A weak Dollar lifts the markets and, this morning, the Dollar fell from 79.50 at yesterday's close to 79 at 6:45 and that's why, despite earnings disappointments from both INTC and IBM, the Futures are up slightly 3 hours before the open. As you can see from the chart on the right, to say there's a strong inverse correlation between the Dollar and the S&P is quite the understatement. Over the longer run – the effect tends to wash out but, over the short run, it's an almost perfect match.

Of course, this also has a very direct effect on commodity pricing and part of the reason for the Dollar's big sell-off last night was the much-better-than-last-time performance of Barack Obama in the second Presidential Debate as the future of the Fed and all that free money hangs in the balance.

Of course, this also has a very direct effect on commodity pricing and part of the reason for the Dollar's big sell-off last night was the much-better-than-last-time performance of Barack Obama in the second Presidential Debate as the future of the Fed and all that free money hangs in the balance.

After the first debate, two weeks ago, Romney clearly won and has made it known that he will kick both Big Bird and Big Ben to the curb as soon as he gets in office – that sent the Dollar up from 79.10 to 80.21 (up 1.4%) last week and dropped the S&P from 1,460 to 1,430 (2%). After last night, Romney looks to be back off the table and that leaves the Dollar to resume it's downward slope – giving another lift to the markets.

At the same time, Moody's left Spain's credit rating above junk this morning and that's lifting the Euro to $1.31 and the Pound is moving in lock-step at $1.61 BUT the Yen dropped 0.5% to 78.63 and it's not likely the BOJ will let the Dollar slip below 79 as that makes Toyotas and Sonys more expensive just ahead of the holidays. Also, the Nikkei finally got back to 8,850 last night and you know they hate to lose that line.

So get set for some heavy-duty Global Market Manipulation by our Central Banksters as everyone but Europe tries to race for the bottom. Europe, interestingly enough, doesn't mind a strong currency as they are fuel and goods importers and most of the goods they export are "luxury" class and less susceptible to currency fluctuations. With strong intra-zone trading the backbone of the EU economy, it doesn't matter where the Euro is trading from that perspective either and, of course, the SNB works very hard to keep the Euro up against the Franc. Almost as hard as the BOJ works to keep the Yen weak against the Dollar…

So get set for some heavy-duty Global Market Manipulation by our Central Banksters as everyone but Europe tries to race for the bottom. Europe, interestingly enough, doesn't mind a strong currency as they are fuel and goods importers and most of the goods they export are "luxury" class and less susceptible to currency fluctuations. With strong intra-zone trading the backbone of the EU economy, it doesn't matter where the Euro is trading from that perspective either and, of course, the SNB works very hard to keep the Euro up against the Franc. Almost as hard as the BOJ works to keep the Yen weak against the Dollar…

That means we'll take this morning's open with a grain of salt as the 0.5% dive in the Dollar since the close SHOULD have the markets gapping up at least 0.5% but it's hard to imagine that INTC and IBM won't put a drag on both the Dow and the Nasdaq (and the SOX) with their less than exciting reports. IBM alone is down $7 pre-market and that's over 50 Dow points right there – in the very least, we're going to take a bite out of yesterday's momentum.

I mentioned in yesterday's morning post we were playing AAPL bullish and the Nov $660 calls jumped from $13.63 at the open to $20.70 at the close, up 51% for the day and that was a gain worth protecting, of course. The TNA Oct $61 calls I also mentioned in the morning post finished the day at $1.10 but we took .95 and ran – up 111% from our last entry at .45. In fact, our last trade for the day in our $25,000 Portfolio was a bearish one as we picked up the weekly DIA $135 puts at .65 as we were worried Romney would win again and tank the markets – we won't be sticking with them if the Dollar stays down this morning, though. In the Morning Alert to Members, we also put an earnings play on ISRG:

ISRG – Looking at UNH's numbers and XLV in general, I would think ISRG is doing well. The stock is low in the channel, right at the 200 dma, I think the way I would play them for earnings is to set up an April $510/485 bear put spread for $10 and sell the Oct $500 puts for $11 so a net $1 credit on the combo and ISRG would have to be below $475 before you're down more than the $25 you make on the spread and, of course, the short puts are rollable and we like the company. Let's do 2 of these in the $25KPA to see how it goes.

ISRG had a nice beat last night but not good enough to justify the run-up into earnings and they were back to $510 after hours which is, of course, PERFECT for our bet. The Oct $500 puts should expire worthless and whatever value remains on the bear spread, plus $1, will be our profit – times 200, of course, for 2 contracts in the spread – hopefully about $2,000 in profits for the day's work. These are the kind of quick earnings plays we love and, so far, this earnings season has been a lot more reliable to predict than the last.

ISRG had a nice beat last night but not good enough to justify the run-up into earnings and they were back to $510 after hours which is, of course, PERFECT for our bet. The Oct $500 puts should expire worthless and whatever value remains on the bear spread, plus $1, will be our profit – times 200, of course, for 2 contracts in the spread – hopefully about $2,000 in profits for the day's work. These are the kind of quick earnings plays we love and, so far, this earnings season has been a lot more reliable to predict than the last.

