The six key pieces from the November sale all (except one) went well- above their high estimates. I am only concentrating on these “key pieces” because while the sale also consisted of other accouterments such as frames, cufflinks, gem-studded evening purses, and medals these six items were particularly extraordinary. This is not just because of their intrinsic value but also because they examples of great jewelry design, superb craftsmanship, and finally, because they all had an important personal connection to the Duchess.

Now a look at the prices (we must take into consideration inflation and also the currency exchange rate):

Lot 15: Cartier emerald, ruby, and diamond brooch which the Duke presented the Duchess with on their 20th wedding anniversary (est. 100,000-150,000 GBP), 2010: 205,250 GBP, 1987:185,597 GBP

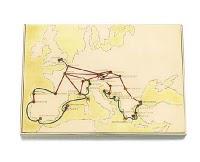

Lot 16: Cartier, Gold and multi-gem set cigarette case which engraved with a map of Europe charting three holiday trips (est.150,000-200,000 GBP), 2010: 181, 250 GBP 1987: 181,070 GBP.

Lot 17: Cartier diamond and gem-set cross bracelet (est. 350,000-450,000 GBP).2010: 601,250 GBP 1987: 235, 391 GBP

Lot 18: Cartier, Paris The gold and diamond necessaire du soir, 1947 (this pendent in the shape of an egg opens to reveal a mirror and a powder puff) (est. 70,000—90,000 GBP) 2010: 139,250 GBP 1987: 181,070 GBP

Lot 19: Cartier onyx and diamond panther bracelet, (est.1, 000,000-1,500,000 GBP) 2010: 4,521,250 GBP 1987: 860, 082 GBP.—this is certainly the star of the sale!

Lot 20: Cartier Flamingo clip with rubies, emeralds, diamonds, citrines, and sapphires (est. 1,000,000-1,500,000 GBP), 2010: 1,721,250. GBP 1987: 497,942 GBP

For more information on Wallis Simpson and her jewels, I recommend Suzy Menkes’s book, “The Windsor Style” (Harper Collins, 1987) and also, if you can, get your hands on the original Sotheby’s catalogue from April 1987 of the Geneva sale of the Jewels of the Duchess of Windsor. You will not be disappointed. Not only is all the jewelry photographed in color but there are wonderful photographs of the Duchess wearing the pieces. My personal favorite was the incredibly fabulous, jaw-droppingly beautiful, stained blue chalcedony, sapphire, and diamond necklace, ear clips and bangles – some lucky lady still has that in her collection!