(click on the image for a better view)

Small Industry Loans without Collateral

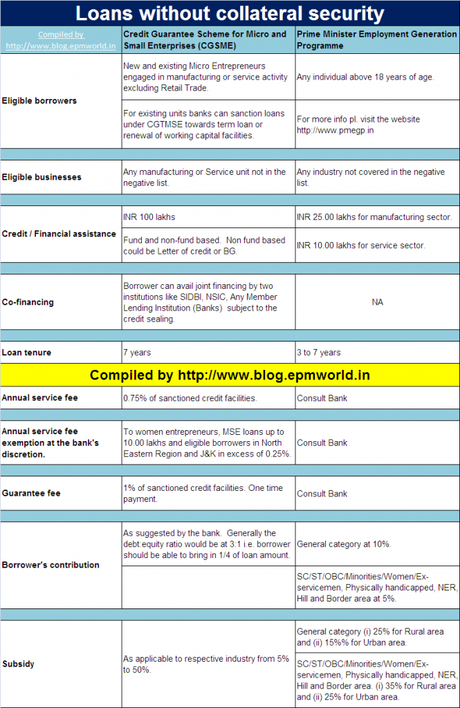

Loans without collateral security

Compiled by http://www.blog.epmworld.in Credit Guarantee Scheme for Micro and Small Enterprises (CGSME) Prime Minister Employment Generation Programme

Eligible borrowers New and existing Micro Entrepreneurs engaged in manufacturing or service activity excluding Retail Trade. Any individual above 18 years of age.

For existing units banks can sanction loans under CGTMSE towards term loan or renewal of working capital facilities. For more info pl. visit the website http://www.pmegp.in

Eligible businesses Any manufacturing or Service unit not in the negative list. Any industry not covered in the negative list.

Credit / Financial assistance INR 100 lakhs INR 25.00 lakhs for manufacturing sector.

Fund and non-fund based.Non fund based could be Letter of credit or BG. INR 10.00 lakhs for service sector.

Co-financing Borrower can avail joint financing by two institutions like SIDBI, NSIC, Any Member Lending Institution (Banks)subject to the credit sealing. NA

Loan tenure 7 years 3 to 7 years

Compiled by http://www.blog.epmworld.in

Annual service fee 0.75% of sanctioned credit facilities. Consult Bank

Annual service fee exemption at the bank’s discretion. To women entrepreneurs, MSE loans up to 10.00 lakhs and eligible borrowers in North Eastern Region and J&K in excess of 0.25%. Consult Bank

Guarantee fee 1% of sanctioned credit facilities. One time payment. Consult Bank

Borrower’s contribution As suggested by the bank.Generally the debt:equity ratio would be at 3:1 i.e. borrower should be able to bring in 1/4 of loan amount. General category at 10%.

SC/ST/OBC/Minorities/Women/Ex-servicemen, Physically handicapped, NER, Hill and Border area at 5%.

Subsidy As applicable to respective industry from 5% to 50%. General category (i) 25% for Rural area and (ii) 15%% for Urban area.

SC/ST/OBC/Minorities/Women/Ex-servicemen, Physically handicapped, NER, Hill and Border area. (i) 35% for Rural area and (ii) 25% for Urban area.

You may also like -