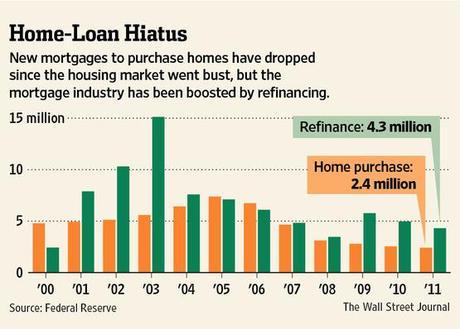

It looks like we're getting past BAC's earnings without too much damage, EPS was 0.07 vs 0.00 expected but Revenues missed by 7.5% and I'm more than a little concerned that 83% of the Mortgage Loan volume is refinances because what we're doing here (and this goes for all banks) is borrowing business from the Future because every home you refinance at 3.5% is a home that will not be coming back to you for 3 decades for another loan, once they start moving back to more normal (unsupported) rates.

The banks are also locking in 30-year periods of low returns on their loans and, of course, it doesn't take much inflation to wipe out all of their gains. All this refinancing at lower rates is also bad for REITs, who are very out of favor at the moment but there are some that make good long-term entries for the patient investor.

The banks are also locking in 30-year periods of low returns on their loans and, of course, it doesn't take much inflation to wipe out all of their gains. All this refinancing at lower rates is also bad for REITs, who are very out of favor at the moment but there are some that make good long-term entries for the patient investor.

NLY, for example, has fallen to $15.50 and their board got fed up and approved a $1.5Bn share buyback (10% of float) yesterday so probably $16 this morning. They still pay a $2 dividend and you can buy the stock for $16 and sell the 2015 $13 puts and calls for $4.85 and that drops your net cash outlay to $11.15 with an obligation to buy another round of shares at $13 if NLY finishes below. That would put you in 2x at net $12.08, which is still 25% below $16 and you only have $11 cash in the stock so that $2 dividend becomes an 18% annual bonus while you wait.

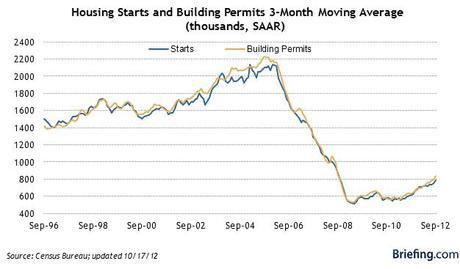

Meanwhile, September housing starts are up another 15% to an annualized 872,000 vs 765,000 expected so a really nice beat and that should pop the Futures. Even better, permits jumped to 894,000 vs just 810,000 expected so a 10% beat there as well.

Meanwhile, September housing starts are up another 15% to an annualized 872,000 vs 765,000 expected so a really nice beat and that should pop the Futures. Even better, permits jumped to 894,000 vs just 810,000 expected so a 10% beat there as well.

As of this moment (8:40) it's not reflected in the Briefing.com chart but I'm sure you can imagine the impressive uptick 872,000 will give us. More employment, more housing – I'm sensing a trend. Poor Jack Welch must be turning over in his grave.

Tomorrow we get the Philly Fed, which may turn positive after last month's -1.9 reading and also we'll see Leading Economic Indicators, which also should turn positive based on the improvements we're seeing in recent data. The last data-point for the week is Existing Home Sales on Friday and next week we continue in the housing vein with the MBA Mortgage Index, New Home Sales and the FHFA Housing Price Index – all on Wednesday along with another Fed decision that afternoon. Thursday will be Durable Goods and Pending Home Sales and Friday we get another look at Q3 GDP, which will possibly be revised up from 1.3%.

Unfortunately, Germany revised their GDP down for 2013 this morning, from 1.6% all the way down to 1% as austerity blows up right in their face. This year is projected to be an equally anemic 0.8% so and optimist could say things are picking up but 2010 was 4.2% and last year was 3% so basically, it's just sad. "Germany is navigating stormy waters because of the European sovereign debt crisis and an economic weakening in emerging nations," Economy Minister Philipp Roesler says.

Unfortunately, Germany revised their GDP down for 2013 this morning, from 1.6% all the way down to 1% as austerity blows up right in their face. This year is projected to be an equally anemic 0.8% so and optimist could say things are picking up but 2010 was 4.2% and last year was 3% so basically, it's just sad. "Germany is navigating stormy waters because of the European sovereign debt crisis and an economic weakening in emerging nations," Economy Minister Philipp Roesler says.

That being the case, it's a good idea to reiterate yesterday's trade idea for a TZA hedge from afternoon Member Chat to lock in our current gains:

Ultra hedges/Bdon – You just can't beat TZA at $15. The Jan $12/15 bull call spread is $1.50 so 100% upside if TZA simply doesn't go any lower. If they do go lower, you can sell the April $11 puts, now .50 for $1 (the Apr $12 puts are .92) before your $1.50 is even out of the money and then you'd be in the Jan $12s at net .50 and worst case is you get assigned at net $11.50 in April but, of course, you can roll or simply accept the assignment and cover and then you have more long-term protection.

While the US is clearly improving – we're simply not out of the woods yet internationally and an economic collapse in Europe or Asia will send people flying back to the Dollar – and you know what that will do to the S&P!

Email This Post

Email This Post

Twitter

Twitter

LinkedIn

LinkedIn

del.icio.us

Google+

del.icio.us

Google+