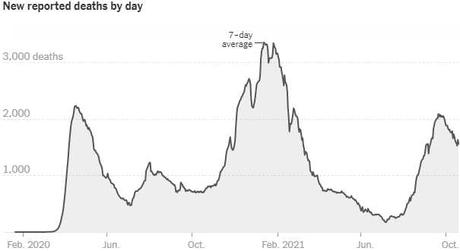

1,557 people died of Covid yesterday in the US.

1,557 people died of Covid yesterday in the US.

That's not really news, that's how many people die every day in the pandemic. It's improving, in fact, as we were losing 2,000 people a day during the summer so, as long as things don't pick up too much during cold and flu season – we'll only lose another 150,000 shoppers before Christmas – happy holidays to all the survivors!

There might have been a time when we would have considered 150,000 deaths shocking, not to mention the 8M new cases (2.6 out of each 100 Americans) who will be infected in the next 100 days – but that was the old America. Now it's "as long as it isn't me – I don't want to do anything about it at all," right? I mean, honestly, what have you done about it? Have you been outraged? Have you demanded action? Oh, you wore a mask while the pandemic raged on – what an action movie that will make…

Getting vaccinated is really helping – it prevents you and those around you from getting infected (as you tend to carry a lower viral load for spreading when you are infected and it goes away faster) and now many places are requiring you either show that you are vaccinated or have a clean test before entering but guess what I just learned – those clean tests cost $100 and guess who pays for them? We do!

That's right, the people who refuse to take the $35 vaccine are choosing instead to take dozens of $100 tests at the taxpayer's expense. These "Vaccine Queens" are costing us a lot more than Reagan's "Welfare Queens" ever did – abusing the system so they can carry on their unvaccinated lifestyles.

Florida Governor, Ron DeSantis has long been anti-vax but it's interesting to note that previous Governor, Rick Scott, made a lot of money owning part of the labs that drug-tested people when he required people on welfare and unemployment to be drug-tersted. I wonder if DeSantis and other GOP Governors now own part of the labs that test for Covid – a very profitable activity in anti-vax states as the Government pays for the testing.

For those Governors and their families and donors who have an interest in selling tests – of course they don't want mandatory vaccinations. In Florida, where 20% of the population is unvaccinated, a 50,000 seat concert or football game can require 10,000 $100 tests per event for $1M in sales – paid for with our tax dollars. That's happening every single day – all over the counrty – BILLIONS of Dollars every month, testing the unvaccinated so they can have "normal" lives despite being unwilling to take basic health precautions.

We just let this sort of thing happen, don't we?

Also happening is a huge bounce in the S&P 500 and other indexes BUT it's happening at ridiculously low volumes – especially compared to the sell-offs. Only 46M shares were traded on SPY yesterday – less than a typical holiday and 100M share's haven't been traded in two weeks, when we bottomed out on October 6th.

Also happening is a huge bounce in the S&P 500 and other indexes BUT it's happening at ridiculously low volumes – especially compared to the sell-offs. Only 46M shares were traded on SPY yesterday – less than a typical holiday and 100M share's haven't been traded in two weeks, when we bottomed out on October 6th.

As we pointed out recently, there's enough inflows from IRAs and 401Ks as well as the Fed's $120Bn monthly QE that any lightly-traded day is bound to be positive. However, there are nowhere near enough buyers to support a heavily-traded day so, when volume does return, you can be certain the market will turn down as well. So far, the 4,550 line on the S&P has triggered the selling bots – we're pretty close to that line this morning at 4,512.

The question is, what will the catalyst be? We have the Beige Book this afternoon, but no one really cares so it's more likely to be GDP next week, though we also have Consumer Confidence, New Home Sales, Durable Goods, PCE and Personal Income & Spending to mull over – as well as about 150 S&P 500 earnings reports.

This week is more of a "watch and wait" situation.

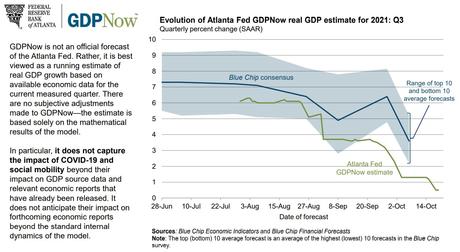

As noted by the most recent GDPNow from the Atlanta Fed – even the leading Economorons are beginning to realize Q3 GDP is nowhere near where it was projected to be – but they are still 3 points higher than the official Fed Estimate – so plenty of room for the masses to be shocked by our GDP number:

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!