Wheeeee, this is fun!

Wheeeee, this is fun!

Suddenly we're making a lot more money on the way down than we did on the way up on our Futures trades and that's not a good sign for the market. We played the Dow (/YM) Futures and the Naturar Gas Futures (/NG) for a bounce in the morning and only bounced from 28,000 to 28,100 (up $500 per contract) before we stopped out at the opening bell and we quickly got our bearish crosses which allowed us to play the Dow (/YM) down from 28,000 to 27,000 for gains of $5,000 per contract at 27,000 – now that's a nice hedge!

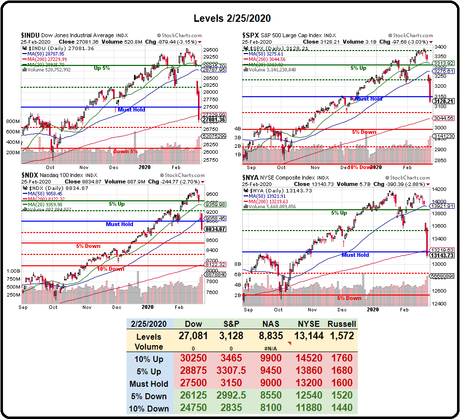

Sadly, we're still in the index shorts as we haven't had a reason to stop out as the weak bounce line on the Dow, for example, after a 2,000-point drop in two days, is 27,400 and we haven't gotten over that yet. More importantly, as noted on our Big Chart, the Dow has failed it's 200-day moving average at 27,223 and, below that, we may be on the way to the -10% line at 24,750, which would be nice for our /YM shorts (another $20,000 per contract) but terrible for the markets and the US Economy – so we're not exactly hoping to make that much money.

That's what the Must Hold lines are on our big chart, they signal the beginning of a bear market and we really need to stay on top of them or things are likely to get much worse indeed as we only capitulated and raised our Must Hold lines earlier this year. Before that, we had been predicting a fall back to 2,850 on the S&P anyway so, on the whole, "everything is proceeding as I have foreseen".

As in yesterday morning's PSW Report (except lower), we'll stop out of our shorts at 27,250 and, like yesterday, we can reshort if the indexes cross back under their low supports at 27,000 on the Dow (/YM), 3,100 on the S&P 500 (/ES), 8,800 on the Nasdaq (/NQ) and 1,565 on the Russell (/RTY). We certainly need to see the Dow back over it's 200 dma and the Nasdaq has to clear 9,000 before I'd consider it bullish again.

The reason the markets fell so quickly was exactly what we had talked about most of the fall as I complained about the rally: As soon as the volume came back, we found out there were simply not enough buyers out there at those silly prices and the sellers quickly had to capitulate in order to cash out there stocks – leading everyone to finally realize their stocks certainly aren't worth what they thought they were.

Feb 25, 2020 323.94 324.61 311.69 312.65 312.65 217,834,900

Feb 24, 2020 323.14 333.56 321.24 322.42 322.42 161,088,400

Feb 21, 2020 335.47 335.81 332.58 333.48 333.48 113,788,200

Feb 20, 2020 337.74 338.64 333.68 336.95 336.95 74,163,400

Feb 19, 2020 337.79 339.08 337.48 338.34 338.34 48,814,700

Feb 18, 2020 336.51 337.67 335.21 336.73 336.73 57,226,200

Feb 14, 2020 337.51 337.73 336.20 337.60 337.60 64,582,200

Feb 13, 2020 335.86 338.12 335.56 337.06 337.06 54,501,900

Feb 12, 2020 336.83 337.65 336.43 337.42 337.42 43,992,700

Those are the daily volumes on the S&P ETF (SPY) as it fell 8% in four days. We haven't been over 100M since August 7th and you have to go back to 2018 to see a 200M volume day (also not a good one!). On quiet days, the Corporate Buybacks, ETF Transfers and Fed Money Printing are enough to give the market a very predictable push – espeically into the close but that volume of automated buying doesn't change when lots of people want to sell and, since there are the same, very small number, of real buyers out there – prices quickly collapse when sales volumes increase substantially.

That's why people think their brokers are malfunctioning – the brokers simply aren't able to match brokers to buyers. If you are a buyer – your broker seems to be working great but if you are trying to sell Tesla (TSLA) at $920 while it drops below $900, $880, $850, $800… your sell order might not be able to fill!

That's why people think their brokers are malfunctioning – the brokers simply aren't able to match brokers to buyers. If you are a buyer – your broker seems to be working great but if you are trying to sell Tesla (TSLA) at $920 while it drops below $900, $880, $850, $800… your sell order might not be able to fill!

8:30 Update: My mother just called me to tell me she bought me a mask in case I go out – I'm pretty sure we're hitting peak panic over the virus if that's the case but maybe not as my daughter slept on the streets of NY last night (28 degrees) to see Harry Styles on the Today Show and she wasn't wearing a mask.

We'll be hearing from the Fed's Robert Kaplan at the open and we'll see if he's wearing a mask or if Neel Kashkari is at 1pm, after the 5-year note auction, which should do well with all the panic in the air. State Street Investor Confidence should be interesting at 10am but tomorrow's Q4 GDP Revision will tell us very little and, strangely enough, the Q1 GDP still hasn't been revised lower by the Atlanta Fed in their GDP Now and that's going to be another market shoe to drop when they do finally downgrade it:

We're doing a little bit of put selling to establish positions in companies we REALLY want to own – even if the economy tanks but, other than that, we're very content to watch the carnage from the sidelines. This is not an unjustified panic, this is a repricing of the markets to take into account the very real possibility – ALMOST PROBABILITY! – of a Global Recession caused by this virus spreading outside of China.

I think the Central Banksters do have another save in them and we should hear nice noises from Kaplan and Kashkari today and from Evans tomorrow and Bullard on Friday so the save should be in but God help us if that doesn't work!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!

Author's Latest Articles

-

Expect Lawyers to Set the Tone in Trump’s Hush Money Trial with Dramatic, Possibly Explosive, Opening Arguments

-

AI is Turning into Something Totally New

-

Despite a Fortified Border, Migrants Will Keep Coming, Analysts Agree. Here’s Why.

-

David Pecker Was Once ‘valuable’ to Donald Trump. Now His Testimony Could Sink Him.