Joe Cotton is one of the finest and most experienced Technical Analysts in the country. Besides winning National Stock Picking Contests, he has accurately predicted the direction of the stock market and individual stocks on many occasions, including the top of the Bull Market in January of 2008, and the bottom of the Bear Market in March of 2009.

INTERVIEW WITH JOE COTTON

”It’s not What you buy, but When, you buy it”

Joseph W. Cotton, Publisher

Website: www.cottonstocks.net

E-mail: [email protected]

Question:

Joe, you have won 2 National Stock Picking Contests with 1-year returns of 97% or better.

In this year’s “Wall Street’s Best Investments” stock picking contest you posted a 742.86% 6-Month Return for your January 2020 pick, Inovio Pharmaceuticals (INO) @ $3.82, which you closed out at $28.32. How do you do it?

Answer:

First of all, I have been publishing my Market Letter continuously since 1986, and so have a lot of experience trading in all kinds of Markets, both Bull and Bear.

Secondly, and most important, I use technical analysis to analyze the last 2 years of a prospective company’s stock chart and by doing so, I have the ability to pick stocks that usually go up.

And third, I have a strong financial background and am able to analyze a company’s financial statements, and also make a calculated guess as to whether they will be successful. As the former Credit Analyst for the National Accounts Division of Fifth Third Bank, I analyzed the financial statements of our National Corporate Clients in order to recommend renewing or declining their Line of Credit with our bank.

My education at Xavier University served me well…I obtained a BSBA Degree, Major in Finance, Dean’s List all semesters attended. As a former Registered Representative for Fidelity Investments, I achieved the highest Series 7 Score in the history of the regional Blue Ash (Cincinnati) Ohio office while employed there.

But, believe me, it’s all in the charts. And you should never buy a stock without looking at the chart of the company’s stock.

Question:

On your website www.cottonstocks.net, you claim that some of your stock picks have doubled in 30 days. That’s a pretty big boast. Can you provide any recent examples of your stock picks that actually doubled in that short of a time period.

Answer:

Surely!

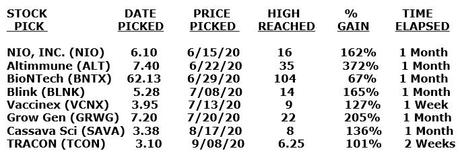

Below is a list of stocks, beginning in June, that doubled within 30 days. BioNTech is included- to show you one of my higher priced stock picks that also did well….within 30 days…up 67%.

As you can see, we’re not just a one-hit wonder.

If you would like to verify the above figures, just send me your email address and I will send you the respective Market Letters for each pick. Then you can to to www.stockcharts.com to see the performance of each pick.

Question:

There are those that have compared you to Jim Cramer. What do you say about that?

Answer:

Well, I respect Cramer, and he is fabulous at what he does, just as I am fabulous at what I do. But he and I have different approaches for choosing stocks.

He meets with the CEOs of lots of companies and does in depth analyses on their companies. His recommendations are mostly, I believe, for longer term holds, whereas I expect my stock picks to move up 20% within 90 days. I, on the other hand, just do my fundamental analysis for any prospective stock pick and then analyze the company’s stock chart for the last 2 years.

If the fundamentals are ok and the chart is good, I may give the stock a Buy Rating.

But no matter how great the company is, if their stock chart isn’t good, then I won’t give it a Buy Rating. The Motto on my website is ”It’s not What you buy, but When, you buy it”.

I’m not aware of any National Stock Picking Contests that Jim has won, nor am I aware of the performance record for his stock picks. But I would be willing to bet $1000 that my performance results are a great deal higher than his. I know for a fact that my performance returns for 90 days and 6 months are steller.