Wheeeeeeee – what a ride!

Wheeeeeeee – what a ride!

It's 7:39:11 am and Greece is "fixed" at the moment and we have to time-stamp it to the second or it may change again. European markets are LOVING IT with 1.5-2.5% gains across the board but, on the whole, the DAX (the only one we really care about) isn't even close to our weak bounce line at 11,250 yet – so we don't care. We do care about CHINA!!! (see yesterday's post), who dropped over $200Bn in stimulus this week and they fell another 5% this morning anyway. That's not good, folks…

5% would be a 900-point drop in the Dow in one day. I think I need to put that in perspective because we say "China fell 5% today" and people go "well, isn't that a shame" and that's the end of it. It's not a shame, folks, it's a TRAGEDY! To sum things up, the Shanghai has fallend from 5,200 to 4,000, which is 23%, which would be over 4,000 Dow points and it bounced back to 4,300, which was a weak 25% retrace of the drop that was IMMEDIATELY reversed DESPITE massive stimulus measures.

Of course the 3,900 line is bouncy – it represents a 25% drop from 5,200 so SOMEONE is going to speculate and buy that dip but the dip buyers ran straight into a new round of sellers and now 3,900 MUST HOLD on the Shanghai or Greece will be the last thing you're worried about next week!

We are nowhere near unwinding the 2 TRILLION Yuan ($339Bn) of margin debt that has built up in China, much of it financed at the 22% capped interest rates. When your market is gaining 100% a year, taking a 22% loan out to buy stocks seems to make sense – especially when all of your state-controlled media (not to mention the Corporate Propaganda you pick up in the US) tells you how AWESOME everything is.

We are nowhere near unwinding the 2 TRILLION Yuan ($339Bn) of margin debt that has built up in China, much of it financed at the 22% capped interest rates. When your market is gaining 100% a year, taking a 22% loan out to buy stocks seems to make sense – especially when all of your state-controlled media (not to mention the Corporate Propaganda you pick up in the US) tells you how AWESOME everything is.

There are now more registered stock traders in China (90M) than there are registered Communist Party Members (87.8M) – interesting news on the 94th anniversary of the party's founding. It’s safe to assume this is not what Mao Zedong envisioned when he led the Communists to power in 1949, and it presents tricky challenges for President Xi Jinping. Record numbers of Chinese citizens have flocked to the stock market as the Shanghai has doubled in the past year. That boom is at risk of turning into a bust after as the index falls more than 20% in just over a week, leaving many retail investors bruised and undercutting the nation’s already sluggish economy.

Meanwhile, strategists at BlackRock (BLK), Credit Suisse (CS) and Bank of America Corp (BAC) are now saying that Chinese equities are, in fact, in a bubble (duh!). The median stock on mainland exchanges is valued at 73 times earnings — higher than when the market peaked in October 2007, data compiled by Bloomberg show.

Meanwhile, strategists at BlackRock (BLK), Credit Suisse (CS) and Bank of America Corp (BAC) are now saying that Chinese equities are, in fact, in a bubble (duh!). The median stock on mainland exchanges is valued at 73 times earnings — higher than when the market peaked in October 2007, data compiled by Bloomberg show.

Still, never doubt the will China has to prop up their markets – $200Bn in stimulus was just their knee-jerk reaction to last week's fall – it's entirely possible they can announce $500Bn to $1Tn in new spending programs at their anniversary party. OR, China could play it the other way and let the markets collapse and THEN save the people – giving them a proper lesson on the evils of Capitalism and reminding them why it's so great to have the Communist party overseeing every aspect of their lives….

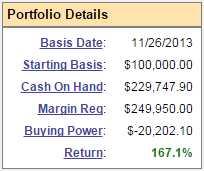

Meanwhile, the Capitalist Members of Philstockworld were pleased that our Short-Term Portfolio popped $17,000 since Friday morning, finishing yesterday up 167.1% at $267,125. That kept us even in our paired portfolios as our Long-Term Portfolio fell to +41.8% at $708,968 (the same $975K combined) and we debated cashing out the Short-Term Portfolio to play for the bounce but decided it was too dangerous into the weekend, so we reamain fairly market-neutral, waiting to see how this mess shakes out next week.

