As we expected yesterday, we had a BS sell-off, followed by an even more BS run up, now followed by another sell-off and we’re right back where we were yesterday, which is great because you can just re-read yesterday’s post and there’s nothing to change except we hit our $97.50 target on oil, where I said yesterday I wanted to press our short bets, only pulling back if we rose over the mark (but still looking to re-short, even if that happened).

This is the pain of Fundamental Investing, you have to make your bets when all the technicals are going against you and the majority of traders are on the bandwagon going the other day. Yes, we miss a lot of good parties – but we celebrate with some huge wins when we get it right!

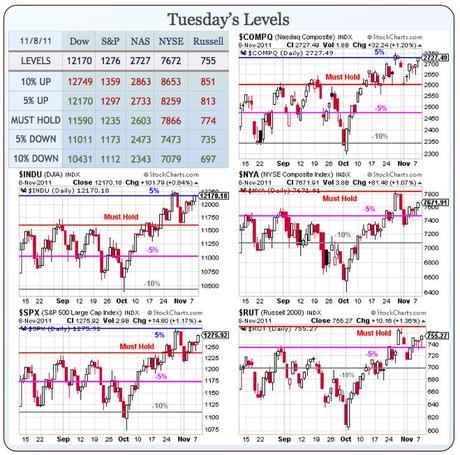

As you can see from our Big Chart – we hit our 5% lines on the nose on the Nasdaq and the Dow and yesterday’s post was my lecture on why the Dow didn’t have the Fundies to break that line so no need to re-hash it here.

The "scusa del giorno" for the market move is Berlusconi’s resignation, which is sending the interest on Italian 10-year notes over 7%. Belusconi may have been a lot of things but above it all, he was a businessman who engendered investor confidence – Italy may have cast that anchor away a bit too hastily.

Greece gets a new Government today and that’s always fun and Bernanke…