Down in the pleasure center,

Hell bent or heaven sent,

listen to the propaganda,

listen to the latest slander.

Though you try to stop it,

it’s like a narcotic.

Pump it up until you can feel it.

Pump it up when you don’t really need it.

Yeah – GO MARKETS!!!

The Global markets are EXPLODING this morning (literally in Japan) and I’m not going to pretend there’s a reason for it other than to impress the suckers who can’t tell the real thing from – well, this. Asia is having a nuclear-fueled rally as the Nikkei pops 2.64% this morning, back over the 9,700 line on news like "Record Levels of Radiation," "Fujitsu Sees Billions in Losses," "PM Kan Says Tax Cuts May Be Suspended" and "Drainage of Radioactive Water Poses New Set of Problems." Well, what are you waiting for? BUYBUYBUY!!!

Let’s take a moment to accentuate the positive in Japan. Unemployment ticked down in a survey taken before the quake and Factory Output was up 0.4% in February – also before the quake. The WSJ headline is "Japan Output Rose in February" but, for those very few investors who read more than the headlines, that very same article says: "Damage to factories—along with subsequent power outages, which are expected to continue for months—means industrial output will likely be down 3% to 4% from a month earlier in March and down 1% to 2% in April, which would smother overall economic growth ahead, said Takuji Aida, senior economist at UBS Securities Japan."

Let’s take a moment to accentuate the positive in Japan. Unemployment ticked down in a survey taken before the quake and Factory Output was up 0.4% in February – also before the quake. The WSJ headline is "Japan Output Rose in February" but, for those very few investors who read more than the headlines, that very same article says: "Damage to factories—along with subsequent power outages, which are expected to continue for months—means industrial output will likely be down 3% to 4% from a month earlier in March and down 1% to 2% in April, which would smother overall economic growth ahead, said Takuji Aida, senior economist at UBS Securities Japan."

Well no wonder the Nikkei is up 2.6% today, at February’s rate of growth, they can make up that drop in less than 18 months – let’s party! Perhaps the markets are celebrating the fact that there hasn’t been a major aftershock since Monday morning or perhaps the low-volume Nikkei was the perfect way for the Gang of 12 to get the manipulative ball rolling this morning as they roll the global markets into a glorious end to Q1 tomorrow.

Speaking of glorious – Congrats to Pharmboy for nailing the timing on Monday’s Cephalon (CEPH) post, where the trade idea was the Jan $50/55 bull call spread for $3.50, offset by the sale of the $50 puts for $2.70 for net .80 on the $5 spread. Pharmboy wasn’t the only person who thought CEPH was a bargain at $58 as Valeant (VRX) made an all-cash $75 per share offer last night and that should give us almost the full 525% gain in a just two days on that trade. Congrats to all PSW Members who played along!

Speaking of glorious – Congrats to Pharmboy for nailing the timing on Monday’s Cephalon (CEPH) post, where the trade idea was the Jan $50/55 bull call spread for $3.50, offset by the sale of the $50 puts for $2.70 for net .80 on the $5 spread. Pharmboy wasn’t the only person who thought CEPH was a bargain at $58 as Valeant (VRX) made an all-cash $75 per share offer last night and that should give us almost the full 525% gain in a just two days on that trade. Congrats to all PSW Members who played along!

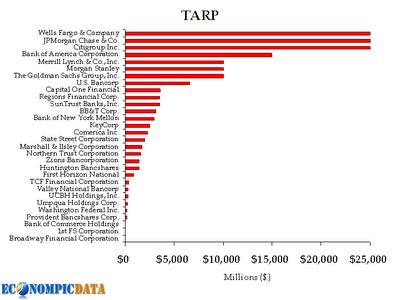

No longer feeling the need to play along is Neil Barofsky, the Special Inspector General for TARP, who is resigning in style today with a scathing editorial in the NYTimes (when WILL Murdoch shut those radicals down?) in which he calls the program a FAILURE and "little more than a giveaway to Wall Street executives."

From the perspective of the largest financial institutions, the glowing assessment is warranted: billions of dollars in taxpayer money allowed institutions that were on the brink of collapse not only to survive but even to flourish. These banks now enjoy record profits and the seemingly permanent competitive advantage that accompanies being deemed “too big to fail.”

The act’s emphasis on preserving homeownership was particularly vital to passage. Congress was told that TARP would be used to purchase up to $700 billion of mortgages, and, to obtain the necessary votes, Treasury promised that it would modify those mortgages to assist struggling homeowners. Indeed, the act expressly directs the department to do just that… That program has been a colossal failure, with far fewer permanent modifications (540,000) than modifications that have failed and been canceled (over 800,000).

Treasury’s mismanagement of TARP and its disregard for TARP’s Main Street goals — whether born of incompetence, timidity in the face of a crisis or a mindset too closely aligned with the banks it was supposed to rein in — may have so damaged the credibility of the government as a whole that future policy makers may be politically unable to take the necessary steps to save the system the next time a crisis arises. This avoidable political reality might just be TARP’s most lasting, and unfortunate, legacy.

While I applaud Barofsky for destroying his chances of ever working for the Gang of 12 in order to tell the truth to the American people – I do wish he had done so while he was actually in charge of the program. Is there no one in Government actually willing to stand up and blow the whistle on the corruption in they system while they are still in office? Are the people you are up against really that scary? I want to be elected to the Senate (the House is for losers) and I want to go to DC and record every word said at every meeting and they can edit it into a reality show so the people can find out what kind of crap is really going on in our Government!

While I applaud Barofsky for destroying his chances of ever working for the Gang of 12 in order to tell the truth to the American people – I do wish he had done so while he was actually in charge of the program. Is there no one in Government actually willing to stand up and blow the whistle on the corruption in they system while they are still in office? Are the people you are up against really that scary? I want to be elected to the Senate (the House is for losers) and I want to go to DC and record every word said at every meeting and they can edit it into a reality show so the people can find out what kind of crap is really going on in our Government!

Something needs to be done to wake this country up – that’s for sure. Anyway, there’s hardly any point but let’s look at the kind of news that might move a market -if we had a real one and not this total prop-job joke that’s been made of the American system:

New York has virtually no way to balance its $132Bn budget and is headed for a disaster of Biblical proportions:

- William Shatner is a Billionaire from making a commercial for a dot com company. Shades of 1999 or just a sign of the Apocalypse?

- ECB Member Yves Mersch says EU banks are being forced to buy Government paper through changes in regulation in order to preserve the ZIRP fallacy, which will lead to explosive bubbles and another complete financial meltdown.

- Euro Zone Consumer Confidence is down and Inflation Expectations are up to 30.8, the highest reading since December, 2001.

- Greece and Portugal continue to slide into bond-rate Hell.

- Case-Shiller showed eye-popping drops in Home Prices in states other than Florida and California this time with Atlanta down 7%, Chicago down 7.5%, Minneapolis down 7.6% and Seattle down 6.7%. "Prices are retesting the lows againwith no reason to think they won’t break below," Peter Boockvar writes. Nevada is also a TOTAL DISASTER.

- MBA Mortgage Applications are off 7.5% this week.

- To make matters much, much worse (if possible) – House Republicans proposed eight bills yesterday that collectively aim to privatize the mortgage market, and passed a bill to kill off Obama’s HAMP program. They proposed yesterday that borrowers be required to make at least a 20% down payment in order to get the best mortgage rates. In other words – let’s save the best rates for the richest people, of course!

- Meanwhile, budget negotiations are breaking down and we are barreling into a possible government shutdown in 10 days.

- IBIS World has a great report on the Top 10 Dying Industries.