Meanwhile, the Capitalist Members of Philstockworld were pleased that our Short-Term Portfolio popped $17,000 since Friday morning, finishing yesterday up 167.1% at $267,125. That kept us even in our paired portfolios as our Long-Term Portfolio fell to +41.8% at $708,968 (the same $975K combined) and we debated cashing out the Short-Term Portfolio to play for the bounce but decided it was too dangerous into the weekend, so we reamain fairly market-neutral, waiting to see how this mess shakes out next week.

We were able to go long on Gasoline Futures (/RB) again this morning at $2.02 and yesterday, in our Live Trading Webinar, we made a very quick $400 playing a couple of contracts (replay available here). The Futures are an excellent tool when events like this hit. Already this morning, the indexes are up 1% on news that hit the wire at 4:45 this morning. That was good for quick gains but now, at 1%, we are looking to short the Dow at 17,700 (/YM), S&P at 2,080 (/ES), Nasdaq at 4,450 (/NQ) and Russell at 1,265 (/TF). We're also looking to get long on Silver (/SI) at $15.50 and, of course, who can resist Gold at $1,165 (/YG)?

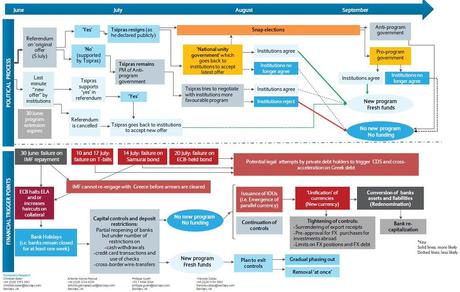

Greece isn't really fixed and China is simply terrifying so we will be remaining "Cashy and Cautious" into the Holiday Weekend and THEN, if Greece jumps through the appropriate hoops – there are about 200 S&P companies trading at their 52-week lows we can choose from. Here's a handy flow-chart to follow the action with:

We'll be keeping a close eye on the Euro at that $1.10 line, below that may test $1.08 again and that will pop the Dollar back to 98 and pop the Nikkei higher (already 20,600 again on /NKD Futures) but it will put further short-term pressure on commodities. Speaking of commodities, it seems no one had the crop report early other than us as we were long the Agriculture ETF (DBA).

Turns out, droughts in California and late harvest issues have depleted grain stocks significantly, with Corn storage down 39% from last year (it's still at the farm) while Wheat is down 18% AND down 19% at the farms – so that's going to be a serious issue.

Turns out, droughts in California and late harvest issues have depleted grain stocks significantly, with Corn storage down 39% from last year (it's still at the farm) while Wheat is down 18% AND down 19% at the farms – so that's going to be a serious issue.

I sent out a Top Trade Alert to our Members yesterday after we discussed the position in our Webinar, live, as the report came out, so we were able to take full advantage as DBA climbed towards $23 (now over). The trade idea was (and still is):

As I mentioned in the Webinar, that LTP trade is still good for a nice gain:

- Buy 25 DBA Jan $21 calls for $2.54 ($6,350)

- Sell 25 DBA Jan $23 calls for $1.30 ($3,250)

- Sell 25 DBA Jan $22 puts for 0.50 ($1,250)

That's net $1,850 on $5,000 worth of spreads that are now in the money. Our original entry was net $350, so we're already up $1,500 (428%) and it does seem less attractive but we took a big risk in April and now it seems a lot more likely that we'll get the full $5,000, which is up $3,150 (170%) from here so I do still like this trade – even though it now only pays 170% in 6 months…

So there's your free trade idea for the week – enjoy!

Do you know someone who would benefit from this information? We can send your friend a strictly confidential, one-time email telling them about this information. Your privacy and your friend's privacy is your business... no spam! Click here and tell a friend!