S&P 2,050!

S&P 2,050!

Why not? Why not 3,000? 3,500? 4,000? Is there any number that will begin to sound ridiculous to top 1% traders, who are using the Fed's Free Money to make even more money for themselves? It's like the $50M balloon dog at Christies – what's the difference to people who have, essentially, infinite amounts of money to spend?

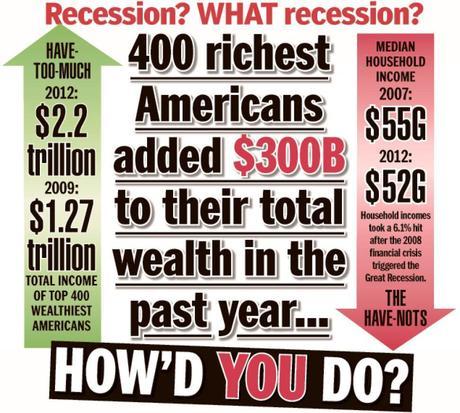

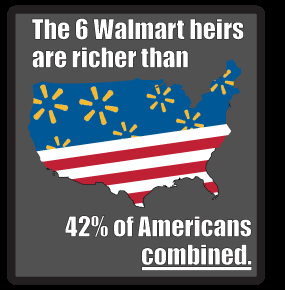

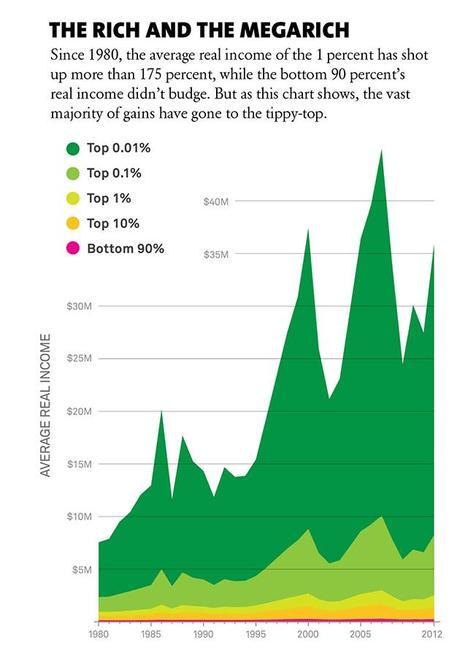

The Forbes 400, for example, made $1Tn MORE between 2009 and 2012 – an average of $300Bn a year. Last year, they added on another $400Bn bringing their total INCOME up to an average of $1,000,000,000 PER YEAR per Billionaire. Compared to the average household income of the average US Citizen of $52,000, that is, pretty much, INFINITELY more (19,230 times more, to be exact).

Meanwhile, over the same period of rampant QE, the average income of the Median Household FELL 4%, from $54,000 to $52,000.

Of course, that should be obvious, as it takes $2,000 from 150M working people just to come up with $300Bn of the $400Bn the top 400 made last year. That's how it works, folks – they take $2,000 from 150M people and the rich get richer and the poor (or the middle class) get poorer.

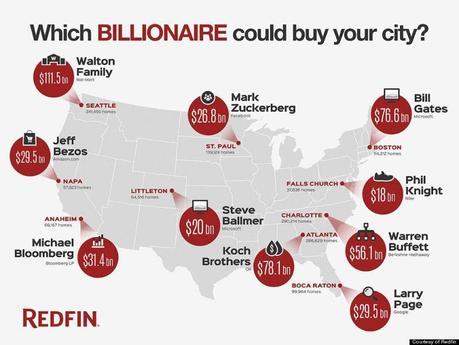

And what do the top 0.0001% do with their money? Over $1Bn more pours in every day – they can't possibly spend it all on balloon dogs and $5,000 hamburgers – they HAVE to invest some of it!

Real estate left a bad taste in people's mouth very recently and, as noted by the chart below, there's not enough homes in the US for all these Billionaires to buy. Gold and silver have lost their shine, oil is a bust, bonds aren't paying any interest (also thanks to Fed meddling), so that makes equities the only game in town. Rich folks MUST put their money into the market – there's literally nowhere else to put it.

That's not appealing to the top 1% at all – so they avoid giving money to the Government and they avoid giving money to their workers and they put their money into stocks, where they effectively reduce the amount of shares that are available to the general public – further assuring that no one but the top 1% will be able to participate in an economic recovery.

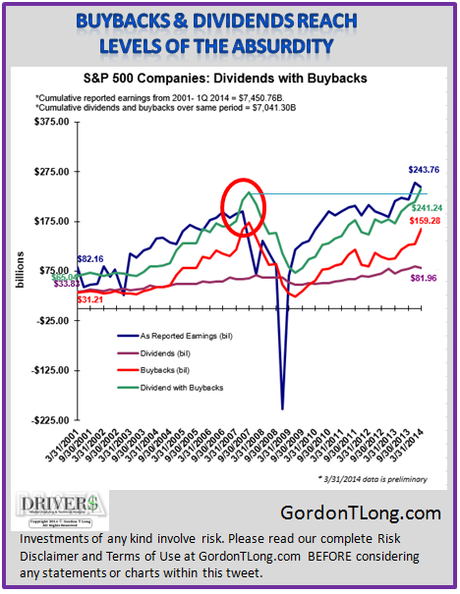

And, when we talk about the top 1%, we're talking about our top 1% corporate citizens as well. This year, S&P 500 companies spent MORE money on dividends and buybacks than they earned. They borrowed the FREE MONEY from the Fed to reduce the number of outstanding shares available to the public – a neat way for the top 1% to circle the wagons and keep others from getting in on their game.

This too drives up the price of stocks since, like a big red balloon dog, they become rare and hard to get. The stock market is a constant auction where people with 19,230 time more money than you are bidding on the same stock that you want.

IBM, for example, earned $16Bn in 2011 and $16Bn in 2012 and $16Bn in 2013, which is not impressive BUT, because they bought back 25% of their outstanding shares over that period, earnings PER SHARE showed a nice, steady 25% gain over that period of time. It's an illusion – a trick of the light to make people believe that earnings are improving when they are not. Rather than invest in long-term growth, R&D, infrastructure and (God forbid!) training employees – companies these days grow almost exclusively through financial engineering.

This is the kind of thing that works until it doesn't. As long as the Fed (and other Central Banksters) are handing out FREE MONEY and as long as the top 1% have nowhere else to put their ever-increasing piles of money – the markets can continue to go up. After all, IBM is dropping $16Bn a year to the bottom line – even without borrowing, they can buy back 100% of their stock in 10 years and then they'd be making $16Bn per share.

If a company is making $16Bn per share, then a share is worth a lot more than $160, right? So this is not a premise to bet against companies that are buying their own stock – just a warning to beware a market that increases on this kind of nonsense, because we're not increasing the VALUE of these companies at all – we're simply increasing the PRICE of their stocks – and that is NOT the same thing AT ALL!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!