root of the reponse variable and bind them in the data frame

#and check the box plot for normality

#then run the shaprio test

shapiro.test(inrvsusdprediction$Price)

#check multi collienarity

pairs(inrvsusdprediction,gap = 0.5)

attach(inrvsusdprediction)

#linear relationship between the predictors

#VIF – Variance Inflation factor

inrvsus.lm<-lm(Price~Open+High+Low,data = inrvsusdprediction)

summary(inrvsus.lm)

vif(inrvsus.lm)

#if any values are > 10 then there is collienarity between variables

#we do not have any so we can move ahead

par(mfrow=c(1,2))

plot(Price~Open)

smooth.line = smooth.spline(Price~Open,spar = 0.99)

lines(smooth.line,col= ‘red’)

plot(Price~High)

smooth.line = smooth.spline(Price~Open,spar = 0.99)

lines(smooth.line,col= ‘red’)

#check the linear model summary for the relationship between the variables.

inrvsusd.model <- lm(Price~Open+High, data = inrvsusdprediction)

summary(inrvsusd.model)

#residual model

ResidualsInrUSD<-resid(inrvsusd.model)

print(ResidualsInrUSD)

#fitted model

PredictedINRUSD <-predict(inrvsusd.model)

print(PredictedINRUSD)

par(mfrow=c(1,1))

plot (ResidualsInrUSD~PredictedINRUSD)

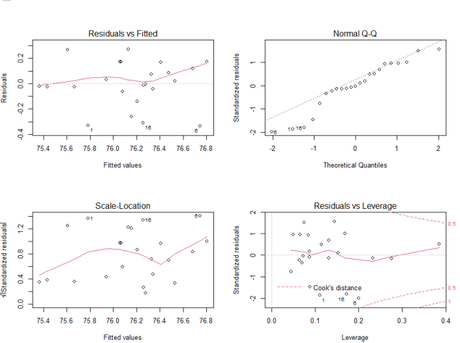

#Cooks distance

par(mfrow=c(2,2))

plot(inrvsusd.model)

#Confidence interval 2.5% & 97.5% should not be 0, if 0 then its

#less influential

confint(inrvsusd.model)

#Partial Regression Plots

avPlots(inrvsusd.model)

#hypotheis test of each model

OpenvsHigh.model <- lm(Price~Open+High, data = inrvsusdprediction)

inrvsusdHigh.model <- lm(Price~High, data = inrvsusdprediction)

inrvsusdOpen.model <- lm(Price~Open, data = inrvsusdprediction)

inrvsusdLow.model <- lm(Price~Low, data = inrvsusdprediction)

#Null Hypothesis Test

anova(inrvsusdHigh.model,inrvsusdOpen.model,test =’Chi’)

#summary of each model the highest r2 value model is a good mo

summary(OpenvsHigh.model)

summary(inrvsusdHigh.model)

summary(inrvsusdLow.model)

#Akaike Information Criterion – Lowest AIC value for the best model

AIC(OpenvsHigh.model)

AIC(inrvsusdHigh.model)

AIC(inrvsusdLow.model)

#Best model after all testing

summary(OpenvsHigh.model)

#model final testing

par(mfrow=c(2,2))

plot(OpenvsHigh.model)

#tested the price of the INR is highly depended on the Open & the high value against USD

ResidualsInrUSD<-resid(OpenvsHigh.model)

shapiro.test(OpenvsHigh.model$residuals)

avPlot(OpenvsHigh.model)

vif(OpenvsHigh.model)

To be Continued….!!