How can we be negative at a time like this? The markets are back to record high territory and Cramer says to BUYBUYBUY and keep buying because the Fed is going to print free money forever and gold is no longer worth anything and oil worth $105 a barrel and TSLA is a $125 company, etc, etc…. What's not to love?

Nothing based on the technicals and THAT is why we're going to have to get more bullish (even if we have to hold our noses while we buy to fight of the stink of the BS) but, step on in our buying process is taking some downside hedges so – at these "breakout" levels, we like to hedge first and THEN buy the breakout.

If this seems crazy to you, I will point out that you have a very short memory because we last did a "Hedging for Disaster" post on June 3rd, when the S&P was at 1,650 and we caught that ride down to 1,560 for HUGE profits on our hedges. Now the S&P is back at 1,650 so, guess what, it's time to do it again! This is not complicated stuff folks – we buy at the bottoms (see "5 Trade Ideas that Made 1,816% in 21 Days") and sell at the top.

By the way, before we get started, I sent out an alert to short oil this morning at $105 (USO $37 on Dave Fry chart) and they're currently (7:47) over the line at $105.29 but we're going to keep on that line as a shorting spot (with very tight stops over $105) unless we get a big pop to $106 or $105.50 at the 9am NYMEX open – then we'll probably move up to the higher lines. We are CERTAINLY going to follow through with our plan to roll up and double down our August shorts on oil in our Short-Term Portfolio.

By the way, before we get started, I sent out an alert to short oil this morning at $105 (USO $37 on Dave Fry chart) and they're currently (7:47) over the line at $105.29 but we're going to keep on that line as a shorting spot (with very tight stops over $105) unless we get a big pop to $106 or $105.50 at the 9am NYMEX open – then we'll probably move up to the higher lines. We are CERTAINLY going to follow through with our plan to roll up and double down our August shorts on oil in our Short-Term Portfolio.

Now, on to the hedges!

TZA is our favorite hedge and you can pick up the Oct $28/35 bull call spread for $1.25 and you can sell the Oct $23 puts for .95 for net .30 on the $7 spread, giving you 2,233% of upside potential and, best of all, with TZA at $27.81, you are starting out just .19 out of the money! TZA drops $4.81 (17%), to $23 if the Russell goes up 5.7% plus these ultra-ETFs tend to decay over time but owning TZA for net $23.30 is not a bad portfolio hedge and the Russell would have to be net up 5.7% to 1,072 in October for this to happen and, if so, your longs should be doing well.

DXD Aug $33 calls at $1.20, selling Aug $35 calls for .60. This is a net .60 entry on a $2 spread so your upside is 233% at $35 (DXD is now $33.46). If the Dow ends up holding 15,300 and moves back up, there’s a good chance you can kill this cover with a small loss as a $2 move on DXD is about 6% and that would be about a 3% move up in the Dow to new highs at 16,218 before the spread, with a net .26 delta loses its value.

You need $33.60 (+.1%) to get your money back and that's any drop below 15,300 in the Dow, which makes this fantastic protection for any longs you may enter here. Using a short put to make an entry in a stock you REALLY want to buy at the net strike is a great way to offset this trade so let's say, for example, you are willing to own AA (just had OK earnings) for net $7 (now $7.91) in January. You can sell the Jan $7 puts for .28 and that drops the net of the DIA spread to .32 and now your upside, at $35 is $1.68 for a 525% gain. Or, perhaps you REALLY want to own 100 shares of AAPL for $350 (now $422) in January. You can sell those Jan $350 puts for $9 (which can be rolled to the 2015 $270 puts, now $10) and that pays for 15 of the long spreads with a $3,000 upside potential. That's all it takes.

SDS is the S&P's utlra-short ETF and you can see how we were willing to cover on June 6th when it was still above it's May lows. Now we're right back to the May lows so we're going to have a BETTER entry at $38.50 and we can pick up the Aug $37 calls are only $2.05, which is just .50 in premium. Selling the $40 calls for .85 knocks the net down to $1.20 with a $1.80 upside but, in our virtual Income Portfolio, I want to sell 5 ISRG Aug $400 puts for $9 ($4,500) and buy 50 of the SDS spreads for $6,000 so we net $1,500 (.30 per spread) and we have a break-even at $37.50 on SDS ($1 lower than it is now) and we have, at $40, $13.500 worth of downside protection.

We're committing to buying 500 shares of ISRG for $400 but, as with AAPL, the Jan $300 puts are $5.50 and the 2015 $250 puts (they don't go lower) are $9 so that's our real commitment, to buy 500 shares of ISRG in 2015 for $250 or less – that's something we'll almost be disappointed if we DON'T get assigned to us!

