In quantum mechanics, the Heisenberg uncertainty principle states a fundamental limit on the accuracy with which certain pairs of physical properties of a particle, such as position and momentum, cannot be simultaneously known. In other words, the more precisely one property is measured, the less precisely the other can be controlled, determined, or known.

That’s what’s going on in the markets recently, as soon as we know the outcome of one thing, the outcome of other things in reaction to it becomes a new thing to worry about. The EU passed the EFSF and all seemed well for 2 days but then the Greeks, now certain that further austerity measures would be asked of them, said perhaps (58% of those polled) they don’t want a bailout at that cost.

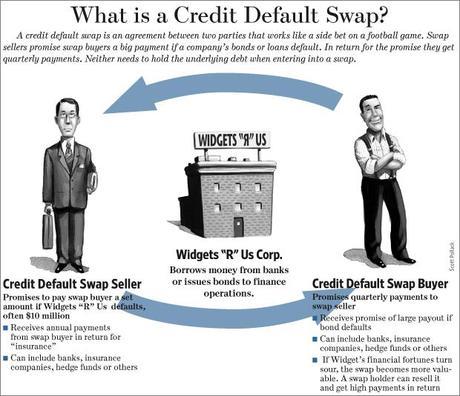

Now the banks, who nicely "volunteered" to take 50% haircuts on their debt are faced once a gain with the REAL ISSUE, which is that an INvoluntary default by Greece (and the country rejecting the package and defaulting would seal that deal) would trigger $500Bn worth of Credit Default Swaps, the majority of which are insured by Gang of 12 Members in the TBTF Club like GS, MS, CS, DB, BAC, JPM, C…

MF Global Holdings Ltd. (MF), is/was a broker-dealer run by former Goldman Sachs co-Chairman Jon Corzine – so we can assume GS has a similar formula for offsetting their CDS exposure. MF reported $1 billion of net exposure to Spain and $3 billion to Italy in its second- quarter financials, explaining in a footnote that the net was partly due to a short position on French bonds. Those hedges weren’t enough to protect MF Global, which filed for bankruptcy yesterday after losses in the portfolio wiped out its capital. Keep in mind Lehman, Merrill and Bear Stearns assured us to the last moment that they were "just fine."