Seems a little high, doesn't it?

Seems a little high, doesn't it?

We're so close to 5,000, we might as well get there as, clearly, the numbers are meaningless. We've discussed how trading the S&P 500 at 40 x earnings is ridiculous but it's still happening so get used to the "new normal", I guess. Of course it all comes down to risk vs. reward and there's just as much RISK in a 10-year bond that pays you 1.666% as there is in a stock that pays a 3% dividend so of course buy the stock.

See the multiples don't matter when the underlying returns don't match up. Usually you can get 4-5% on bonds and they are considered very safe but, in a rising rate environment, the interest paid on the bonds may not keep up with inflation and you end up losing money – in steady Dollar terms. Stocks, on the other hand, usually inflate with everything else so you keep up on the investment side and, if they are paying more dividends than a bond does interest – well then it's a pretty easy choice.

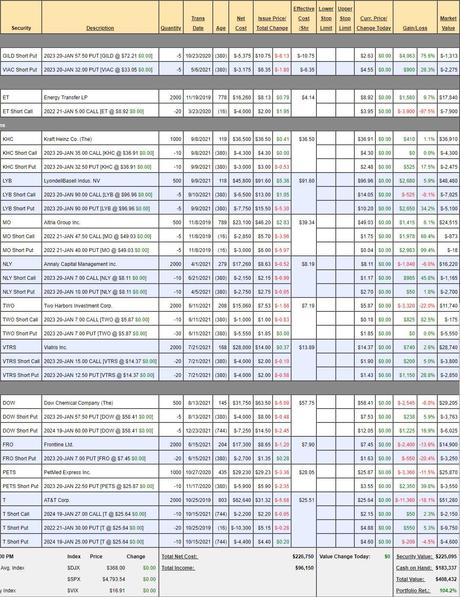

At PSW, we have a Dividend Portfolio which we reviewed for our Members on December 23rd and we only made 2 adjustments (closing out PFE and gettting more aggressive on DOW), as it's a very low-touch portfolio and, if we're doing it right, it shouldn't need to be touched as it's a very conservative portfolio. Generally we aim to make 30-40% a year and we started this one on 10/25/19 with $200,000 and we're up to $408,432 (up 104.2%) so far – a bit ahead of schedule.

Let's look at what we expect out of this portfolio, which is still conservatively 45% in CASH!!

- GLD – We expect the puts to expire worthless and we'll collect $1,313.

- VIAC – We expect the short puts to expire worthless and we'll collect $2,275.

- ET – We will get called away at $5 and collect net $10,000. The stock pays an 0.61 dividend so instead we can double down on the stock, spending $17,840 for 2,000 more shares and we'll sell 20 2024 $7 puts for $1.35 ($2,700) and we'll roll the 20 short Jan $5 calls at $3.95 ($7,900)

…

You must login to see all of Phil's posts. To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.

To signup for a free trial membership, click here.

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!