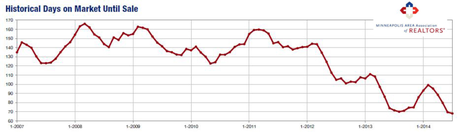

In the Twin Cities real estate market, July 2014 average days on market until sale were 68... the lowest since the Minneapolis Area Association of Realtors started recording this metric in 2007. This also helps keep sale price percent of list price strong, at 96.8% in July 2014.

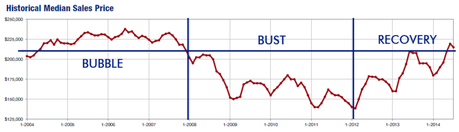

Although median sale dropped from $219,900 in June to $215,000 in July, that still is a 3.4% increase over last July and a typical seasonal trend... we are still on a recovery trajectory.

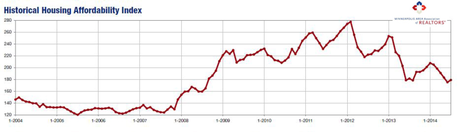

Job growth has strengthened, but wage growth has not kept pace with home prices, having an effect on housing affordability. Rents are still rising but interest rates are still historically low... making this a desirable time to buy for those wanting to keep housing costs in check.

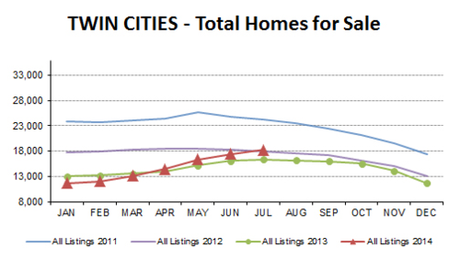

Inventory levels are finally continuing to rise, ahead of not only last July but also July 2012.

This means buyers have more choices than they had last year, as months supply of inventory rose to 4.4 compared to 3.8 months last year. The market is considered balanced at a 5-6 month supply of inventory.

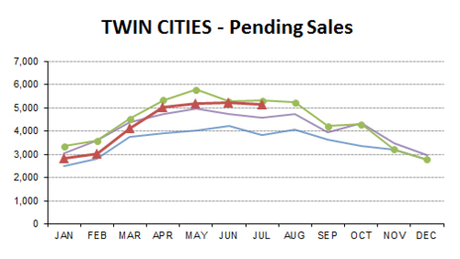

Pending sales continue to hold pretty steady, although 2014 pending sales have hung below 2013 all year.

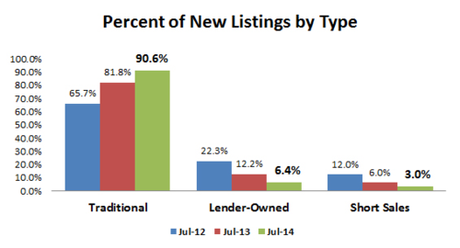

Distressed bank owned and short sale properties continue to command a shrinking percentage of the total homes for sale, a good indicator that the real estate market is staying on the recovery path.

The figures above are based on statistics for the combined 13-county Twin Cities metropolitan area released by the Minneapolis Area Association of Realtors.

Never forget that all real estate is local and what is happening in your neighborhood may be very different from the overall metro area.

- Click here for local reports on 350+ metro area communities

Sharlene Hensrud, RE/MAX Results - Email - Minneapolis - St. Paul Real Estate Market

RELATED POSTS

- What housing type is in shortest supply? Houses, townhomes or condos?

- June 2014 Real Estate Update... median sale price finally touches pre-bust levels

- Signs of an up and coming neighborhood