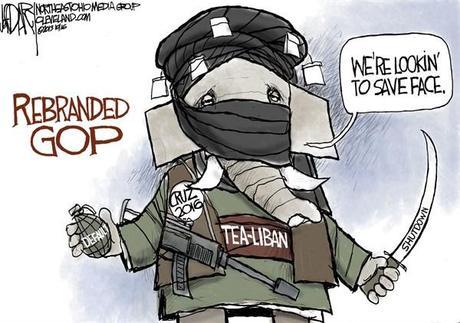

Watching this Daily Show interview with a GOP strategist, I still have my doubts. Once again the House of Representatives dropped the ball and once again the Senate is saying reassuring thing and once again the Futures are back up in hopes that things will be better now – it's MADNESS!

The Daily Show

Get More: Daily Show Full Episodes,The Daily Show on Facebook

It would be funny if it wasn't so sad. Yesterday, the House of Representatives failed to even manage to agree with each other on a bill to present to the Senate, putting the ball back in the Senate's court today as Harry Reid and Mitch McConnell hold talks to hammer out an agreement that they, in turn, will present to the House this afternoon.

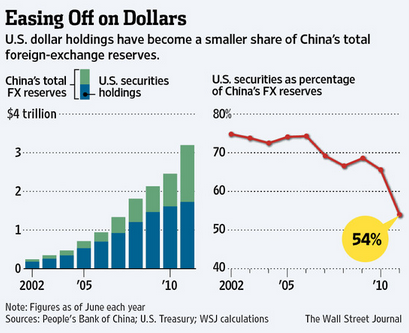

That doesn't actually solve anything as the House has to then pass the bill and, so far, they have refused to even hold a vote on one during this entire crisis. Even if we do pass a bill, it is very likely to be only a stop-gap measure that funds our Government through Jan 15th, raising the debt ceiling through Feb 7th – and then we're back in the same situation again. Meanwhile, Fitch has already put the US's credit rating on negative watch and China is already taking full advantage of our screw-up and is brokering a deal with the UK to bolster the Yuan as an International alternative to the Dollar.

That doesn't actually solve anything as the House has to then pass the bill and, so far, they have refused to even hold a vote on one during this entire crisis. Even if we do pass a bill, it is very likely to be only a stop-gap measure that funds our Government through Jan 15th, raising the debt ceiling through Feb 7th – and then we're back in the same situation again. Meanwhile, Fitch has already put the US's credit rating on negative watch and China is already taking full advantage of our screw-up and is brokering a deal with the UK to bolster the Yuan as an International alternative to the Dollar.

Ted Cruz has, in this way, done more for China than Mao Tse Tung, driving the Yuan to record highs against the Dollar and possibly setting the dominoes in motion that will dethrone the Dollar as the World's reserve currency – a change that would have MASSIVE negative repercussions for the US Economy:

"As U.S. politicians of both political parties are still shuffling back and forth between the White House and the Capitol Hill without striking a viable deal to bring normality to the body politic they brag about, it is perhaps a good time for the befuddled world to start considering building a de-Americanized world," China's official state-run news agency, Xinhua, said in an English-language commentary Sunday.

Treasury bonds and other dollar-based investments are used as the main form of collateral worldwide, so questions about their security would cause more problems than the financial system failures in fall 2008, said Benjamin J. Cohen, an international political economy professor at UC Santa Barbara. "It would make the Lehman Bros. episode look like a garden party by comparison," Cohen said.

Treasury bonds and other dollar-based investments are used as the main form of collateral worldwide, so questions about their security would cause more problems than the financial system failures in fall 2008, said Benjamin J. Cohen, an international political economy professor at UC Santa Barbara. "It would make the Lehman Bros. episode look like a garden party by comparison," Cohen said.

Global finance ministers are worried that the uncertainty surrounding a U.S. default "would mean massive disruption the world over, and we would be at risk of tipping yet again into a recession," Christine Lagarde, head of the IMF, told NBC's "Meet the Press." Most countries hold their foreign exchange reserves in U.S. dollars because the currency is viewed as the world's most stable. "The very fact that more than 60% of central banks' reserves are in dollars gives them every reason to be concerned," Barry Eichengreen, a professor of economics and political science at UC Berkeley and a former senior policy advisor at the IMF, said of foreign governments. "If the bank in which you held 60% of your savings was threatening to default, you'd be concerned too."

"They never lose an opportunity to take advantage of embarrassing behavior by the United States," Cohen said. China made similar calls in 2011, when a debt limit standoff was resolved at the last minute. "The only thing that can hurt the dollar these days is political dysfunction in Washington. We're shooting ourselves in the foot," he said. "The more we play these games in Washington, the less confidence people will have in the dollar and the more incentive people will have to do this diversification."

So a crisis like this isn't "resolved" just because the GOP backs off at the last minute. The fact that it happens at all shakes the confidence of our "investors" and they begn to look for less crazy places to put their money – especially if all we do is extend the problem for 3 more months. When foreign holders begin dumping US Treasuries on the open market, it makes it harder for us to borrow new money and drives the rates we have to offer for loans higher and, even if our Fed moves to contain those rates – it's at the cost of putting ourselves even further in debt as we use accounting tricks to buy our own debt.

So a crisis like this isn't "resolved" just because the GOP backs off at the last minute. The fact that it happens at all shakes the confidence of our "investors" and they begn to look for less crazy places to put their money – especially if all we do is extend the problem for 3 more months. When foreign holders begin dumping US Treasuries on the open market, it makes it harder for us to borrow new money and drives the rates we have to offer for loans higher and, even if our Fed moves to contain those rates – it's at the cost of putting ourselves even further in debt as we use accounting tricks to buy our own debt.

So thank you Comrade Cruz, you and your GOP friends have sold America down the river and caused more damage to our Nation than 50 years of Cold War and a dozen years of Terrorism ever could – you have destroyed the good faith and credit of the United States of America, something Warren Buffet just this morning (CNBC) called our Nation's most valuable asset – squandered for political gain (what little there was in the end).

The markets did about what we expected and oil finally faild that $101 line and, if anyone is keeping track, that's a $222,305,000 gain from just last week, when I called for shorting the remaining 222,305 open NYMEX contracts at $102.

The markets did about what we expected and oil finally faild that $101 line and, if anyone is keeping track, that's a $222,305,000 gain from just last week, when I called for shorting the remaining 222,305 open NYMEX contracts at $102.

Of course, I also told you so when oil was $110 and there were 365,000 open contracts, which was a $3.285Bn shorting opportunity and I'm still waiting for Obama to give me the keys to the SPR because I will run those NYMEX criminals straight out of town and we'll have $80 oil in 2014! (we may get there anyway, the way things are going)

When we heard the the House was making their own proposal yesterday, at 11:13, BECAUSE we are in cash and BECAUSE we do pay attention to the political game, we were able to come up with 3 aggressive short plays in our Member Chat (not even counting shorting oil at $102 – again!).Our trade ideas were:

- QQQ Oct $80.50 puts at .88, out at $1.20 – up 36%

- TZA Oct $23 calls at .23, out at .37 – up 60%

- Dow (/YM) Futures short at 15,200, out at 15,100 – up $500 per contract

We got out at 2:55, taking a non-greedy just as the usual closing pump job began. The ability to make 36% or 60% or $500 per contract in less than 3 hours is why you should never feel you HAVE to be invested in the market. When the conditions are uncertain, cash is king – just ask Warren Buffett.

It's just too bad that cash should probably be in Yuan….