That's the deal today as we wait for the Fed minutes at 2pm. We already had the Fed statement back on December 17th, when the Fed announced a very light version of tapering along with a promise to keep rates near zero for at least another year.

That sent the Dow flying from 15,750 back to 16,500 (4.5%) and a 750-point run gives us the expectation of a 150 point retrace (20% – weak) to 16,350 or a 300-point retrace (40% – strong) back to 16,200 and, so far, 16,350 has held and that's a bullish sign for the Dow.

BUT, it's held on ridiculously low volume (see Dave Fry's chart) so it don't mean a thing until we see a proper test and it's hard to imagine what the Fed can say that would be worth adding to the 5% pop that's already been baked into these minutes – so I made the call to short the Dow Futures at 16,450 (/YM) this morning in our Member Chat Room.

During yesterday's Member Chat, we caught a nice move on the Russell. Aside from our usual Futures short (/TF) we looked at the option combo of buying the Jan $17 calls for .52 and selling the Jan $17 puts for .47 for a net entry of 0.05. That was at 11am and, by the time we were doing our weekly Webinar, at 2pm, that combo was at 0.25, up 400% in two hours. This is why we don't mind being mainly in CASH – you can make a Hell of a lot of money in this market by just deploying small amounts of your sidelined capital.

Brokers don't like you to be in cash because cash is the gateway drug to savings and brokers and financial advisers don't have any incentives for you to get passive with your money. They want your money in play, because that creates a need for their services and more fees for them.

During yesterday's webcast, I demonstrated how we could make $100 in less than 5 minutes trading Nikkei Futures contracts, unless you usually make more than $1,200 an hour, this sort of thing should be interesting to you! One of the good things about being in CASH is it allows you to focus on small trade ideas like that and practice your trading skills until you end up having more hits than misses when trading the Futures.

That's what we're geared up for in our short-term portfolios and it's hard to see how Fed taper-talk this afternoon won't be a net positive for the Dollar – especailly given that Europe is facing DEflation and is likely to ease even further – adding relative strength to the Dollar.

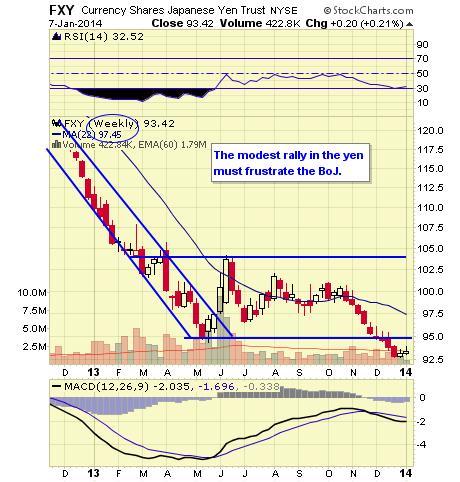

The Yen has fallen through it's trading floor, which is what the BOJ wants BUT, doesn't a declining Yen mean a stronger Dollar? We have our Non-Farm Payroll report on Friday and ADP already came in with a 10% beat at 238,000 jobs added in December. If NFP confirms ADP then don't those 238,000 new people need to get paid in Dollars? What about trade? We had our smallest trade deficit since 2009 in November – that's less Dollars we're sending overseas and that too makes the Dollar stronger (more demand for less Dollars).

So up, up, UUP, the Dollar goes and that's going to sting if it pops 81, which was our shorting premise this morning. That should make gold cheap again and keep oil from rising and it will also keep a lid on Natural Gas (/NG), which we just rode long from $4.35 to $4.36 for another $100 gain ($100 per penny per contract) to make our Egg McMuffin money. The Dollar will give us a re-test of $4.32 and I'll like them long again into tomorrow's inventory report (10:30) unless the Dollar really goes crazy.

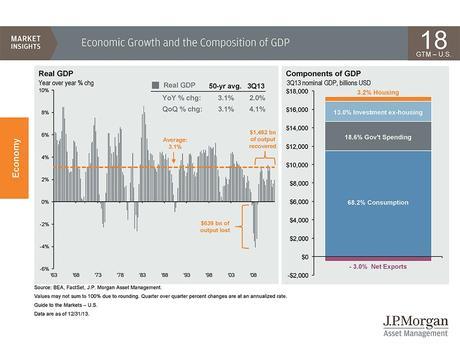

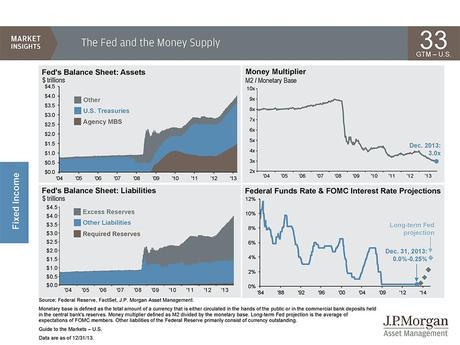

Meanwhile, JP Morgan took a break from evil-doing to put out their very useful 2014 Guide to the Markets, which is very worth glancing through. Here's a few of the many charts that caught my eye:

There's 67 slides, but you get the idea – lots of useful information and well worth a look. Aside from the Fed, we still have plenty of data to sift through this week, along with 10 and 30-year note sales by Treasury and a smattering of Fed speak – plenty of ways to move the markets that have nothing at all to do with whether or not the companies in the stock market are actually making money or not – even in this FREE MONEY environment.

So pull up a blanket of CASH and let's all have a nap this morning – wake us up when the Fed notes come out and then things get interesting as earnings season heats up with STZ, MON, BBBY, RT and WDFC reporting today, followed by FDO, SVU and PSMT tomorrow, INFY Friday and then next week, things get serious with JPM, WFC and CBSH Tuesday, BAC, SCHW and MBFI on Wednesday, BLK, GS, HBAN, INTC and PBCT on Thursday with BK, FHN and GE closing us out next Friday so banking, Banking, Banking next week!

We're short XLF at $22, by the way…