What a quarter the Dollar is having.

What a quarter the Dollar is having.

We're 5% stronger since October 1st and that increased buying power is helping to keep inflation under control (seemingly) as the unit we measure inflation with (Dollars) is not a steady instrument. That's one of the big games the Government is able to play to get the outcome they desire. Of course, Dollar strength is playing out on the World stage as most investors are moving money back to CASH as Covid resurges into the holiday season.

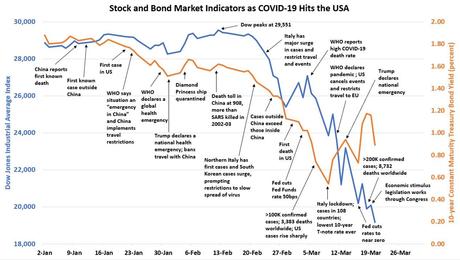

I know it was a long time ago but some people remember the bad old days of early 2020, when the Dow was at 29,500 and Covid was a "China Problem". Even after China declared a state of emergency, we decided we were immune and just kept doing what we were doing and it wasn't until late February that the markets began to take notice. By March, the Dow was down to 18,000 – a 38% drop in just over a month. I always find it interesting that traders don't believe history repeats itself – and then they go looking for "patterns" on their charts…

Here we are, 2 years and $6Tn (of Government Debt) and $5Tn (Fed Balance Sheet) later (not counting the $3Tn Biden just spent) and the Dow is up it's typical 20% over the past two years – as if nothing ever happened and traders are trading like nothing ever will happen again or, if it does, that we'll toss another $10-15Tn in to make sure the Top 1% don't take any losses.

And that's all great for the US because we can go $32Tn into debt and still have a strong (looking) currency and our Central Bank can buy $5Tn worth of worthless assets, using he people's money to take bad debt off their member bank's balance sheets because we live in a land of no consequences – EVER! – I hope….

So, to sum it up into the holidays: Just because Covid happened 2 years ago and still hasn't gone away doesn't mean we should be worried about it now and there are no detriments to running up 160% of our GDP in debt and the Fed can just keep buying bad assets with the checks they write that are backed by the bad assets they are about to buy (not even Dr Who can explain that one!). God bless us, everyone!

So, to sum it up into the holidays: Just because Covid happened 2 years ago and still hasn't gone away doesn't mean we should be worried about it now and there are no detriments to running up 160% of our GDP in debt and the Fed can just keep buying bad assets with the checks they write that are backed by the bad assets they are about to buy (not even Dr Who can explain that one!). God bless us, everyone!

Of course we are hoping to ride this free money train until the last stop but just remember that there WILL BE a last stop – we just don't know where it is yet. Powell has been reinstated by Biden as the last thing he wants to do is pull the plug on this party, not with his approval rating (42.8%) already almost as low as Trump's (38.4%) at the same point in their Presidencies.

To be fair to Trump, George Bush 1st had an approval rating of 27.6% 6 months before the end of his term – yet his party still ran him for re-election! Jimmy Carter's bottom was 28.3% and inflation was also his downfall. Obama (with Biden) bottomed out in his first term (year 2) at 42.5% – that's the mark Biden is trying to avoil but he's not too worried about it so far – as he's been through this before.

Of course, if you are a Fox watcher, you probably think Biden's approval rating is more like 22% than 42% – which is why you'll think he must have stolen the next election – being so unpopular. 42.8% is about where Trump was during the last election – and multiple recounts have shown that he got his ass kicked by Biden. Go ahead – check the numbers again….

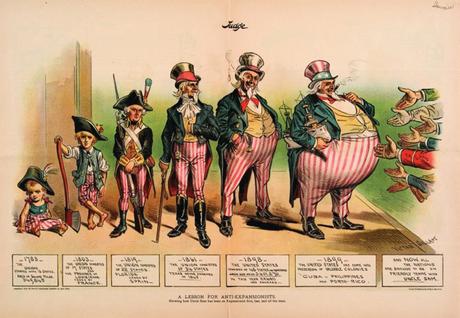

Why does this matter? Well, as we have seen, one President can completely reverse the policies of the previous President and, while all these revenge politics are fun – the country ends up making no progress at all for decades at a time. This, of course, suits the anti-progressives very well – if they can't get us back to the stone age, they will damned certain make sure we don't make any further progress, right?

To give Trump credit, he did try to buy Greenland – that's pretty progressive. Biden's version of being progressive is trying to save the planet – fortunately, he's way down in the polls so his policies aren't likely to stick long enough to have any effect but it does make for a tricky investment climate. Do we buy solar stocks or will coal make a comeback like Trump promised it would in 2016? Peabody Energy (BTU) went from $24 to $47.50 in Trump's first two years – before collapsing back to $11.57 today – because nothing Trump promised the coal industry ever actually happened.

There's another lesson we need to learn – just because your leaders say they are going to do something – doesn't mean they are actually going to do it. As we're looking ahead to our Trade of the Year for 2022 (sounds like the future, doesn't it?) we have to think about what policies will stick over the next year and that, sadly, brings us all the way to the next election, whcih can turn Biden into a lame duck after just 2 years in office.

So, for planning sake, we're better off looking at countries with more stable governments to see what they are doing. Putin has been in power for 20 years. China's Communist Party is always in power. Ali Khamenei has been Iran's Supreme Leader for 38 years. Assad is still the guy in charge of Syria (19 years) – remember when we were mad at him for a while? Erdogan has been running Turkey forr 16 years and Lee Hsien Loong has been Prime Minister of Singapore for 15 years and Merkel is retiring in Germany after 14 years. These are the people who are running the World – we are just visiting when the current President stops by because – if you don't like him – just wait a few years.

So, for planning sake, we're better off looking at countries with more stable governments to see what they are doing. Putin has been in power for 20 years. China's Communist Party is always in power. Ali Khamenei has been Iran's Supreme Leader for 38 years. Assad is still the guy in charge of Syria (19 years) – remember when we were mad at him for a while? Erdogan has been running Turkey forr 16 years and Lee Hsien Loong has been Prime Minister of Singapore for 15 years and Merkel is retiring in Germany after 14 years. These are the people who are running the World – we are just visiting when the current President stops by because – if you don't like him – just wait a few years.

We're still thinking about what we want to be trading in 2022 but, in order to do that effectively, we have to think about what's likely to happen in 2022 and that's a tough nut to crack this year.

Have a very happy holiday,

- Phil

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!