She knows how hard her heart grows under the nuclear shadows

She can't just escape the feeling repeating in her head

When after all the urges some kind of truth emerges

We felt the deadly surges discovering Japan – Graham Parker

Happy Halloween!

The shorts are certainly getting a scare this morning as the BOJ hands out another $124Bn (yes, we did the relative math in this morning's Alert to our Members) and that was more than enough to pop the Nikkei 5% in 90 minutes, with the /NKD Futures now testing 16,850 – almost catching up to the Dow for the 3rd time in 2 years.

The shorts are certainly getting a scare this morning as the BOJ hands out another $124Bn (yes, we did the relative math in this morning's Alert to our Members) and that was more than enough to pop the Nikkei 5% in 90 minutes, with the /NKD Futures now testing 16,850 – almost catching up to the Dow for the 3rd time in 2 years.

Unfortunately, each time the Nikkei has matched up with the Dow's gains, it's marked and overbought top and led to a sell-off so we were forced to officially reverse our long call on Russell Futures (/TF) from yesterday morning's post and flip short at 1,169 (with tight stops over 1,170). That's OK though because a move from 1,132.50 to 1,169 on /TF is a profit of $3,650 per contract – not bad for a day's work, right?

See, I told you we could pay for your trip to our Las Vegas Live Seminar next week with a Futures trade!

Not that we advocate holding Futures positions overnight – it could just have easily gone the other way. That's what Wednesday's TNA spread was for – the longer-term long position on the Russell, which will pop TNA well over our $80 goal this morning – that trade has a 316% profit potential in less than a month!

Not that we advocate holding Futures positions overnight – it could just have easily gone the other way. That's what Wednesday's TNA spread was for – the longer-term long position on the Russell, which will pop TNA well over our $80 goal this morning – that trade has a 316% profit potential in less than a month!

Notice how we're popping out of the channel. It would be one thing if we were doing it based on US earnings but doing on Japanese stimulus, coming at the last day of the month just rubs me the wrong way and we'll be beefing up our shorts over the weekend to prepare for the post-election sell-off next week.

Meanwhile, back in the real World's economy, German Retail Sales were TERRIBLE just now plunging 3.2% in September, the worst monthly drop since May of 2007. THAT's what's REAL in the economy – it's just being masked by endless stimulus:

Meanwhile, back in the real World's economy, German Retail Sales were TERRIBLE just now plunging 3.2% in September, the worst monthly drop since May of 2007. THAT's what's REAL in the economy – it's just being masked by endless stimulus:

This all follows the grim news earlier in October that the country's industrial sector seems to be grinding to a halt. There's no doubt that this data point is going in the pile suggesting that Germany might be about to fall into recession.

The plunge in German retail sales, the biggest drop since May 2007, indicates that the German economy was very close to a technical recession in Q2 and Q3.Retail sales were on track for a decent quarterly expansion before September data, but today’s data are bad enough to indicate that retail sales fell back to a modest contraction in Q3.

The Analyst Who Predicted Germany's Horrible Industrial Numbers Has Another Terrifying Forecast

Jakobsen has not changed his stance, telling Business Insider about his extremely bleak outlook for the currency union: "The end game is that Germany is very likely to be in recession — that will bring the rest of the eurozone into recession. I think that will be in the first quarter of next year."

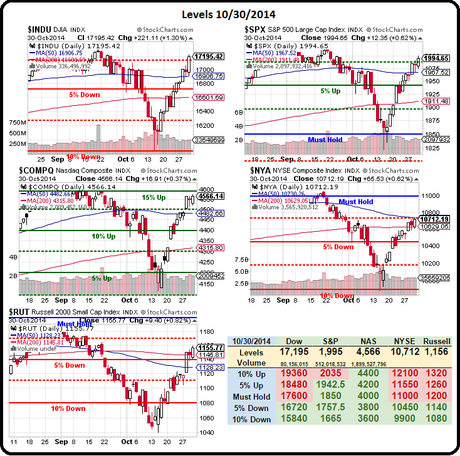

So, as crazy as it may seem on this super-bullish run, we're going to be looking for shorting opportunities into the weekend in our Live Member Chat room today – seeking to lock in the crazy gains we've made in our long-term portfolios from our "V" recovery:

Have a great weekend,

- Phil

Tags: Big Chart, BOJ, EWG, EWJ, Futures Trading, Japan Stimulus, Kuroda, Russell Futures, Smart Monkeys with Smart Phones, TNA

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!