Now, on to what I DON'T like about the markets. This will be the last time if the NYSE holds 9,300 today as we have to switch off our brains and get technically bullish but, if you'll indulge me, we can summarize GaveKal's commentary from Louis and Charles Gave (a fantastic read) as:

- A first bad omen: fewer markets rising

- Another bad omen: collapsing silver prices

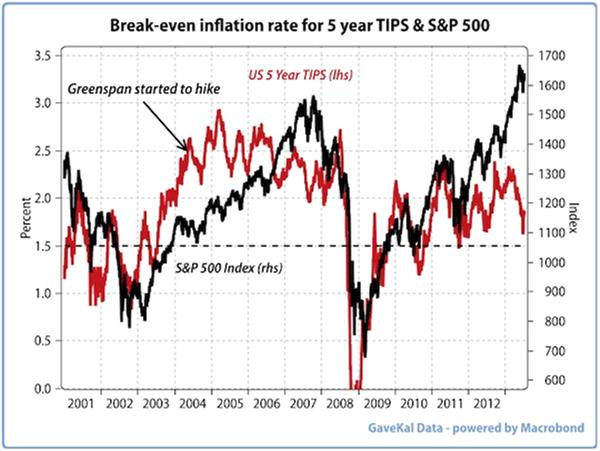

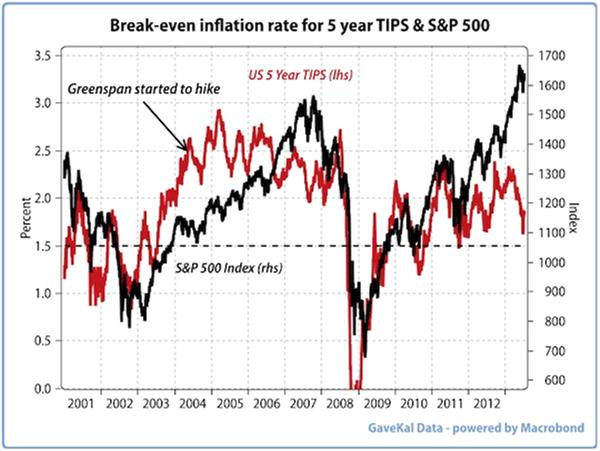

- Falling inflation expectations

-

- China, the single biggest contributor to global growth over the past decade, slowing markedly.

- World trade now flirting with recession.

- OECD industrial production in negative territory YoY.

- Southern Europe showing renewed signs of political tensions (i.e.: Portugal, Greece, Italy…) as unemployment continues its relentless march higher and tax receipts continue to collapse.

- Short-term interest rates almost everywhere around the world that are unable to go any lower.

- Valuations on most equity markets that are nowhere near distressed (except perhaps for the BRICS?).

- A World MSCI that has now just dipped below its six month moving average.

- A diffusion index of global equity markets that is flashing dark amber.

- Margins in the US at record highs and likely to come under pressure, if only because of the rising dollar (most of the US margin expansion of the past decade has occurred thanks to foreign earnings—earnings that may now be challenging to sustain in the face of a weaker global trade growth and a stronger dollar).

The Gave brothers note that the world has experienced a series of deflationary shocks, each of which has been met by more activism from the Fed and other central banks: i.e.: lower rates and higher monetary base growth. And each time, the excess money allowed for the rise in a few asset classes (TMT in the late 1990s, housing and financial intermediaries in the mid 2000s, commodities, fixed income instruments and emerging markets in the late 2000s…).

Each time, the asset price rise was followed by an equity market bust; begging the question of whether the bust that seems to be unfolding in emerging markets is now the third iteration of a movie every investor has seen before (and which few have enjoyed)? Or whether the recent correlation between bonds and equities indicates that the repeated deflationary shocks are a thing of the past and nominal GDP growth will accelerate from now on?

They also note that more markets have fallen then risen in the previous six months. The red line on the above chart is the performance of the S&P 500. Since 1992, we have had 14 occurrences in which more stock markets were falling than rising. In 10 of these 14 occurrences, the S&P500 fell by at least –10%. In the other 4, the S&P 500’s performance hovered between 0% and –10%. As things stand, the S&P 500 has recorded a double digit rise in the past six months, a major divergence.

We have Fed minutes at 2pm and Bernanke speaks at 2:30 and either of those events can violently move the markets up or down and, this morning, we'll prepare for down but we'll also be lookng for upside plays – should we finally break up and over our May highs.

So, for the last day before switch of our brains and join the herd: Let's be careful out there!