13th Month Pay

By Eric Tutor Cabalda, November 9, 2013. Makati City

My email is flooded with questions regarding the 13th Month Pay as an employee benefit. Thus, I will explain this employee benefit to its simplest term and based on some references.

Historical Background

The 13th Month Pay otherwise known as the Presidential Decree No. 851 was passed into law by the late President Ferdinand E. Marcos on December 16, 1975. According to the law, all employees receiving a salary not exceeding P1, 000.00 shall be given a 13th month pay. This was revise by President Corazon Aquino on August 13, 1968 by virtue of the Memorandum Order No. 28 removing the P1, 000.00 salary ceiling. With this revision, all rank and file employees regardless of salary shall be entitled to the 13th month pay unless otherwise the employer is exempted as prescribed by PD 851.

Who are covered

All rank and file employees regardless of their designation, status, salary and method of which their salaries are paid, provided they had rendered work of not less than one month within a calendar year are covered by the 13th Month Pay.

Likewise, covered by the 13th month pay shall also consider what is agreed in the Collective Bargaining Agreement of a company.

Rank and File Employees Defined

As defined by The Labor Code, a rank-and-file employee is distinguished from a managerial employee. A managerial employee is one who is vested with powers of prerogatives to lay down and execute management policies and/or to hire, transfer, suspend, lay-off, recall discharge, assign or discipline employees, or to effectively recommend such managerial actions.

All employees not falling within the definition above are considered rank-and-file employees and that distinction shall be used as guide for determining who are rank-and-file employees.

Amount of the 13th Month Pay

The amount shall be not less than 1/12 of the total basic salary earned by an employee within the calendar year.

Computation of the 13th Month Pay

The revised guideline specifies for the purpose of computing the 13th month pay shall include all remunerations or earning paid by this employer for services rendered but does not include allowances and monetary benefits which are not considered or integrated as part of the regular or basic salary, such as the cash conversion of unused vacation and sick leave credits, overtime, premium, night differential and holiday pay, and cost-of-living allowances. However, these salary-related benefits should be included as part of the basic salary in the computation of the 13th month pay if by individual or collective agreement, company practice or policy, the same are treated as part of the basic salary of the employees.”

As defined above, the formula in computing 13th month pay is:

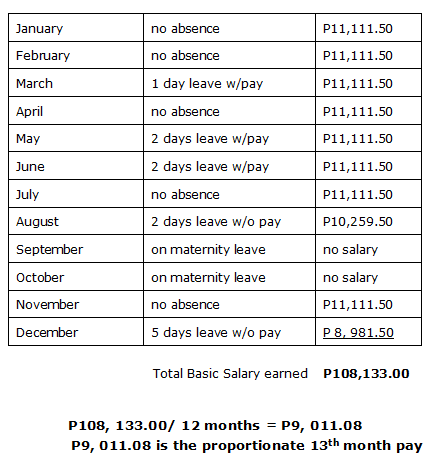

13monthpay = total basic salary within the calendar year / 12

Below is an example of how to compute the 13th Month Pay as provided by the Department Advisory No. 2 Series of 2012 by the Department of Labor and Employment.

Illustration: Using the basic wage in the National Capital Region P426.00 per day and a six-day workweek or an equivalent Monthly Basic Salary of P11,111.50, to wit:

When is it Paid?

The 13th month pay shall be paid not be later than December 24 of each year. However, companies may give its employees one half before the classes starts every June and the remaining half not later than December 24

Is 13th month pay taxable?

Thirteenth month pay and other benefits amounting to P 30,000 and below are not subject to income tax.

Who are excluded from receiving the 13th month pay

- Managerial employees;

- Those covered under the civil service law;

- Those already receiving 13th month pay or its equivalent. Christmas bonus, mid-year bonus, cash bonuses and other payments amounting to not less than 1/12 of the basic salary are treated as equivalent of 13th month pay;

- Household helpers and persons in the personal service of another; and

- Those paid on purely commission, boundary, or task basis, and those who are paid fixed amount for performing specific work except those paid on a piece-rate basis.

13th Month Pay of Certain Types of Employees

(From http://www.laborlaw.usc-law.org)

Employees paid on commission basis.

Employees paid on a purely commission basis are not entitled to 13th month pay. They are expressly excluded from the coverage of PD 851. However, employees paid on partly commission basis, i.e., those guaranteed with a fixed wage aside from the commission, are entitled to 13th month pay.

Computation. In the computation of the basic salary of employees paid partly on commission basis, we must distinguish between the two types of commission:

- Commission as an incentives or encouragement to ensure productivity, i.e., productivity bonus; and

- Commission as a direct remuneration for service rendered.

Commission that take the form of an incentives or encouragement to ensure productivity, e.g., productivity bonus, does not form part of the basic salary. As such, it may be excluded from the computation of 13th month pay. Only the fixed or guaranteed wage is required to be included in the computation (see Boie Takeka case, 1993.)

Basic salary = Fixed wage (commission is excluded)

On the other hand, commission that takes the form of a direct remuneration for services rendered should be included in the computation of the basic salary. That is, it should be added to the guaranteed wage of the employee in computing his “basic salary” (see Philippine Duplicators v. NLRC, 1993.)

Basic salary = Fixed wage + Commission

13th Month Pay of Employees with Multiple Employers.

Employees with multiple employers are entitled to 13th month pay from all their private employers.

Thus, if an employee works in two or more private firms, he is entitled to the pay from both or all of them. If he is a government employee, but works part time in a private enterprise, he is entitled to 13th month pay from the private enterprise.

13th Month Pay of Private School Teachers.

Private school teachers are entitled to 13th month pay regardless of the numbers of months they work in a year, provided it is at least one month.

Are employees who have recently resigned entitled to the 13th month pay?

(From http://salongacenter.org/2013/03/what-is-the-13th-month-pay/)

An employee who has resigned or whose services were terminated at any time before the time for payment of the 13th month pay is entitled to this monetary benefit in proportion to the length of time he worked during the year, reckoned from the time he started working during the calendar year up to the time of his resignation or termination from the service. Thus, if he worked only from January up to September his proportionate 13th month pay should be equivalent of 1/12 his total basic salary he earned during that period.

The payment of the 13th month pay may be demanded by the employee upon the cessation of employer-employee relationship. This is consistent with the principle of equity that as the employer can require the employee to clear himself of all liabilities and property accountability, so can the employee demand the payment of all benefits due him upon the termination of the relationship.

References:

http://www.dole.gov.ph

http://www.chanrobles.com

http://www.laborlaw.usc-law.org

http://salongacenter.org