Is your great idea ready to roll?

It’s tough raising funds for new ventures right now. The market for startup capital is being squeezed at both ends. On one hand, soft valuations have put exit sales into limbo. On the other, nervousness about a successful exit  stops investors from entering in the first place. It also means less capital returning for reinvestment.

stops investors from entering in the first place. It also means less capital returning for reinvestment.

The larger end of venture capital still has some dry-powder, but a lot of that was raised prior to the financial crisis, often with a five or six year time horizon. Many funds are approaching the end of their mandate with a poor track record and significant undrawn commitments. In current conditions, much of the dry powder will simply expire.

As for high-risk angels prepared to punt exciting ideas, there are fewer around and they have less money. Even the heavily engaged investor bases that reside in incubator hubs like Silicon Valley seem to be marking time.

What profile works in these conditions?

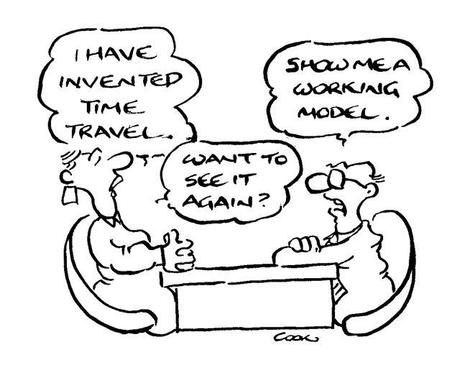

The first hurdle is having a product, not just a concept. Money to build your great idea is either difficult to attract or too expensive to raise. A diligent investor wants to see and test a working model.

Secondly, you need barriers to entry. First mover advantage is a powerful dynamic but the rapid emergence of look-alike competition can quickly erode even your worst-case revenue forecasts. You need some time inside the city walls.

It’s a big problem for technology start-ups. The accessibility of the cloud – pretty much a wall-free entity – means good ideas that are easy to launch can be quickly duplicated and commoditised. Once that happens, profitability gets squeezed.

Thirdly, if you’ve got something that works, will it work in the market? You may have technical proof-of-concept, but do you have commercial proof? If you can realistically demonstrate demand, you are asking for money to roll it out. You have already started to de-risk the investment and it’s looking more attractive.

Lastly, if you successfully raise funds, will you be capable of self-sustaining growth? The turn-off for early stage investors is not so much having to ante up for a second round of founding. It’s the reason for it.

It’s fine for a marketing rollout. But if it’s for more product development rather than revenue generation, investor appetite will be limited. If there is appetite at all, the cost of raising those funds – in terms of the equity you have to give away, or the caveats they will demand – will be correspondingly higher.

Does your proposal have what it takes?

You may have a comprehensive business plan and a great PowerPoint presentation – everyone does – but do you have a working model with clear commercial potential? Will you have some time to build momentum in a well-defended walled city? When the drawbridge is finally lowered and the marketplace rushes in, you will need critical mass, immediate traction and competitive protection.

You can you tick all those boxes and still get it wrong, but there are investors who will take that chance. In the current environment, that’s where the money is.