2.9%.

2.9%.

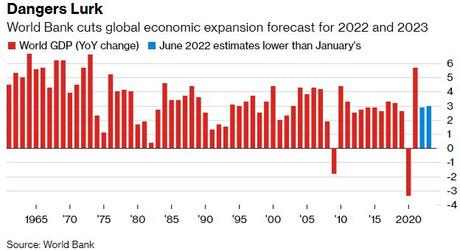

That's the new World Bank forecast for Global GDP growth and it's down 1.2% (29%) from their January estimate. Even worse, the World Bank does not expect growth to come back in 2023 – or 2024. We are essentially just one more downgrade away from a World-wide Depression. The World Bank said we are now entering what may be “a protracted period of feeble growth and elevated inflation” (which would be STAGFLATION):

“The war in Ukraine, lockdowns in China, supply-chain disruptions, and the risk of stagflation are hammering growth. For many countries, recession will be hard to avoid,” World Bank President David Malpass said.

The World Bank’s June report offers what it calls the “first systematic” comparison between the situation now and that of 50 years ago - a period of intense stagflation which required steep increases in interest rates in advanced economies and triggered a string of financial crises in emerging market and developing economies. Clear parallels exist between then and now, it said. Those include supply side disturbances, prospects for weakening growth, and the vulnerabilities emerging economies face with respect to the monetary policy tightening that will be needed to rein in inflation.

Meanwhile, the Fed has drastically lowered their own GDP outlook for the US, from 1.3% to 0.9% for Q2 (the one we are in) and that too is a 30% reduction – but over just the past two weeks!

Meanwhile, the Fed has drastically lowered their own GDP outlook for the US, from 1.3% to 0.9% for Q2 (the one we are in) and that too is a 30% reduction – but over just the past two weeks!

As you can see, the forecasts of Leading Economorons (the ones you hear yammering on in the Financial Media) is still at 3%, giving people a 200% WRONG impression of what to expect in Q2 earnings. When there is this much room for downside surprises – it pays to be very, very cautious with our portfolios.

One of the things we are watching for signs of strain is Consumer Credit, which popped $38.1Bn yesterday vs $35Bn expected. That indicates Consumers are still dipping into their savings and borrowing to keep up with inflation and that's not a trend that can go on forever. Credit card debt alone popped $17.8Bn – to an all-time record just at the time when interest rates are on the rise (Fed meeting next Wednesday).

…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!