As you can see from our Big Chart – we're still 3 of 5 over our 10% lines but it seems like we're always 3 of 5 over and it's getting about time for the Dow (needs 15,200) and the Nasdaq (needs 3,300) to put up or shut up. The Dow made a mighty move yesterday – up 152 points but still 500 shy of goal at 14,700 and the Nasdaq just lost AAPL as a possible catalyst as their conference call indicated there would be no new iStuff at least until Christmas.

That's going to weigh on AAPL's suppliers this morning so most likely the Nasdaq goes lower but we did get good news from FDX and BA this morning and BA is a Dow component and FDX is big in the Transports so that should help the overall picture on the Industrial side.

Even ABX chipped in with a beat and our stock of the year (AAPL) may be getting kicked in the teeth but our stock of the century, IRBT, is up 16% pre-market on way better than expected earnings and raised guidance. We just added 20 short Sept $17.50 puts at $1.50 to our Income Portfolio last week – and that's how fast we can lock down a $3,000 gain! We were actually hoping they'd go $3 the other way, so we'd get a chance to buy them but it looks like $3,000 will be our consolation prize for not being able to buy the stock below $17.50…

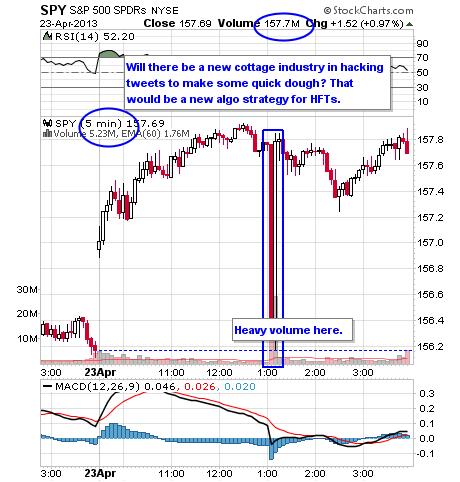

Turns out, of course, that it was a false rumor from someone who hacked the AP account (will an arrest be made or is Lloyd Blankfein still at large?) and was quickly corrected by human traders but, as there are less than 12 of us left – it took 5 minutes for the markets to correct.

Actually, the "Syrian Electronic Army" is taking…

This article will become free after 48 hours (see below for free content). To read the rest of this article now, along with Phil's live intra-day comments, live trading ideas, Phil's market calls, additional member comments, and other members-only features - Subscribe to Phil's Stock World by clicking here.